Cisco 2011 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

portfolio consisting primarily of high quality investment-grade securities. We believe that our strong cash and

cash equivalents and investments position allows us to use our cash resources for strategic investments to gain

access to new technologies, for acquisitions, for customer financing activities, for working capital needs, and for

the repurchase of shares of common stock and dividends.

We expect that cash provided by operating activities may fluctuate in future periods as a result of a number of

factors, including fluctuations in our operating results, the rate at which products are shipped during the quarter

(which we refer to as shipment linearity), the timing and collection of accounts receivable and financing

receivables, inventory and supply chain management, deferred revenue, excess tax benefits resulting from share-

based compensation, and the timing and amount of tax and other payments. For additional discussion, see “Part I,

Item 1A. Risk Factors” in this report.

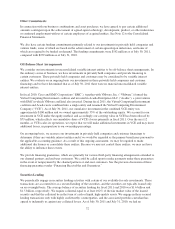

Accounts Receivable, Net The following table summarizes our accounts receivable, net (in millions), and DSO:

July 30, 2011 July 31, 2010 Decrease

Accounts receivable, net ....................... $4,698 $4,929 $(231)

DSO ...................................... 38 41 (3)

Our accounts receivable net, as of July 30, 2011 declined by approximately 5% compared with the end of fiscal

2010. Our DSO as of July 30, 2011 was lower by 3 days compared with the end of fiscal 2010. During the fourth

quarter of fiscal 2011, our cash collections were strong, and both product and services billings linearity

improved, particularly with respect to the timing of product shipments.

Services billings have traditionally had the effect of increasing DSO due in part to the timing of billings which in

comparison to product billings, have a larger proportion billed in the latter part of the quarter. As services

revenues have increased as a percentage of our total revenue, this has contributed to a higher DSO level in

comparison to levels we experienced in past years. We believe that the current DSO level is in line with levels we

expect in the near future.

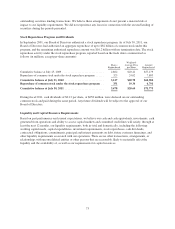

Inventories and Purchase Commitments with Contract Manufacturers and Suppliers The following table

summarizes our inventories and purchase commitments with contract manufacturers and suppliers (in millions,

except annualized inventory turns):

July 30, 2011 July 31, 2010

Increase

(Decrease)

Inventories ................................................... $1,486 $1,327 $159

Annualized inventory turns ...................................... 11.8 12.6 (0.8)

Purchase commitments with contract manufacturers and suppliers ....... $4,313 $4,319 $ (6)

Inventories as of July 30, 2011 increased by 12% from our balance at the end of fiscal 2010, while for the same

period purchase commitments with contract manufacturers and suppliers were flat. On a combined basis,

inventories and purchase commitments with contract manufacturers and suppliers increased by 3% from the

balance at the end of fiscal 2010. We believe our inventory and purchase commitments are in line with our

current demand forecasts.

The inventory increase was due to higher levels of distributor inventory and higher deferred cost of sales. Our

inventories have decreased from the levels we experienced in the first half of fiscal 2011. In the third quarter of

fiscal 2011 we announced a restructuring of our consumer business, and as a result we lowered inventory levels

for our consumer products. We also lowered inventory in certain parts of our cable set-top business. Our finished

goods consist of distributor inventory and deferred cost of sales and manufactured finished goods. Distributor

inventory and deferred cost of sales are related to unrecognized revenue on shipments to distributors and retail

partners as well as shipments to customers. Manufactured finished goods consist primarily of build-to-order and

67