GameStop 2014 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2014 GameStop annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

of our data security or function of our computer systems or website were to occur,itcould have amaterial adverse effect on our

operating results and financial condition and, possibly,subject us to additional legal, regulatory and operating costs and damage

our reputation in the marketplace.

Also, the interpretation and enforcement of data protection laws in the United States, Europe and elsewhere are uncertain and,

in certain circumstances, contradictory.These laws may be interpreted and enforced in amanner that is inconsistent with our

policies and practices. If we are subject to data security breaches or government-imposed fines, we may have alossinsales or be

forced to pay damages or other amounts, which could adversely affect profitability,orbesubject to substantial costs related to

compliance.

Litigation and the outcomes of such litigationcould negatively impact our future financial condition and results of

operations.

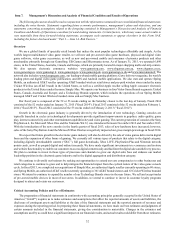

In the ordinary course of our business, we are, from time to time, subject to various litigation and legal proceedings. In the

future, the costs or results of such legal proceedings, individually or in the aggregate, could have anegative impact on our financial

condition, results of operations and cash flows.

Legislative actionsand changesinaccounting rules may cause our general and administrative and compliance costs to

increase and impact our futurefinancial condition and results of operations.

In order to comply with laws adopted by the U.S. government or other U.S. or foreign regulatory bodies, we may be required

to increase our expenditures and hire additional personnel and additional outside legal, accounting and advisory services, all of

which may cause our general and administrative and compliance costs to increase. Significant workforce-related legislative changes

could increase our expenses and adversely affect our operations. Examples of possible workforce-related legislative changes

include changes to an employer's obligation to recognize collective bargaining units, the process by which collective bargaining

agreements are negotiated or imposed, minimum wage requirements, and health care mandates. In addition, changes in the

regulatory environment affecting Medicare reimbursements, product safety,supplychain transparency,and increased compliance

costs related to enforcement of federal and state wage and hour statutes and common law related to overtime, among others, could

cause our expenses to increase without an ability to pass through any increased expenses through higher prices. Environmental

legislation or other regulatory changes could impose unexpected costs or impact us more directly than other companies due to our

operations as aglobal retailer.Specifically,environmental legislation or international agreements affecting energy,carbon

emissions, and water or product materials are continually being explored by governing bodies. Increasing energy and fuel costs,

supplychain disruptions and other potential risks to our business, as well as any significant rule making or passage of any such

legislation, could materially increase the cost to transport our goods and materially adversely affect our results of operations.

Additionally,regulatory and enforcement activity focused on the retail industry has increased in recent years, increasing the risk

of fines and additional operational costs associated with compliance.

Our Board of Directors could change ourdividend policy at any time.

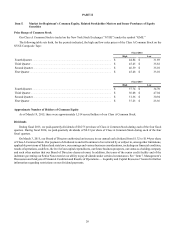

We initiated our first cash dividend on our common stock during fiscal 2012. Notwithstanding the foregoing, there is no

assurance that we will continue to pay cash dividends on our common stock in the future. Certain provisions in our credit facility

and covenants under the indenture for our Senior Notes may restrict our ability to pay dividends in certain circumstances. In

addition, subject to any financial covenants in current or future financing agreements that directly or indirectly restrict our ability

to pay dividends, the payment of dividends is within the discretion of our Board of Directors and will depend upon our future

earnings and cash flow from operations, our capital requirements, our financial condition and any other factors that the Board of

Directors may consider.Unless we continue to pay cash dividends on our common stock in the future, the success of an investment

in our common stock will depend entirely upon its future appreciation. Our common stock may not appreciate in value or even

maintainthe priceatwhich it was purchased.

We may record future goodwill impairment charges or other asset impairment charges which could negatively impact our

future results of operations andfinancial condition.

In recent periods we have recorded significant non-cash charges relating to the impairment of goodwill and other tangible

and intangible assets that had amaterial adverse effect on our consolidated statements of operations and consolidated balance

sheets. Because we have grown in part through acquisitions, goodwill and other acquired intangible assets represent asubstantial

portion of our assets. We also have long-lived assets consisting of property and equipment and other identifiable intangible assets

which we review both on an annual basis as well as when events or circumstances indicate that the carrying amount of an asset

maynot be recoverable. If adetermination is made that asignificant impairment in value of goodwill, other intangible assets or

long-lived assets has occurred, such determination could require us to impair asubstantial portion of our assets. Asset impairments

could have amaterial adverse effect on our financial condition and results of operations.

22