Cisco 2011 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

the Internal Revenue Code. All matching contributions vest immediately. The Company’s matching contributions

to the Plan totaled $239 million, $210 million, and $202 million in fiscal 2011, 2010, and 2009, respectively.

The Plan allows employees who meet the age requirements and reach the Plan contribution limits to make a

catch-up contribution not to exceed the lesser of 75% of their eligible compensation or the limit set forth in the

Internal Revenue Code. The catch-up contributions are not eligible for matching contributions. In addition, the

Plan provides for discretionary profit-sharing contributions as determined by the Board of Directors. Such

contributions to the Plan are allocated among eligible participants in the proportion of their salaries to the total

salaries of all participants. There were no discretionary profit-sharing contributions made in fiscal 2011, 2010, or

2009.

The Company also sponsors other 401(k) plans that arose from acquisitions of other companies. The Company’s

contributions to these plans were not material to the Company on either an individual or aggregate basis for any

of the fiscal years presented.

(i) Deferred Compensation Plans

The Cisco Systems, Inc. Deferred Compensation Plan (the “Deferred Compensation Plan”), a nonqualified

deferred compensation plan, became effective in 2007. As required by applicable law, participation in the

Deferred Compensation Plan is limited to a select group of the Company’s management employees. Under the

Deferred Compensation Plan, which is an unfunded and unsecured deferred compensation arrangement, a

participant may elect to defer base salary, bonus, and/or commissions, pursuant to such rules as may be

established by the Company, up to the maximum percentages for each deferral election as described in the plan.

The Company may also, at its discretion, make a matching contribution to the employee under the Deferred

Compensation Plan. A matching contribution equal to 4.5% of eligible compensation in excess of the Internal

Revenue Code limit for qualified plans for calendar year 2011 that is deferred by participants under the Deferred

Compensation Plan (with a $1.5 million cap on eligible compensation) will be made to eligible participants’

accounts at the end of calendar year 2011. The deferred compensation liability under the Deferred Compensation

Plan, together with a deferred compensation plan assumed from Scientific-Atlanta, was approximately $375

million and $280 million as of July 30, 2011 and July 31, 2010, respectively, and was recorded primarily in other

long-term liabilities.

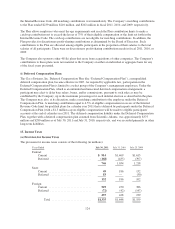

15. Income Taxes

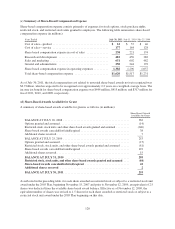

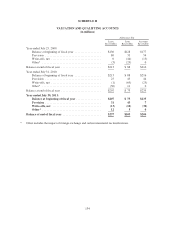

(a) Provision for Income Taxes

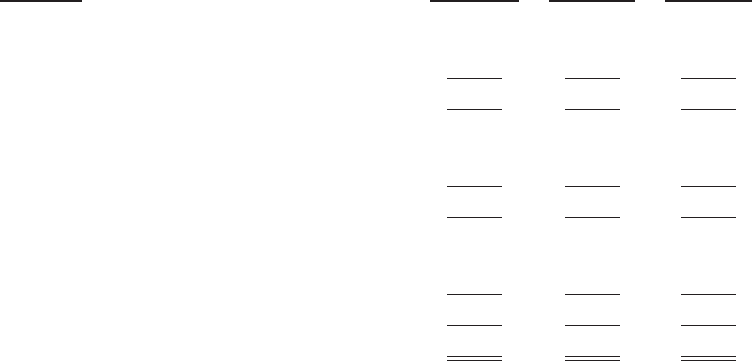

The provision for income taxes consists of the following (in millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Federal:

Current ............................. $ 914 $1,469 $1,615

Deferred ............................ (168) (435) (397)

746 1,034 1,218

State:

Current ............................. 49 186 132

Deferred ............................ 83 — (30)

132 186 102

Foreign:

Current ............................. 529 470 386

Deferred ............................ (72) (42) (147)

457 428 239

Total ........................... $1,335 $1,648 $1,559

124