Cisco 2011 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

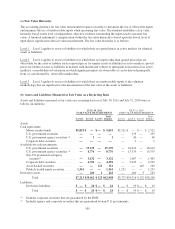

(a) Fair Value Hierarchy

The accounting guidance for fair value measurement requires an entity to maximize the use of observable inputs

and minimize the use of unobservable inputs when measuring fair value. The standard establishes a fair value

hierarchy based on the level of independent, objective evidence surrounding the inputs used to measure fair

value. A financial instrument’s categorization within the fair value hierarchy is based upon the lowest level of

input that is significant to the fair value measurement. The fair value hierarchy is as follows:

Level 1 Level 1 applies to assets or liabilities for which there are quoted prices in active markets for identical

assets or liabilities.

Level 2 Level 2 applies to assets or liabilities for which there are inputs other than quoted prices that are

observable for the asset or liability such as quoted prices for similar assets or liabilities in active markets; quoted

prices for identical assets or liabilities in markets with insufficient volume or infrequent transactions (less active

markets); or model-derived valuations in which significant inputs are observable or can be derived principally

from, or corroborated by, observable market data.

Level 3 Level 3 applies to assets or liabilities for which there are unobservable inputs to the valuation

methodology that are significant to the measurement of the fair value of the assets or liabilities.

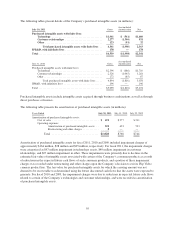

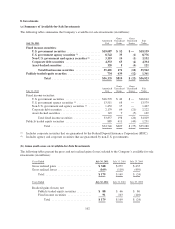

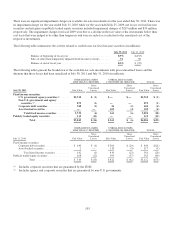

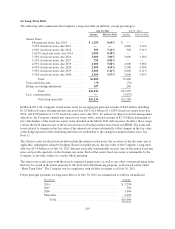

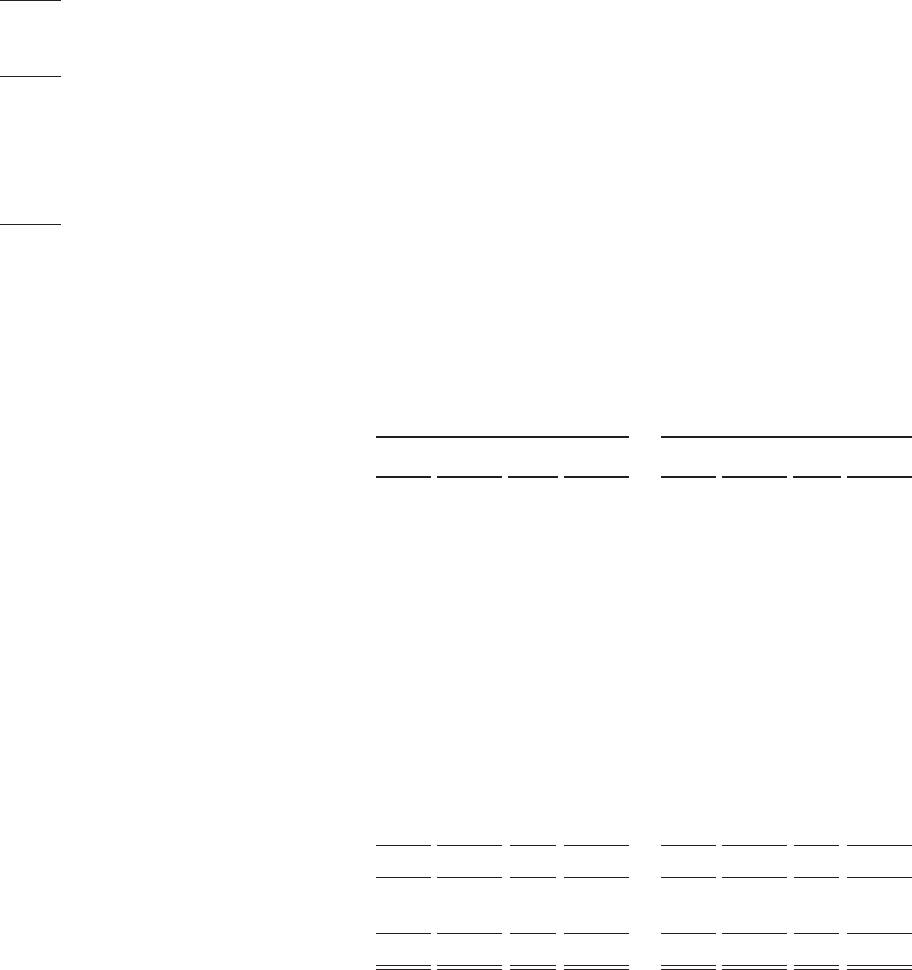

(b) Assets and Liabilities Measured at Fair Value on a Recurring Basis

Assets and liabilities measured at fair value on a recurring basis as of July 30, 2011 and July 31, 2010 were as

follows (in millions):

JULY 30, 2011

FAIR VALUE MEASUREMENTS

JULY 31, 2010

FAIR VALUE MEASUREMENTS

Level 1 Level 2 Level 3

Total

Balance Level 1 Level 2 Level 3

Total

Balance

Assets

Cash equivalents:

Money market funds ................$5,852 $ — $ — $ 5,852 $2,521 $ — $ — $ 2,521

U.S. government securities ........... ———— — 235 — 235

U.S. government agency securities (1) ... —1—1—40—40

Corporate debt securities ............ ———— —1—1

Available-for-sale investments:

U.S. government securities ........... — 19,139 — 19,139 — 16,612 — 16,612

U.S. government agency securities (1) ... — 8,776 — 8,776 — 13,579 — 13,579

Non-U.S. government and agency

securities(2) ........................

— 3,132 — 3,132 — 1,467 — 1,467

Corporate debt securities ............ — 4,394 — 4,394 — 2,222 — 2,222

Asset-backed securities .............. — — 121 121 — — 149 149

Publicly traded equity securities ....... 1,361 — — 1,361 1,251 — — 1,251

Derivative assets ....................... — 220 2 222 — 160 3 163

Total ........................$7,213 $35,662 $ 123 $42,998 $3,772 $34,316 $ 152 $38,240

Liabilities:

Derivative liabilities ................$—$ 24$— $ 24 $—$ 19$— $ 19

Total ........................$—$ 24$— $ 24 $—$ 19$—$ 19

(1) Includes corporate securities that are guaranteed by the FDIC.

(2) Includes agency and corporate securities that are guaranteed by non-U.S. governments.

105