Cisco 2011 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

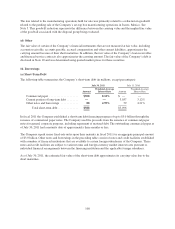

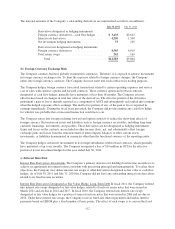

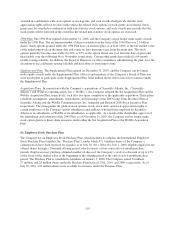

The components of AOCI, net of tax, are summarized as follows (in millions):

July 30, 2011 July 31, 2010 July 25, 2009

Net unrealized gains on investments ............................. $ 487 $333 $138

Net unrealized gains (losses) on derivative instruments .............. 627 (21)

Cumulative translation adjustment and other ....................... 801 263 318

Total .................................................. $1,294 $623 $435

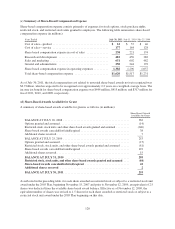

14. Employee Benefit Plans

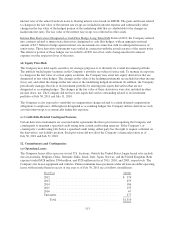

(a) Employee Stock Incentive Plans

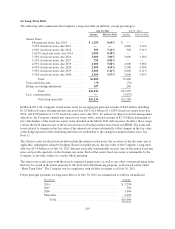

Stock Incentive Plan Program Description As of July 30, 2011, the Company had five stock incentive plans: the

2005 Stock Incentive Plan (the “2005 Plan”); the 1996 Stock Incentive Plan (the “1996 Plan”); the 1997

Supplemental Stock Incentive Plan (the “Supplemental Plan”); the Cisco Systems, Inc. SA Acquisition Long-

Term Incentive Plan (the “SA Acquisition Plan”); and the Cisco Systems, Inc. WebEx Acquisition Long-Term

Incentive Plan (the “WebEx Acquisition Plan”). In addition, the Company has, in connection with the

acquisitions of various companies, assumed the share-based awards granted under stock incentive plans of the

acquired companies or issued share-based awards in replacement thereof. Share-based awards are designed to

reward employees for their long-term contributions to the Company and provide incentives for them to remain

with the Company. The number and frequency of share-based awards are based on competitive practices,

operating results of the Company, government regulations, and other factors. Since the inception of the stock

incentive plans, the Company has granted share-based awards to a significant percentage of its employees, and

the majority has been granted to employees below the vice president level. The Company’s primary stock

incentive plans are summarized as follows:

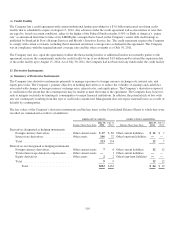

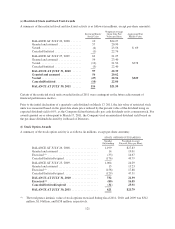

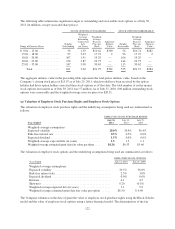

2005 Plan As amended on November 15, 2007, the maximum number of shares issuable under the 2005 Plan

over its term is 559 million shares plus the amount of any shares underlying awards outstanding on

November 15, 2007 under the 1996 Plan, the SA Acquisition Plan, and the WebEx Acquisition Plan that are

forfeited or are terminated for any other reason before being exercised or settled. If any awards granted under the

2005 Plan are forfeited or are terminated for any other reason before being exercised or settled, then the shares

underlying the awards will again be available under the 2005 Plan.

Prior to November 12, 2009, the number of shares available for issuance under the 2005 Plan was reduced by 2.5

shares for each share awarded as a stock grant or stock unit. Pursuant to an amendment approved by the

Company’s shareholders on November 12, 2009, following that amendment the number of shares available for

issuance under the 2005 Plan is reduced by 1.5 shares for each share awarded as a stock grant or a stock unit, and

any shares underlying awards outstanding under the 1996 Plan, the SA Acquisition Plan, and the WebEx

Acquisition Plan that expire unexercised at the end of their maximum terms become available for reissuance

under the 2005 Plan. The 2005 Plan permits the granting of stock options, stock, stock units, and stock

appreciation rights to employees (including employee directors and officers), consultants of the Company and its

subsidiaries and affiliates, and non-employee directors of the Company. Stock options and stock appreciation

rights granted under the 2005 Plan have an exercise price of at least 100% of the fair market value of the

underlying stock on the grant date and prior to November 12, 2009 have an expiration date no later than nine

years from the grant date. The expiration date for stock options and stock appreciation rights granted subsequent

to the amendment approved on November 12, 2009 shall be no later than ten years from the grant date. The stock

options will generally become exercisable for 20% or 25% of the option shares one year from the date of grant

and then ratably over the following 48 or 36 months, respectively. Stock grants and stock units will generally

vest with respect to 20% or 25% of the shares covered by the grant on each of the first through fifth or fourth

anniversaries of the date of the grant, respectively. The Compensation and Management Development Committee

of the Board of Directors has the discretion to use different vesting schedules. Stock appreciation rights may be

118