Cisco 2011 Annual Report Download - page 129

Download and view the complete annual report

Please find page 129 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

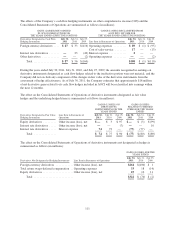

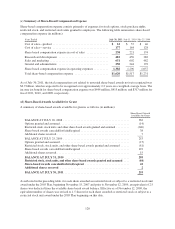

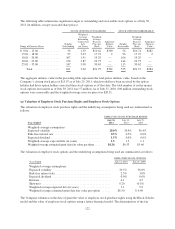

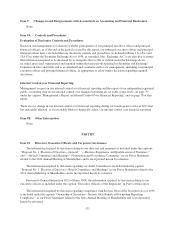

(e) Restricted Stock and Stock Unit Awards

A summary of the restricted stock and stock unit activity is as follows (in millions, except per-share amounts):

Restricted Stock/

Stock Units

Weighted-Average

Grant Date Fair

Value per Share

Aggregated Fair

Market Value

BALANCE AT JULY 26, 2008 ....... 10 $24.27

Granted and assumed ............... 57 20.90

Vested ........................... (4) 23.56 $ 69

Canceled/forfeited .................. (1) 22.76

BALANCE AT JULY 25, 2009 ....... 62 21.25

Granted and assumed ............... 54 23.40

Vested ........................... (16) 21.56 $378

Canceled/forfeited .................. (3) 22.40

BALANCE AT JULY 31, 2010 ...... 97 22.35

Granted and assumed .............. 56 20.62

Vested ........................... (27) 22.54 $529

Canceled/forfeited ................. (10) 22.04

BALANCE AT JULY 30, 2011 ...... 116 $21.50

Certain of the restricted stock units awarded in fiscal 2011 were contingent on the future achievement of

financial performance metrics.

Prior to the initial declaration of a quarterly cash dividend on March 17, 2011, the fair value of restricted stock

units was measured based on the grant date share price reduced by the present value of the dividend using an

expected dividend yield of 0%, as the Company did not historically pay cash dividends on its common stock. For

awards granted on or subsequent to March 17, 2011, the Company used an annualized dividend yield based on

the per-share dividends declared by its Board of Directors.

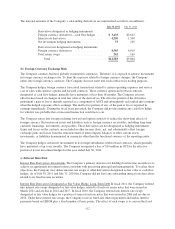

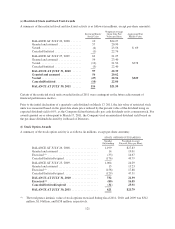

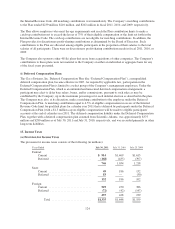

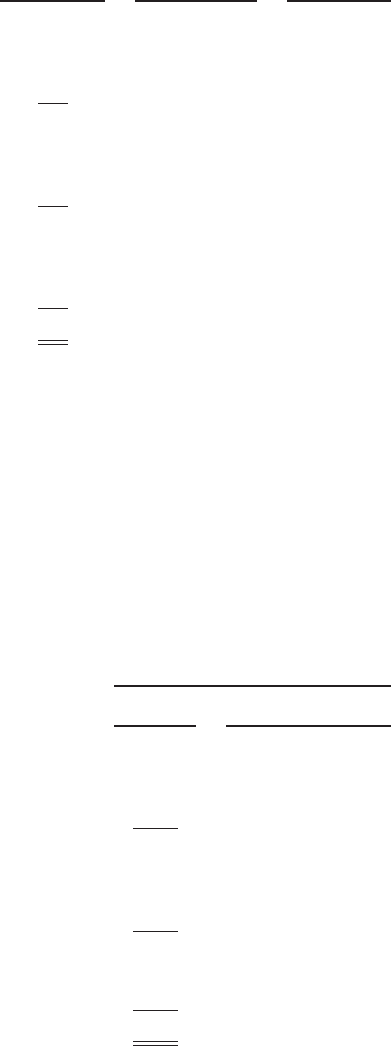

(f) Stock Option Awards

A summary of the stock option activity is as follows (in millions, except per-share amounts):

STOCK OPTIONS OUTSTANDING

Number

Outstanding

Weighted-Average

Exercise Price per Share

BALANCE AT JULY 26, 2008 ................... 1,199 $27.83

Granted and assumed ........................... 14 19.01

Exercised (1) .................................. (33) 14.67

Canceled/forfeited/expired ....................... (176) 49.79

BALANCE AT JULY 25, 2009 ................... 1,004 24.29

Granted and assumed ........................... 15 13.23

Exercised (1) .................................. (158) 17.88

Canceled/forfeited/expired ....................... (129) 47.31

BALANCE AT JULY 31, 2010 .................. 732 21.39

Exercised (1) .................................. (80) 16.55

Canceled/forfeited/expired ..................... (31) 25.91

BALANCE AT JULY 30, 2011 .................. 621 $21.79

(1) The total pretax intrinsic value of stock options exercised during fiscal 2011, 2010, and 2009 was $312

million, $1.0 billion, and $158 million, respectively.

121