Cisco 2011 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

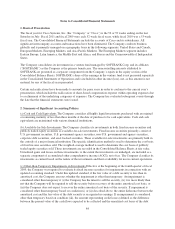

hedge, the effective portion of the derivative’s gain or loss is initially reported as a component of AOCI and

subsequently reclassified into earnings when the hedged exposure affects earnings. The ineffective portion of the

gain or loss is reported in earnings immediately. For derivative instruments that are not designated as accounting

hedges, changes in fair value are recognized in earnings in the period of change. The Company records derivative

instruments in the statements of cash flows to operating, investing or financing activities consistent with the cash

flows of the hedged item.

(l) Foreign Currency Translation Assets and liabilities of non-U.S. subsidiaries that operate in a local currency

environment, where that local currency is the functional currency, are translated to U.S. dollars at exchange rates

in effect at the balance sheet date, with the resulting translation adjustments directly recorded to a separate

component of AOCI. Income and expense accounts are translated at average exchange rates during the year.

Remeasurement adjustments are recorded in other income (loss), net. The effect of foreign currency exchange

rates on cash and cash equivalents was not material for any of the years presented.

(m) Concentrations of Risk Cash and cash equivalents are maintained with several financial institutions. Deposits

held with banks may exceed the amount of insurance provided on such deposits. Generally, these deposits may

be redeemed upon demand and are maintained with financial institutions with reputable credit and therefore bear

minimal credit risk. The Company seeks to mitigate its credit risks by spreading such risks across multiple

counterparties and monitoring the risk profiles of these counterparties.

The Company performs ongoing credit evaluations of its customers and, with the exception of certain financing

transactions, does not require collateral from its customers. The Company receives certain of its components

from sole suppliers. Additionally, the Company relies on a limited number of contract manufacturers and

suppliers to provide manufacturing services for its products. The inability of a contract manufacturer or supplier

to fulfill supply requirements of the Company could materially impact future operating results.

(n) Revenue Recognition The Company recognizes revenue when persuasive evidence of an arrangement exists,

delivery has occurred, the fee is fixed or determinable, and collectibility is reasonably assured. In instances

where final acceptance of the product, system, or solution is specified by the customer, revenue is deferred until

all acceptance criteria have been met. For hosting arrangements, the Company recognizes subscription revenue

ratably over the subscription period, while usage revenue is recognized based on utilization. Technical support

services revenue is deferred and recognized ratably over the period during which the services are to be

performed, which is typically from one to three years. Advanced services revenue is recognized upon delivery or

completion of performance.

The Company uses distributors that stock inventory and typically sell to systems integrators, service providers,

and other resellers. In addition, certain products are sold through retail partners. The Company refers to this as its

two-tier system of sales to the end customer. Revenue from distributors and retail partners generally is

recognized based on a sell-through method using information provided by them. Distributors and retail partners

participate in various cooperative marketing and other programs, and the Company maintains estimated accruals

and allowances for these programs. The Company accrues for warranty costs, sales returns, and other allowances

based on its historical experience. Shipping and handling fees billed to customers are included in net sales, with

the associated costs included in cost of sales.

In October 2009, the FASB amended the accounting standards for revenue recognition to remove from the scope

of industry-specific software revenue recognition guidance tangible products containing software components

and nonsoftware components that function together to deliver the product’s essential functionality. In October

2009, the FASB also amended the accounting standards for multiple-deliverable revenue arrangements to:

(i) provide updated guidance on whether multiple deliverables exist, how the deliverables in an

arrangement should be separated, and how consideration should be allocated;

88