Cisco 2011 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

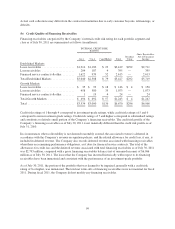

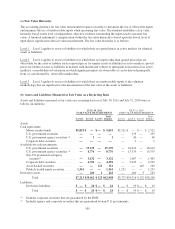

There were no significant impairment charges on available-for-sale investments for the year ended July 30, 2011. There was

no impairment charge for the year ended July 31, 2010 while for the year ended July 25, 2009, net losses on fixed income

securities and net gains on publicly traded equity securities included impairment charges of $219 million and $39 million,

respectively. The impairment charges for fiscal 2009 were due to a decline in the fair value of the investments below their

cost basis that were judged to be other than temporary and were recorded as a reduction to the amortized cost of the

respective investments.

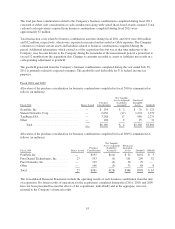

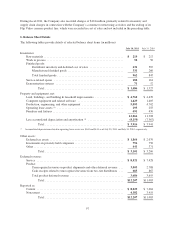

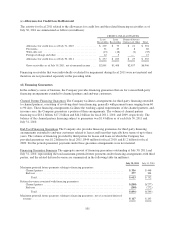

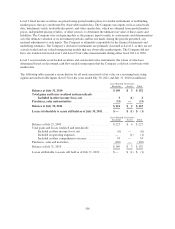

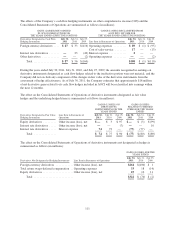

The following table summarizes the activity related to credit losses for fixed income securities (in millions):

July 30, 2011 July 31, 2010

Balance at beginning of fiscal year ............................... $(95) $(153)

Sales of other-than-temporarily impaired fixed income securities ....... 72 58

Balance at end of fiscal year .................................... $(23) $ (95)

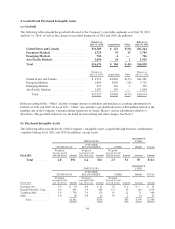

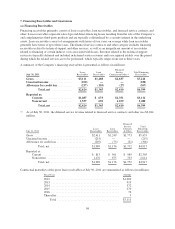

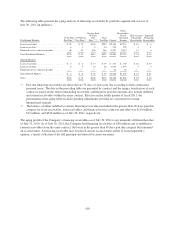

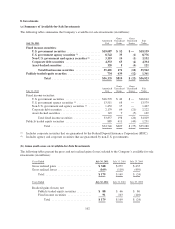

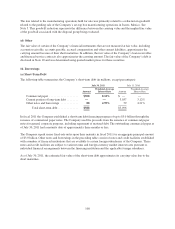

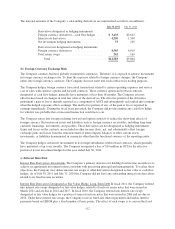

The following tables present the breakdown of the available-for-sale investments with gross unrealized losses and the

duration that those losses had been unrealized at July 30, 2011 and July 31, 2010 (in millions):

UNREALIZED LOSSES

LESS THAN 12 MONTHS

UNREALIZED LOSSES

12 MONTHS OR GREATER TOTAL

July 30, 2011 Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Fixed income securities:

U.S. government agency securities (1) ....... $2,310 $ (1) $ — $ — $2,310 $ (1)

Non-U.S. government and agency

securities (2) .......................... 875 (1) — — 875 (1)

Corporate debt securities ................ 548 (2) 56 (2) 604 (4)

Asset-backed securities .................. — — 105 (4) 105 (4)

Total fixed income securities ......... 3,733 (4) 161 (6) 3,894 (10)

Publicly traded equity securities .............. 112 (12) — — 112 (12)

Total ......................... $3,845 $ (16) $ 161 $ (6) $4,006 $(22)

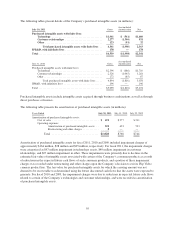

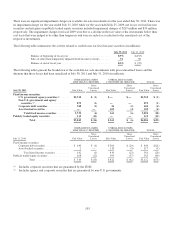

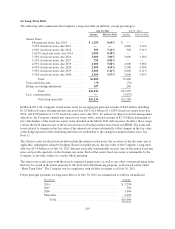

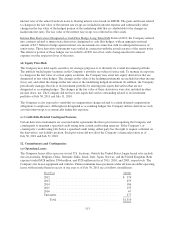

UNREALIZED LOSSES

LESS THAN 12 MONTHS

UNREALIZED LOSSES

12 MONTHS OR GREATER TOTAL

July 31, 2010 Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses Fair Value

Gross

Unrealized

Losses

Fixed income securities:

Corporate debt securities .................. $ 140 $ (1) $304 $ (20) $ 444 $(21)

Asset-backed securities ................... 2 — 115 (5) 117 (5)

Total fixed income securities .......... 142 (1) 419 (25) 561 (26)

Publicly traded equity securities ................ 168 (12) 393 (37) 561 (49)

Total ......................... $ 310 $(13) $ 812 $ (62) $1,122 $(75)

(1) Includes corporate securities that are guaranteed by the FDIC.

(2) Includes agency and corporate securities that are guaranteed by non-U.S. governments.

103