Cisco 2011 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

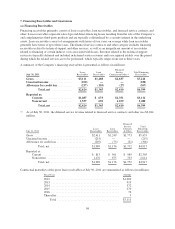

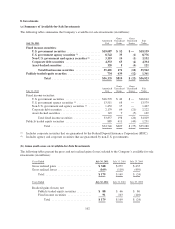

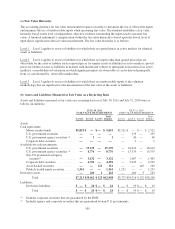

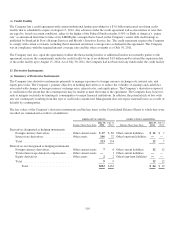

8. Investments

(a) Summary of Available-for-Sale Investments

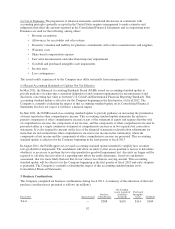

The following tables summarize the Company’s available-for-sale investments (in millions):

July 30, 2011

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ....................... $19,087 $ 52 $ — $19,139

U.S. government agency securities (1) ............... 8,742 35 (1) 8,776

Non-U.S. government and agency securities (2) ....... 3,119 14 (1) 3,132

Corporate debt securities ........................ 4,333 65 (4) 4,394

Asset-backed securities .......................... 120 5 (4) 121

Total fixed income securities ................. 35,401 171 (10) 35,562

Publicly traded equity securities ...................... 734 639 (12) 1,361

Total ................................. $36,135 $810 $ (22) $36,923

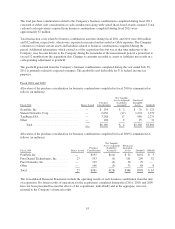

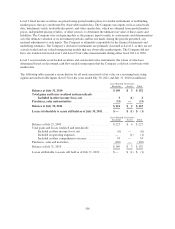

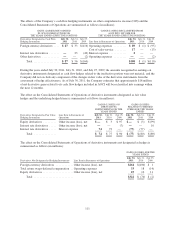

July 31, 2010

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

Losses

Fair

Value

Fixed income securities:

U.S. government securities ........................ $16,570 $ 42 $ — $16,612

U.S. government agency securities (1) ................ 13,511 68 — 13,579

Non-U.S. government and agency securities (2) ........ 1,452 15 — 1,467

Corporate debt securities .......................... 2,179 64 (21) 2,222

Asset-backed securities ........................... 145 9 (5) 149

Total fixed income securities .................. 33,857 198 (26) 34,029

Publicly traded equity securities ........................ 889 411 (49) 1,251

Total .................................. $34,746 $609 $ (75) $35,280

(1) Includes corporate securities that are guaranteed by the Federal Deposit Insurance Corporation (FDIC).

(2) Includes agency and corporate securities that are guaranteed by non-U.S. governments.

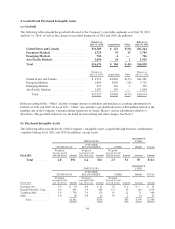

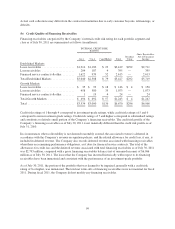

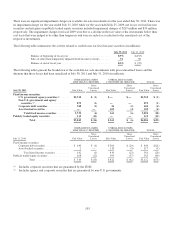

(b) Gains and Losses on Available-for-Sale Investments

The following tables present the gross and net realized gains (losses) related to the Company’s available-for-sale

investments (in millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Gross realized gains ....................... $ 348 $ 279 $ 435

Gross realized losses ....................... (169) (110) (459)

Total ............................... $ 179 $ 169 $ (24)

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Realized gains (losses) net:

Publicly traded equity securities .......... $88 $66 $86

Fixed income securities ................ 91 103 (110)

Total ........................... $ 179 $ 169 $ (24)

102