Cisco 2011 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

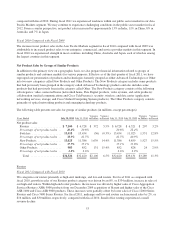

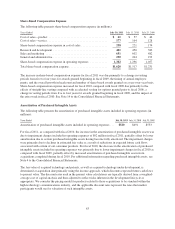

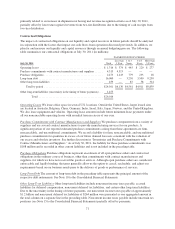

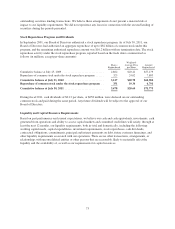

Share-Based Compensation Expense

The following table presents share-based compensation expense (in millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Cost of sales—product ........................................ $61 $57 $46

Cost of sales—service ......................................... 177 164 128

Share-based compensation expense in cost of sales .................. 238 221 174

Research and development ..................................... 481 450 382

Sales and marketing .......................................... 651 602 482

General and administrative ..................................... 250 244 193

Share-based compensation expense in operating expenses ............ 1,382 1,296 1,057

Total share-based compensation expense .......................... $1,620 $1,517 $1,231

The increase in share-based compensation expense for fiscal 2011 was due primarily to a change in vesting

periods from five to four years for awards granted beginning in fiscal 2009, the timing of annual employee

grants, and the overall growth in headcount and number of share-based awards granted on a year-over-year basis.

Share-based compensation expense increased for fiscal 2010 compared with fiscal 2009 due primarily to the

effects of straight-line vesting compared with accelerated vesting for options granted prior to fiscal 2006, a

change in vesting periods from five to four years for awards granted beginning in fiscal 2009, and the impact of

the extra week in fiscal 2010. See Note 14 to the Consolidated Financial Statements.

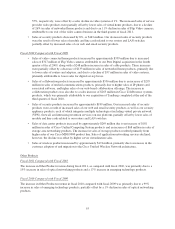

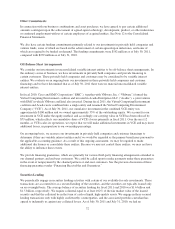

Amortization of Purchased Intangible Assets

The following table presents the amortization of purchased intangible assets included in operating expenses (in

millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Amortization of purchased intangible assets included in operating expenses . . . $520 $491 $533

For fiscal 2011, as compared with fiscal 2010, the increase in the amortization of purchased intangible assets was

due to impairment charges included in operating expenses of $92 million in fiscal 2011, partially offset by lower

amortization due to certain purchased intangible assets having become fully amortized. The impairment charges

were primarily due to declines in estimated fair value as a result of reductions in expected future cash flows

associated with certain of our consumer products. For fiscal 2010, the decrease in the amortization of purchased

intangible assets included in operating expenses was primarily due to lower impairment charges in fiscal 2010 as

compared with fiscal 2009, partially offset by increased amortization of purchased intangible assets from

acquisitions completed during fiscal 2010. For additional information regarding purchased intangible assets, see

Note 4 to the Consolidated Financial Statements.

The fair value of acquired technology and patents, as well as acquired technology under development, is

determined at acquisition date primarily using the income approach, which discounts expected future cash flows

to present value. The discount rates used in the present value calculations are typically derived from a weighted-

average cost of capital analysis and then adjusted to reflect risks inherent in the development lifecycle as

appropriate. We consider the pricing model for products related to these acquisitions to be standard within the

high-technology communications industry, and the applicable discount rates represent the rates that market

participants would use for valuation of such intangible assets.

63