Cisco 2011 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

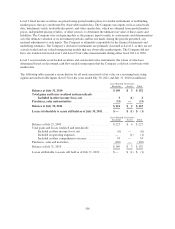

The loss related to the manufacturing operations held for sale was primarily related to a reduction in goodwill

related to the pending sale of the Company’s set-top box manufacturing operations in Juarez, Mexico. See

Note 5. This goodwill reduction represents the difference between the carrying value and the implied fair value

of the goodwill associated with the disposal group being evaluated.

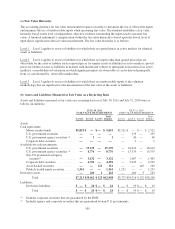

(d) Other

The fair value of certain of the Company’s financial instruments that are not measured at fair value, including

accounts receivable, accounts payable, accrued compensation and other current liabilities, approximates the

carrying amount because of their short maturities. In addition, the fair value of the Company’s loan receivables

and financed service contracts also approximates the carrying amount. The fair value of the Company’s debt is

disclosed in Note 10 and was determined using quoted market prices for those securities.

10. Borrowings

(a) Short-Term Debt

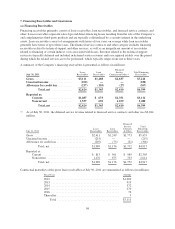

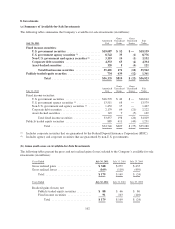

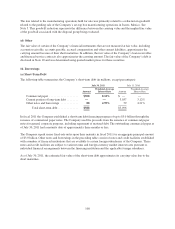

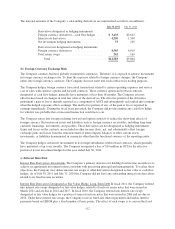

The following table summarizes the Company’s short-term debt (in millions, except percentages):

July 30, 2011 July 31, 2010

Amount

Weighted-Average

Interest Rate Amount

Weighted-Average

Interest Rate

Commercial paper .................... $500 0.14% $— —

Current portion of long-term debt ........ ——3,037 3.12%

Other notes and borrowings ............ 88 4.59% 59 4.21%

Total short-term debt .............. $588 $3,096

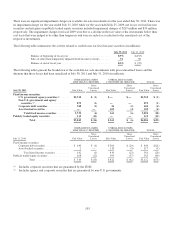

In fiscal 2011 the Company established a short-term debt financing program of up to $3.0 billion through the

issuance of commercial paper notes. The Company used the proceeds from the issuance of commercial paper

notes for general corporate purposes, including repayment of matured debt. The outstanding commercial paper as

of July 30, 2011 had a maturity date of approximately three months or less.

The Company repaid senior fixed-rate notes upon their maturity in fiscal 2011 for an aggregate principal amount

of $3.0 billion. Other notes and borrowings in the preceding table consist of notes and credit facilities established

with a number of financial institutions that are available to certain foreign subsidiaries of the Company. These

notes and credit facilities are subject to various terms and foreign currency market interest rates pursuant to

individual financial arrangements between the financing institution and the applicable foreign subsidiary.

As of July 30, 2011, the estimated fair value of the short-term debt approximates its carrying value due to the

short maturities.

108