Cisco 2011 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

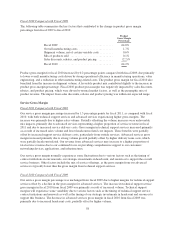

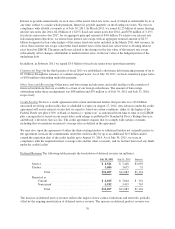

Fiscal 2011 Compared with Fiscal 2010

The increase in total net gains on available-for-sale investments in fiscal 2011 compared with fiscal 2010 was

primarily attributable to higher gains on publicly traded equity securities, partially offset by lower gains on fixed

income securities in fiscal 2011. These changes were the result of market conditions and the timing of sales of

these securities. See Note 8 to the Consolidated Financial Statements for the unrealized gains and losses on

investments.

For fiscal 2011 as compared with fiscal 2010, the decline in net gains on investments in privately held companies

was due to lower net equity method gains and lower gains on sales. The decline was partially offset by lower

impairment charges on investments in privately held companies. Impairment charges on investments in privately

held companies were $10 million and $25 million for fiscal 2011 and 2010, respectively.

The change in other gains and (losses), net for fiscal 2011 as compared with fiscal 2010 was primarily due to

fiscal 2011 experiencing lower gains from customer lease terminations, higher donations expense, and

unfavorable foreign exchange impacts.

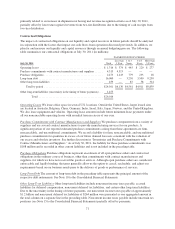

Fiscal 2010 Compared with Fiscal 2009

For fiscal 2010, the increase in net gains on available-for-sale investments was due to the absence of impairment

charges on these securities during fiscal 2010. For fiscal 2009, the net gains and losses on fixed income securities

included impairment charges of $219 million and net gains on publicly traded equity securities included

impairment charges of $39 million.

The change in net gains (losses) on investments in privately held companies in fiscal 2010, compared with fiscal

2009, was primarily due to higher realized gains and lower impairment charges in fiscal 2010. Net losses on

investments in privately held companies included impairment charges of $25 million in fiscal 2010 compared

with $85 million in fiscal 2009.

Other gains (losses), net for fiscal 2010 increased due primarily to gains resulting from customer operating lease

terminations.

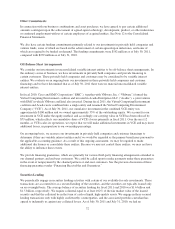

Provision for Income Taxes

Fiscal 2011 Compared with Fiscal 2010

The provision for income taxes resulted in an effective tax rate of 17.1% for fiscal 2011, compared with 17.5%

for fiscal 2010. During fiscal 2010, the U.S. Court of Appeals for the Ninth Circuit (the “Ninth Circuit”)

withdrew its prior holding and reaffirmed the 2005 U.S. Tax Court ruling in Xilinx, Inc. v. Commissioner. The

net 0.4 percentage point decrease in the effective tax rate between fiscal years was attributable to the absence in

fiscal 2011 of this tax benefit of $158 million, or 1.7 percentage points, offset by other items including the tax

benefit of $188 million, or 2.5 percentage points, related to the retroactive reinstatement of the U.S. federal R&D

credit.

Our provision for income taxes is subject to volatility and could be adversely impacted by earnings being lower

than anticipated in countries that have lower tax rates and higher than anticipated in countries that have higher

tax rates. Our provision for income taxes does not include provisions for U.S. income taxes and foreign

withholding taxes associated with the repatriation of undistributed earnings of certain foreign subsidiaries that we

intend to reinvest indefinitely in our foreign subsidiaries. If these earnings were distributed to the United States in

the form of dividends or otherwise, or if the shares of the relevant foreign subsidiaries were sold or otherwise

transferred, we would be subject to additional U.S. income taxes (subject to an adjustment for foreign tax credits)

and foreign withholding taxes. Further, as a result of certain of our ongoing employment and capital investment

actions and commitments, our income in certain countries is subject to reduced tax rates and in some cases is

wholly exempt from tax. Our failure to meet these commitments could adversely impact our provision for

income taxes.

65