Cisco 2011 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Restructuring and Other Charges

In fiscal 2011, we incurred within operating expenses restructuring charges of $799 million. These charges

included $453 million related to a voluntary early retirement program for eligible employees in the United States

and Canada; $247 million related to employee severance for other employees subject to our reduction of our

work force; and $71 million related to the impairment of goodwill and intangible assets, primarily as a result of

the pending sale of our Juarez, Mexico manufacturing operations. We also recorded charges within operating

expenses of $28 million related to the consolidation of excess facilities and other activities. We announced in

July 2011 that we expected to take up to $1.3 billion in pretax charges as part of our expense reduction actions.

We incurred charges of $728 million in the fourth quarter of fiscal 2011 (included as part of the $799 million

discussed above) related to these announcements. We expect the remaining charges to be incurred during fiscal

2012.

Interest and Other Income, Net

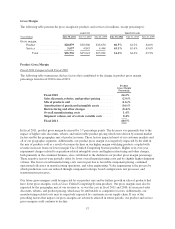

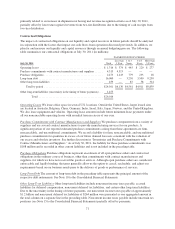

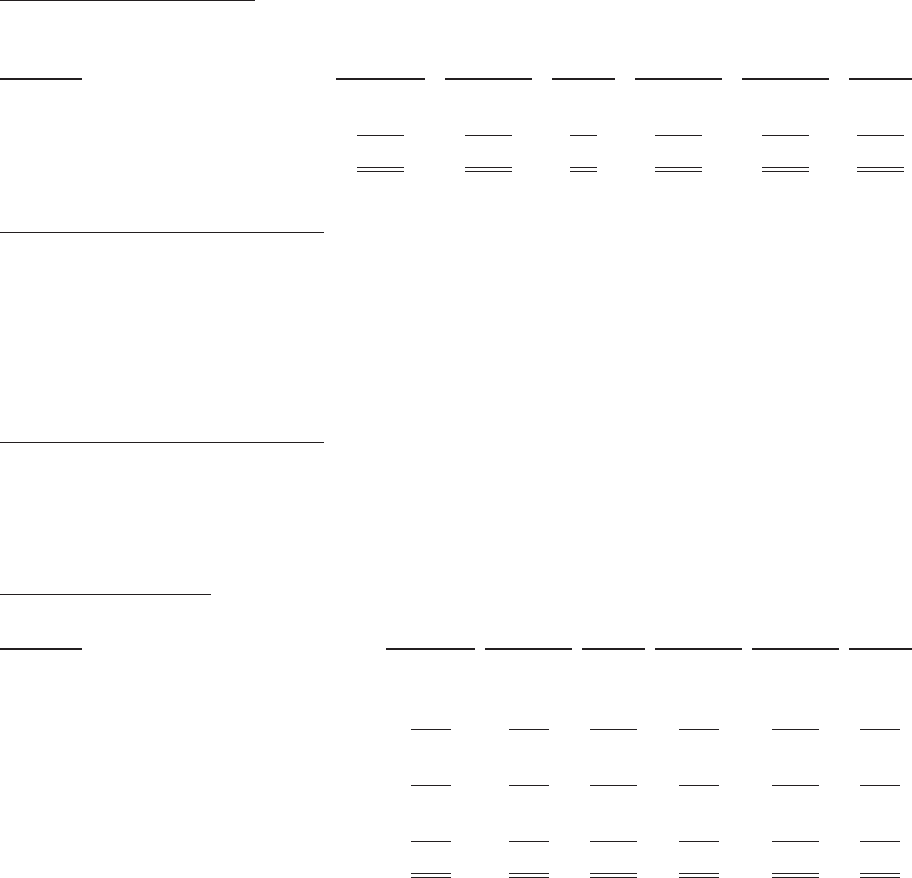

Interest Income (Expense), Net The following table summarizes interest income and interest expense (in

millions):

Years Ended July 30, 2011 July 31, 2010

Variance

in Dollars July 31, 2010 July 25, 2009

Variance

in Dollars

Interest income ................... $ 641 $ 635 $ 6 $ 635 $ 845 $(210)

Interest expense .................. (628) (623) (5) (623) (346) (277)

Interest income (expense), net . . . $13 $ 12 $ 1 $ 12 $ 499 $(487)

Fiscal 2011 Compared with Fiscal 2010

Interest income increased slightly in fiscal 2011 due to increased income from financing receivables offsetting

the effect of lower average interest rates on our portfolio of cash, cash equivalents, and fixed income

investments. The increase in interest expense in fiscal 2011, as compared with fiscal 2010, was due to higher

average debt balances during fiscal 2011 attributable to our senior debt issuance in March 2011. Partially

offsetting the impact of higher average debt balances during fiscal 2011 is the effect of lower average interest

rates on our debt during fiscal 2011.

Fiscal 2010 Compared with Fiscal 2009

The decrease in interest income in fiscal 2010 compared with fiscal 2009 was due to lower average interest rates,

partially offset by higher average total cash and cash equivalents and fixed income security balances in fiscal

2010. The increase in interest expense in fiscal 2010, compared with fiscal 2009, was primarily due to additional

interest expense related to our senior debt issuances in November 2009 and February 2009.

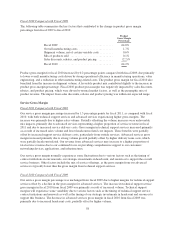

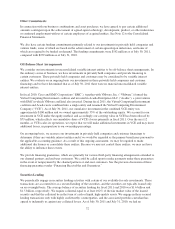

Other Income (Loss), Net The components of other income (loss), net, are summarized as follows (in millions):

Years Ended July 30, 2011 July 31, 2010

Variance

in Dollars July 31, 2010 July 25, 2009

Variance

in Dollars

Gains (losses) on investments, net:

Publicly traded equity securities ....... $88 $ 66 $ 22 $ 66 $ 86 $ (20)

Fixed income securities .............. 91 103 (12) 103 (110) 213

Total available-for-sale investments .... 179 169 10 169 (24) 193

Privately held companies ............. 34 54 (20) 54 (56) 110

Net gains (losses) on investments . . 213 223 (10) 223 (80) 303

Other gains (losses), net .................. (75) 16 (91) 16 (48) 64

Other income (loss), net ...... $138 $239 $(101) $239 $(128) $367

64