Cisco 2011 Annual Report Download - page 135

Download and view the complete annual report

Please find page 135 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

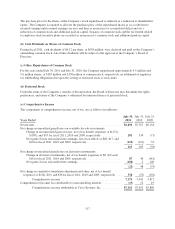

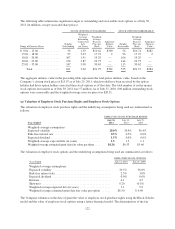

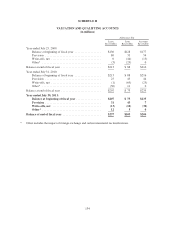

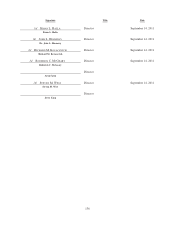

The components of the deferred tax assets and liabilities are as follows (in millions):

July 30, 2011 July 31, 2010

ASSETS

Allowance for doubtful accounts and returns ................................. $ 413 $ 248

Sales-type and direct-financing leases ....................................... 178 224

Inventory write-downs and capitalization .................................... 160 176

Investment provisions ................................................... 226 329

IPR&D, goodwill, and purchased intangible assets ............................. 106 191

Deferred revenue ....................................................... 1,634 1,752

Credits and net operating loss carryforwards .................................. 713 752

Share-based compensation expense ......................................... 1,084 970

Accrued compensation ................................................... 507 339

Other ................................................................. 590 517

Gross deferred tax assets ............................................. 5,611 5,498

Valuation allowance ................................................. (82) (76)

Total deferred tax assets .............................................. 5,529 5,422

LIABILITIES

Purchased intangible assets ............................................... (997) (1,224)

Depreciation ........................................................... (298) (120)

Unrealized gains on investments ........................................... (265) (185)

Other ................................................................. (90) (51)

Total deferred tax liabilities ........................................... (1,650) (1,580)

Total net deferred tax assets ....................................... $ 3,879 $ 3,842

As of July 30, 2011, the Company’s federal, state, and foreign net operating loss carryforwards for income tax

purposes were $334 million, $1.7 billion, and $298 million, respectively. If not utilized, the federal net operating

loss carryforwards will begin to expire in fiscal 2019, the state net operating loss carryforwards will begin to

expire in fiscal 2012, and the foreign net operating loss carryforwards will begin to expire in fiscal 2012. As of

July 30, 2011, the Company’s federal and state tax credit carryforwards for income tax purposes were

approximately $5 million and $531 million, respectively. If not utilized, the federal and state tax credit

carryforwards will begin to expire in fiscal 2013 and fiscal 2012, respectively.

16. Segment Information and Major Customers

The Company designs, manufactures, and sells Internet Protocol (IP)-based networking and other products

related to the communications and IT industry and provides services associated with these products and their use.

Cisco product categories consist of Routers, Switches, New Products, and Other Products. These products,

primarily integrated by Cisco IOS Software, link geographically dispersed local-area networks (LANs),

metropolitan-area networks (MANs) and wide-area networks (WANs).

(a) Net Sales and Gross Margin by Segment

The Company conducts business globally and is primarily managed on a geographic basis. As of July 30, 2011,

the Company had four geographic segments, which consisted of United States and Canada, European Markets,

Emerging Markets, and Asia Pacific Markets, as presented in the following tables. As the Company strives for

faster decision making with greater accountability and alignment to support the Company’s emerging countries

and the five foundational priorities as discussed in Note 5, beginning in fiscal 2012, the Company will organize

into the following three geographic segments: The Americas; Europe, Middle East, and Africa (“EMEA”); and

Asia Pacific, Japan, and China (“APJC”).

The Company’s management makes financial decisions and allocates resources based on the information it

receives from its internal management system. Sales are attributed to a geographic segment based on the ordering

127