Cisco 2011 Annual Report Download - page 97

Download and view the complete annual report

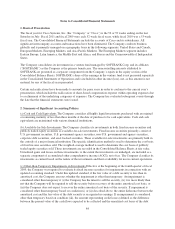

Please find page 97 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(ii) require an entity to allocate revenue in an arrangement using estimated selling prices (ESP) of

deliverables if a vendor does not have vendor-specific objective evidence of selling price (VSOE) or

third-party evidence of selling price (TPE); and

(iii) eliminate the use of the residual method and require an entity to allocate revenue using the relative

selling price method.

The Company elected to early adopt this accounting guidance at the beginning of its first quarter of fiscal 2010

on a prospective basis for applicable transactions originating or materially modified after July 25, 2009. This

guidance does not generally change the units of accounting for the Company’s revenue transactions. Most

products and services qualify as separate units of accounting and the revenue is recognized when the applicable

revenue recognition criteria are met. The Company’s arrangements generally do not include any provisions for

cancellation, termination, or refunds that would significantly impact recognized revenue.

Many of the Company’s products have both software and nonsoftware components that function together to

deliver the products’ essential functionality. The Company’s product offerings fall into the following categories:

Routers, Switches, New Products, and Other Products. The Other Products category includes optical networking

and emerging technology items. The Company also provides technical support and advanced services. The

Company has a broad customer base that encompasses virtually all types of public and private entities, including

enterprise businesses, service providers, commercial customers, and consumers. The Company and its salesforce

are not organized by product divisions and the Company’s products and services can be sold standalone or

together in various combinations across the Company’s geographic segments or customer markets. For example,

service provider arrangements are typically larger in scale with longer deployment schedules and involve the

delivery of a variety of product technologies, including high-end routing, video and network management

software, and other product technologies along with technical support and advanced services. The Company’s

enterprise and commercial arrangements are typically unique for each customer and smaller in scale and may

include network infrastructure products such as routers and switches or collaboration technologies such as

unified communications and Cisco TelePresence systems products along with technical support services.

Consumer products, which constitute a small portion of the Company’s overall business, are sold in standalone

arrangements directly to distributors and retailers without support, as customers generally only require repair or

replacement of defective products or parts under warranty.

The Company enters into revenue arrangements that may consist of multiple deliverables of its product and

service offerings due to the needs of its customers. For example, a customer may purchase routing products along

with a contract for technical support services. This arrangement would consist of multiple elements, with the

products delivered in one reporting period and the technical support services delivered across multiple reporting

periods. Another customer may purchase networking products along with advanced service offerings, in which

all the elements are delivered within the same reporting period. In addition, distributors and retail partners

purchase products or technical support services on a standalone basis for resale to an end user or for purposes of

stocking certain products, and these transactions would not result in a multiple element arrangement. For

transactions entered into prior to the first quarter of fiscal 2010, the Company primarily recognized revenue

based on software revenue recognition guidance. For the vast majority of the Company’s arrangements involving

multiple deliverables, such as sales of products with services, the entire fee from the arrangement was allocated

to each respective element based on its relative selling price, using VSOE. In the limited circumstances when the

Company was not able to determine VSOE for all of the deliverables of the arrangement, but was able to obtain

VSOE for any undelivered elements, revenue was allocated using the residual method. Under the residual

method, the amount of revenue allocated to delivered elements equaled the total arrangement consideration less

the aggregate selling price of any undelivered elements, and no revenue was recognized until all elements

without VSOE had been delivered. If VSOE of any undelivered items did not exist, revenue from the entire

arrangement was initially deferred and recognized at the earlier of (i) delivery of those elements for which VSOE

did not exist or (ii) when VSOE could be established. However, in limited cases where technical support services

were the only undelivered element without VSOE, the entire arrangement fee was recognized ratably as a single

unit of accounting over the technical services contractual period. The residual and ratable revenue recognition

89