Cisco 2011 Annual Report Download - page 105

Download and view the complete annual report

Please find page 105 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

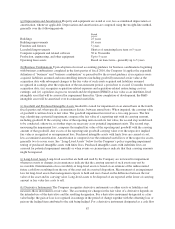

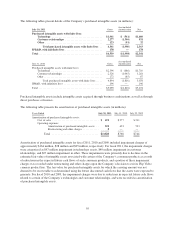

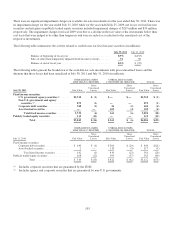

During fiscal 2011, the Company also recorded charges of $124 million, primarily related to inventory and

supply chain charges in connection with the Company’s consumer restructuring activities and the exiting of its

Flip Video cameras product line, which were recorded in cost of sales and not included in the preceding table.

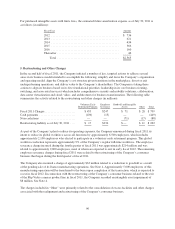

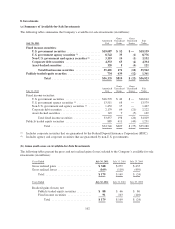

6. Balance Sheet Details

The following tables provide details of selected balance sheet items (in millions):

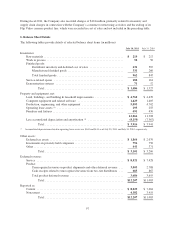

July 30, 2011 July 31, 2010

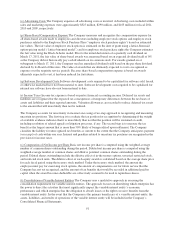

Inventories:

Raw materials ...................................................... $ 219 $ 217

Work in process .................................................... 52 50

Finished goods:

Distributor inventory and deferred cost of sales ....................... 631 587

Manufactured finished goods ...................................... 331 260

Total finished goods ............................................. 962 847

Service-related spares ............................................... 182 161

Demonstration systems .............................................. 71 52

Total ..................................................... $ 1,486 $ 1,327

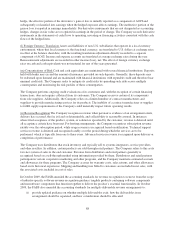

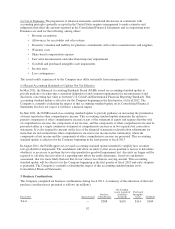

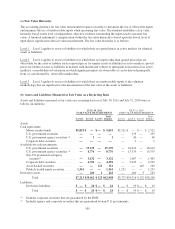

Property and equipment, net:

Land, buildings, and building & leasehold improvements ................... $ 4,760 $ 4,470

Computer equipment and related software ............................... 1,429 1,405

Production, engineering, and other equipment ............................ 5,093 4,702

Operating lease assets (1) ............................................. 293 255

Furniture and fixtures ................................................ 491 476

12,066 11,308

Less accumulated depreciation and amortization (1) ........................ (8,150) (7,367)

Total ..................................................... $ 3,916 $ 3,941

(1) Accumulated depreciation related to operating lease assets was $169 and $144 as of July 30, 2011 and July 31, 2010, respectively.

Other assets:

Deferred tax assets .................................................. $ 1,864 $ 2,079

Investments in privately held companies ................................. 796 756

Other ............................................................. 441 371

Total ..................................................... $ 3,101 $ 3,206

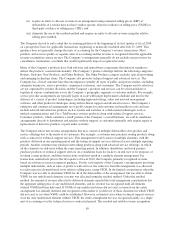

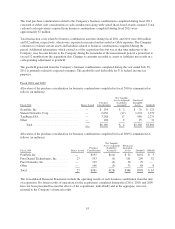

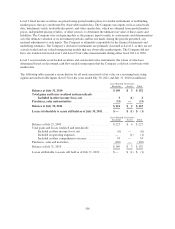

Deferred revenue:

Service ........................................................... $ 8,521 $ 7,428

Product:

Unrecognized revenue on product shipments and other deferred revenue . . . 3,003 2,788

Cash receipts related to unrecognized revenue from two-tier distributors . . . 683 867

Total product deferred revenue .................................... 3,686 3,655

Total ..................................................... $12,207 $11,083

Reported as:

Current ........................................................... $ 8,025 $ 7,664

Noncurrent ........................................................ 4,182 3,419

Total ..................................................... $12,207 $11,083

97