Cisco 2011 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

awarded in combination with stock options or stock grants, and such awards shall provide that the stock

appreciation rights will not be exercisable unless the related stock options or stock grants are forfeited. Stock

grants may be awarded in combination with non-statutory stock options, and such awards may provide that the

stock grants will be forfeited in the event that the related non-statutory stock options are exercised.

1996 Plan The 1996 Plan expired on December 31, 2006, and the Company can no longer make equity awards

under the 1996 Plan. The maximum number of shares issuable over the term of the 1996 Plan was 2.5 billion

shares. Stock options granted under the 1996 Plan have an exercise price of at least 100% of the fair market value

of the underlying stock on the grant date and expire no later than nine years from the grant date. The stock

options generally become exercisable for 20% or 25% of the option shares one year from the date of grant and

then ratably over the following 48 or 36 months, respectively. Certain other grants have utilized a 60-month

ratable vesting schedule. In addition, the Board of Directors, or other committees administering the plan, have the

discretion to use a different vesting schedule and have done so from time to time.

Supplemental Plan The Supplemental Plan expired on December 31, 2007, and the Company can no longer

make equity awards under the Supplemental Plan. Officers and members of the Company’s Board of Directors

were not eligible to participate in the Supplemental Plan. Nine million shares were reserved for issuance under

the Supplemental Plan.

Acquisition Plans In connection with the Company’s acquisitions of Scientific-Atlanta, Inc. (“Scientific-

Atlanta”) and WebEx Communications, Inc. (“WebEx”), the Company adopted the SA Acquisition Plan and the

WebEx Acquisition Plan, respectively, each effective upon completion of the applicable acquisition. These plans

constitute assumptions, amendments, restatements, and renamings of the 2003 Long-Term Incentive Plan of

Scientific-Atlanta and the WebEx Communications, Inc. Amended and Restated 2000 Stock Incentive Plan,

respectively. The plans permit the grant of stock options, stock, stock units, and stock appreciation rights to

certain employees of the Company and its subsidiaries and affiliates who had been employed by Scientific-

Atlanta or its subsidiaries or WebEx or its subsidiaries, as applicable. As a result of the shareholder approval of

the amendment and extension of the 2005 Plan, as of November 15, 2007, the Company will no longer make

stock option grants or direct share issuances under either the SA Acquisition Plan or the WebEx Acquisition

Plan.

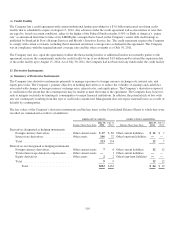

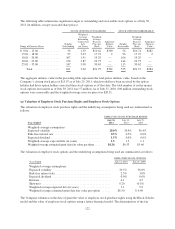

(b) Employee Stock Purchase Plan

The Company has an Employee Stock Purchase Plan, which includes its subplan, the International Employee

Stock Purchase Plan (together, the “Purchase Plan”), under which 471.4 million shares of the Company’s

common stock have been reserved for issuance as of July 30, 2011. Effective July 1, 2009, eligible employees are

offered shares through a 24-month offering period, which consists of four consecutive 6-month purchase

periods. Employees may purchase a limited number of shares of the Company’s stock at a discount of up to 15%

of the lesser of the market value at the beginning of the offering period or the end of each 6-month purchase

period. The Purchase Plan is scheduled to terminate on January 3, 2020. The Company issued 34 million,

27 million, and 28 million shares under the Purchase Plan in fiscal 2011, 2010, and 2009, respectively. As of

July 30, 2011, 122 million shares were available for issuance under the Purchase Plan.

119