Cisco 2011 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

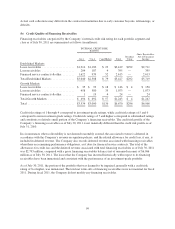

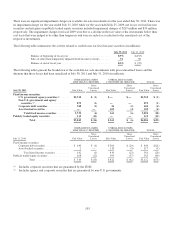

For fixed income securities that have unrealized losses as of July 30, 2011, the Company has determined that

(i) it does not have the intent to sell any of these investments and (ii) it is not more likely than not that it will be

required to sell any of these investments before recovery of the entire amortized cost basis. In addition, as of

July 30, 2011, the Company anticipates that it will recover the entire amortized cost basis of such fixed income

securities and has determined that no other-than-temporary impairments associated with credit losses were

required to be recognized during the year ended July 30, 2011.

The Company has evaluated its publicly traded equity securities as of July 30, 2011 and has determined that there

was no indication of other-than-temporary impairments in the respective categories of unrealized losses. This

determination was based on several factors, which include the length of time and extent to which fair value has

been less than the cost basis, the financial condition and near-term prospects of the issuer, and the Company’s

intent and ability to hold the publicly traded equity securities for a period of time sufficient to allow for any

anticipated recovery in market value.

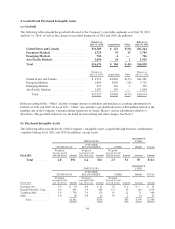

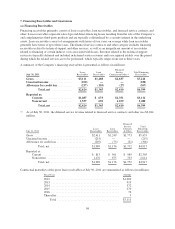

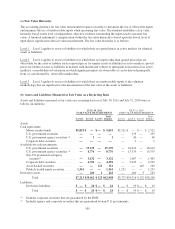

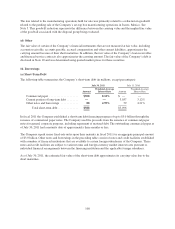

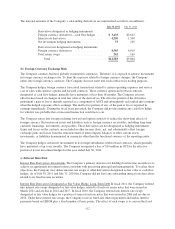

(c) Maturities of Fixed Income Securities

The following table summarizes the maturities of the Company’s fixed income securities at July 30, 2011 (in

millions):

Amortized

Cost Fair Value

Less than 1 year .................................. $17,720 $17,748

Due in 1 to 2 years ................................ 11,519 11,575

Due in 2 to 5 years ................................ 5,860 5,921

Due after 5 years ................................. 302 318

Total ....................................... $35,401 $35,562

Actual maturities may differ from the contractual maturities because borrowers may have the right to call or

prepay certain obligations.

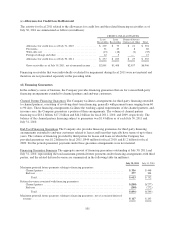

(d) Securities Lending

The Company periodically engages in securities lending activities with certain of its available-for-sale

investments. These transactions are accounted for as a secured lending of the securities, and the securities are

typically loaned only on an overnight basis. The average balance of securities lending for fiscal 2011 and 2010

was $1.6 billion and $1.5 billion, respectively. The Company requires collateral equal to at least 102% of the fair

market value of the loaned security in the form of cash or liquid, high-quality assets. The Company engages in

these secured lending transactions only with highly creditworthy counterparties, and the associated portfolio

custodian has agreed to indemnify the Company against any collateral losses. The Company did not experience

any losses in connection with the secured lending of securities during the years presented. As of July 30, 2011

and July 31, 2010, the Company had no outstanding securities lending transactions.

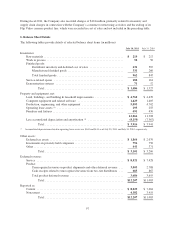

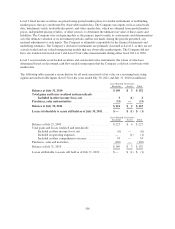

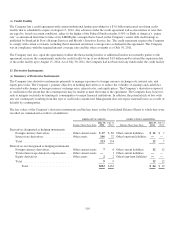

9. Fair Value

Fair value is defined as the price that would be received from selling an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value

measurements for assets and liabilities required or permitted to be recorded at fair value, the Company considers

the principal or most advantageous market in which it would transact, and it considers assumptions that market

participants would use when pricing the asset or liability.

104