Cisco 2011 Annual Report Download - page 107

Download and view the complete annual report

Please find page 107 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

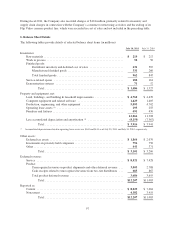

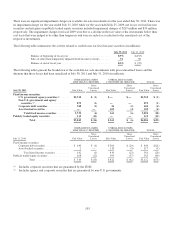

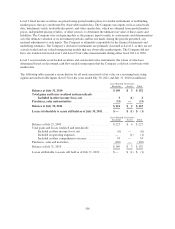

Actual cash collections may differ from the contractual maturities due to early customer buyouts, refinancings, or

defaults.

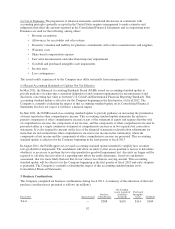

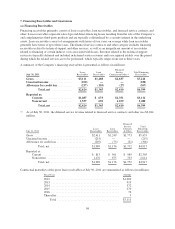

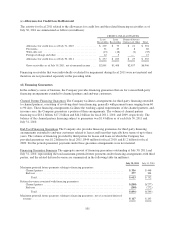

(b) Credit Quality of Financing Receivables

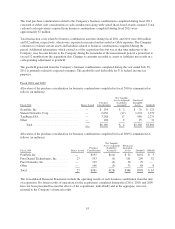

Financing receivables categorized by the Company’s internal credit risk rating for each portfolio segment and

class as of July 30, 2011 are summarized as follows (in millions):

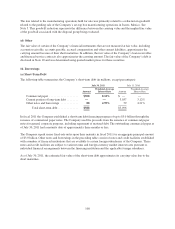

INTERNAL CREDIT RISK

RATING

1to4 5to6 7 and Higher Total

Residual

Value

Gross Receivables,

Net of Unearned

Income

Established Markets

Lease receivables ...................... $1,214 $1,182 $ 23 $2,419 $292 $2,711

Loan receivables ...................... 204 187 4 395 — 395

Financed service contracts & other ........ 1,622 939 52 2,613 — 2,613

Total Established Markets ............... $3,040 $2,308 $ 79 $5,427 $292 $5,719

Growth Markets

Lease receivables ...................... $ 35 $ 93 $ 18 $ 146 $ 4 $ 150

Loan receivables ...................... 458 580 35 1,073 — 1,073

Financed service contracts & other ........ 1 19 4 24 — 24

Total Growth Markets .................. $ 494 $ 692 $ 57 $1,243 $ 4 $1,247

Total ................................ $3,534 $3,000 $136 $6,670 $296 $6,966

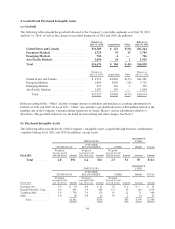

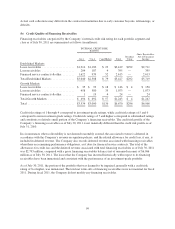

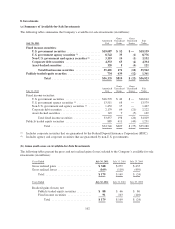

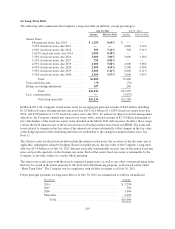

Credit risk ratings of 1 through 4 correspond to investment-grade ratings, while credit risk ratings of 5 and 6

correspond to non-investment-grade ratings. Credit risk ratings of 7 and higher correspond to substandard ratings

and constitute a relatively small portion of the Company’s financing receivables. The credit risk profile of the

Company’s financing receivables as of July 30, 2011 is not materially different than the credit risk profile as of

July 31, 2010.

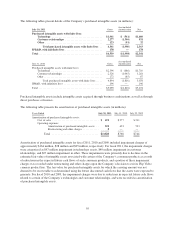

In circumstances when collectability is not deemed reasonably assured, the associated revenue is deferred in

accordance with the Company’s revenue recognition policies, and the related allowance for credit loss, if any, is

included in deferred revenue. The Company also records deferred revenue associated with financing receivables

when there are remaining performance obligations, as it does for financed service contracts. The total of the

allowances for credit loss and the deferred revenue associated with total financing receivables as of July 30, 2011

was $2,793 million, compared with a gross financing receivables balance (net of unearned income) of $6,966

million as of July 30, 2011. The losses that the Company has incurred historically with respect to its financing

receivables have been immaterial and consistent with the performance of an investment-grade portfolio.

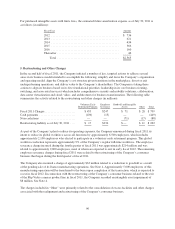

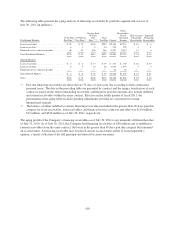

As of July 30, 2011, the portion of the portfolio that was deemed to be impaired, generally with a credit risk

rating of 8 or higher, was immaterial. The total net write-offs of financing receivables were not material for fiscal

2011. During fiscal 2011, the Company did not modify any financing receivables.

99