Cisco 2011 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

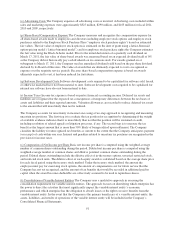

The total purchase consideration related to the Company’s business combinations completed during fiscal 2011

consisted of either cash consideration or cash consideration along with vested share-based awards assumed. Total

cash and cash equivalents acquired from business combinations completed during fiscal 2011 were

approximately $7 million.

Total transaction costs related to business combination activities during fiscal 2011 and 2010 were $10 million

and $32 million, respectively, which were expensed as incurred and recorded as G&A expenses. The Company

continues to evaluate certain assets and liabilities related to business combinations completed during the

period. Additional information, which existed as of the acquisition date but was at that time unknown to the

Company, may become known to the Company during the remainder of the measurement period, a period not to

exceed 12 months from the acquisition date. Changes to amounts recorded as assets or liabilities may result in a

corresponding adjustment to goodwill.

The goodwill generated from the Company’s business combinations completed during the year ended July 30,

2011 is primarily related to expected synergies. The goodwill is not deductible for U.S. federal income tax

purposes.

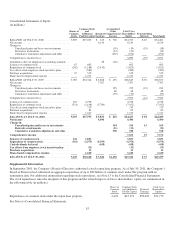

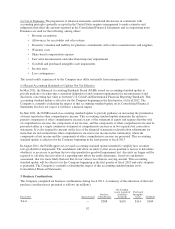

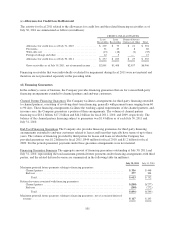

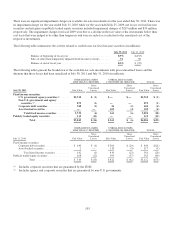

Fiscal 2010 and 2009

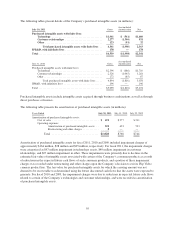

Allocation of the purchase consideration for business combinations completed in fiscal 2010 is summarized as

follows (in millions):

Fiscal 2010 Shares Issued

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill

ScanSafe, Inc. ........................... — $ 154 $ 2 $ 31 $ 121

Starent Networks, Corp. ................... — 2,636 (17) 1,274 1,379

Tandberg ASA ........................... — 3,268 17 980 2,271

Other .................................. — 128 2 95 31

Total ............................... — $6,186 $ 4 $2,380 $3,802

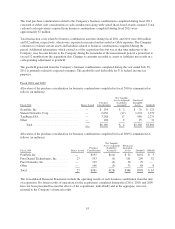

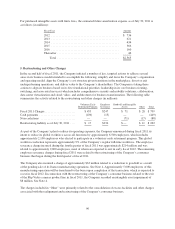

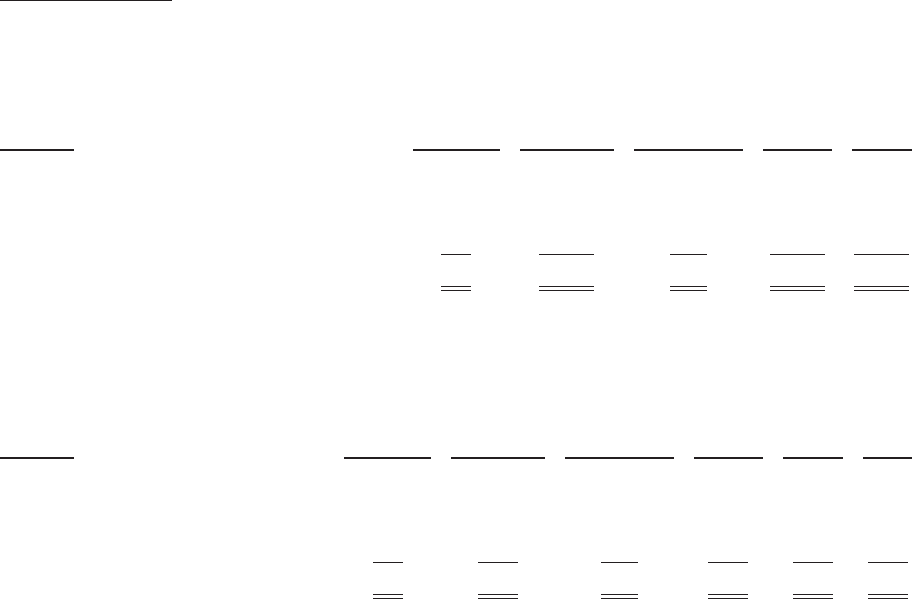

Allocation of the purchase consideration for business combinations completed in fiscal 2009 is summarized as

follows (in millions):

Fiscal 2009 Shares Issued

Purchase

Consideration

Net Tangible

Assets Acquired/

(Liabilities

Assumed)

Purchased

Intangible

Assets Goodwill IPR&D

PostPath, Inc. ..................... — $197 $(10) $ 52 $152 $ 3

Pure Digital Technologies, Inc. ....... 27 533 (9) 191 299 52

Pure Networks, Inc. ................ — 105 (4) 30 79 —

Other ........................... — 146 (5) 75 68 8

Total ............................ 27 $981 $(28) $348 $598 $ 63

The Consolidated Financial Statements include the operating results of each business combination from the date

of acquisition. Pro forma results of operations for the acquisitions completed during fiscal 2011, 2010, and 2009

have not been presented because the effects of the acquisitions, individually and in the aggregate, were not

material to the Company’s financial results.

93