Cisco 2011 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

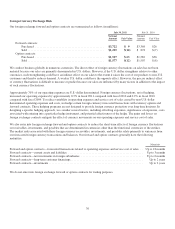

Item 7A. Quantitative and Qualitative Disclosures About Market Risk

Our financial position is exposed to a variety of risks, including interest rate risk, equity price risk, and foreign

currency exchange risk.

Interest Rate Risk

Fixed Income Securities

We maintain an investment portfolio of various holdings, types, and maturities. Our primary objective for

holding fixed income securities is to achieve an appropriate investment return consistent with preserving

principal and managing risk. At any time, a sharp rise in market interest rates could have a material adverse

impact on the fair value of our fixed income investment portfolio. Conversely, declines in interest rates,

including the impact from lower credit spreads, could have a material adverse impact on interest income for our

investment portfolio. We may utilize derivative instruments designated as hedging instruments to achieve our

investment objectives. We had no outstanding hedging instruments for our fixed income securities as of July 30,

2011. Our fixed income investments are held for purposes other than trading. Our fixed income investments are

not leveraged as of July 30, 2011. See Note 8 to the Consolidated Financial Statements. We monitor our interest

rate and credit risks, including our credit exposures to specific rating categories and to individual issuers. As of

July 30, 2011, approximately 75% of our fixed income securities balance consists of U.S. government and U.S.

government agency securities. We believe the overall credit quality of our portfolio is strong.

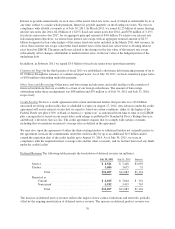

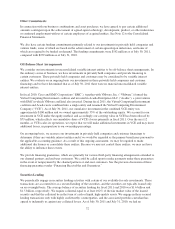

The following tables present the hypothetical fair values of our fixed income securities, including the hedging

effects when applicable, as a result of selected potential market decreases and increases in interest rates. The

market changes reflect immediate hypothetical parallel shifts in the yield curve of plus or minus 50 basis points

(“BPS”), plus 100 BPS, and plus 150 BPS. Due to the low interest rate environment at the end of each of fiscal

2010 and fiscal 2009, we did not believe a parallel shift of minus 100 BPS or minus 150 BPS was relevant. The

hypothetical fair values as of July 30, 2011 and July 31, 2010 are as follows (in millions):

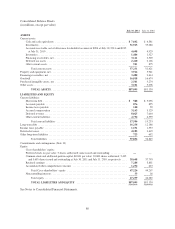

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 30,

2011

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities ........ N/A N/A $35,740 $35,562 $35,384 $35,206 $35,029

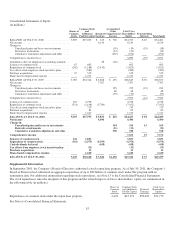

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

DECREASE OF X BASIS POINTS

FAIR VALUE

AS OF

JULY 31,

2010

VALUATION OF SECURITIES

GIVEN AN INTEREST RATE

INCREASE OF X BASIS POINTS

(150 BPS) (100 BPS) (50 BPS) 50 BPS 100 BPS 150 BPS

Fixed income securities ........ N/A N/A $34,187 $34,029 $33,870 $33,712 $33,553

There were no impairment charges on our investments in fixed income securities for fiscal 2011 or 2010. For

fiscal 2009 we had impairment charges of $219 million on investments in fixed income securities.

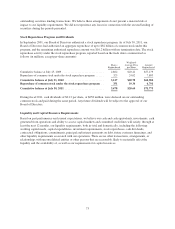

Debt

As of July 30, 2011, we had $16.0 billion in principal amount of senior notes outstanding, which consisted of

$1.25 billion floating-rate notes and $14.75 billion fixed-rate notes. The carrying amount of the senior notes was

$16.2 billion, and the related fair value was $17.4 billion, which fair value is based on market prices. As of

July 30, 2011, a hypothetical 50 BPS increase or decrease in market interest rates would change the fair value of

the fixed-rate debt, excluding the $4.25 billion of hedged debt, by a decrease or increase of $0.5 billion,

respectively. However, this hypothetical change in interest rates would not impact the interest expense on the

fixed-rate debt, which is not hedged.

74