Cisco 2011 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

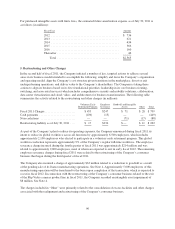

(u) Use of Estimates The preparation of financial statements and related disclosures in conformity with

accounting principles generally accepted in the United States requires management to make estimates and

judgments that affect the amounts reported in the Consolidated Financial Statements and accompanying notes.

Estimates are used for the following, among others:

• Revenue recognition

• Allowances for receivables and sales returns

• Inventory valuation and liability for purchase commitments with contract manufacturers and suppliers

• Warranty costs

• Share-based compensation expense

• Fair value measurements and other-than-temporary impairments

• Goodwill and purchased intangible asset impairments

• Income taxes

• Loss contingencies

The actual results experienced by the Company may differ materially from management’s estimates.

(v) Recent Accounting Standards or Updates Not Yet Effective

In May 2011, the Financial Accounting Standards Board (FASB) issued an accounting standard update to

provide guidance on achieving a consistent definition of and common requirements for measurement of and

disclosure concerning fair value as between U.S. GAAP and International Financial Reporting Standards. This

accounting standard update is effective for the Company beginning in the third quarter of fiscal 2012. The

Company is currently evaluating the impact of this accounting standard update on its Consolidated Financial

Statements but does not expect it will have a material impact.

In June 2011, the FASB issued an accounting standard update to provide guidance on increasing the prominence

of items reported in other comprehensive income. This accounting standard update eliminates the option to

present components of other comprehensive income as part of the statement of equity and requires that the total

of comprehensive income, the components of net income, and the components of other comprehensive income be

presented either in a single continuous statement of comprehensive income or in two separate but consecutive

statements. It is also required to present on the face of the financial statements reclassification adjustments for

items that are reclassified from other comprehensive income to net income in the statement(s) where the

components of net income and the components of other comprehensive income are presented. This accounting

standard update is effective for the Company beginning in the first quarter of fiscal 2013.

In August 2011, the FASB approved a revised accounting standard update intended to simplify how an entity

tests goodwill for impairment. The amendment will allow an entity to first assess qualitative factors to determine

whether it is necessary to perform the two-step quantitative goodwill impairment test. An entity no longer will be

required to calculate the fair value of a reporting unit unless the entity determines, based on a qualitative

assessment, that it is more likely than not that its fair value is less than its carrying amount. This accounting

standard update will be effective for the Company beginning in the first quarter of fiscal 2013 and early adoption

is permitted. The Company is currently evaluating the impact of this accounting standard update on its

Consolidated Financial Statements.

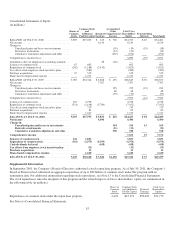

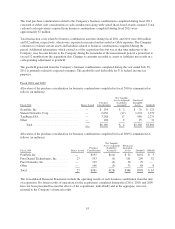

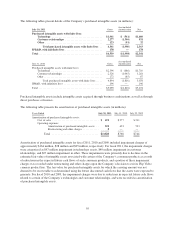

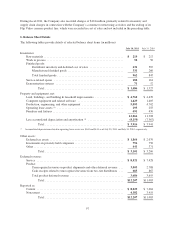

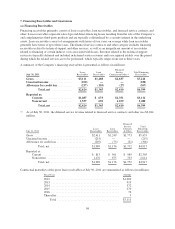

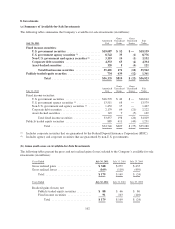

3. Business Combinations

The Company completed six business combinations during fiscal 2011. A summary of the allocation of the total

purchase consideration is presented as follows (in millions):

Fiscal 2011 Shares Issued

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

Total ................................... — $288 $(10) $114 $184

92