Cisco 2011 Annual Report Download - page 95

Download and view the complete annual report

Please find page 95 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

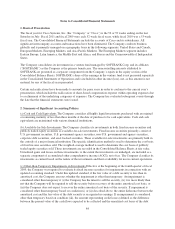

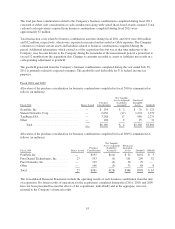

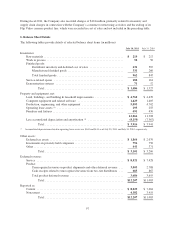

(g) Depreciation and Amortization Property and equipment are stated at cost, less accumulated depreciation or

amortization, whenever applicable. Depreciation and amortization are computed using the straight-line method,

generally over the following periods:

Period

Buildings 25 years

Building improvements 10 years

Furniture and fixtures 5 years

Leasehold improvements Shorter of remaining lease term or 5 years

Computer equipment and related software 30 to 36 months

Production, engineering, and other equipment Up to 5 years

Operating lease assets Based on lease term—generally up to 3 years

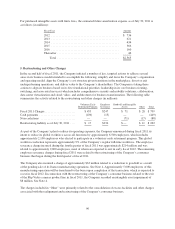

(h) Business Combinations Upon adoption of revised accounting guidance for business combinations beginning

with business combinations completed in the first quarter of fiscal 2010, the Company (i) applies the expanded

definition of “business” and “business combination” as prescribed by the revised guidance ii) recognizes assets

acquired, liabilities assumed and noncontrolling interests (including goodwill) measured at fair value at the

acquisition date with subsequent changes to the fair value of such assets acquired and liabilities assumed

recognized in earnings after the expiration of the measurement period, a period not to exceed 12 months from the

acquisition date; (iii) recognizes acquisition-related expenses and acquisition-related restructuring costs in

earnings; and (iv) capitalizes in-process research and development (IPR&D) at fair value as an indefinite-lived

intangible asset that will be assessed for impairment thereafter. Upon completion of development, the R&D

intangible asset will be amortized over its estimated useful life.

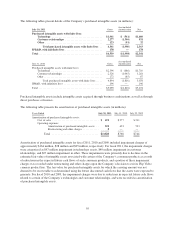

(i) Goodwill and Purchased Intangible Assets Goodwill is tested for impairment on an annual basis in the fourth

fiscal quarter and, when specific circumstances dictate, between annual tests. When impaired, the carrying value

of goodwill is written down to fair value. The goodwill impairment test involves a two-step process. The first

step, identifying a potential impairment, compares the fair value of a reporting unit with its carrying amount,

including goodwill. If the carrying value of the reporting unit exceeds its fair value, the second step would need

to be conducted; otherwise, no further steps are necessary as no potential impairment exists. The second step,

measuring the impairment loss, compares the implied fair value of the reporting unit goodwill with the carrying

amount of that goodwill. Any excess of the reporting unit goodwill carrying value over the respective implied

fair value is recognized as an impairment loss. Purchased intangible assets with finite lives are carried at cost,

less accumulated amortization. Amortization is computed over the estimated useful lives of the respective assets,

generally two to seven years. See “Long-Lived Assets” below for the Company’s policy regarding impairment

testing of purchased intangible assets with finite lives. Purchased intangible assets with indefinite lives are

assessed for potential impairment annually or when events or circumstances indicate that their carrying amounts

might be impaired.

(j) Long-Lived Assets Long-lived assets that are held and used by the Company are reviewed for impairment

whenever events or changes in circumstances indicate that the carrying amount of such assets may not be

recoverable. Determination of recoverability of long-lived assets is based on an estimate of the undiscounted

future cash flows resulting from the use of the asset and its eventual disposition. Measurement of an impairment

loss for long-lived assets that management expects to hold and use is based on the difference between the fair

value of the asset and its carrying value. Long-lived assets to be disposed of are reported at the lower of carrying

amount or fair value less costs to sell.

(k) Derivative Instruments The Company recognizes derivative instruments as either assets or liabilities and

measures those instruments at fair value. The accounting for changes in the fair value of a derivative depends on

the intended use of the derivative and the resulting designation. For a derivative instrument designated as a fair

value hedge, the gain or loss is recognized in earnings in the period of change together with the offsetting loss or

gain on the hedged item attributed to the risk being hedged. For a derivative instrument designated as a cash flow

87