Cisco 2011 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

intends to defend the claims vigorously. While the Company believes there is no legal basis for its alleged

liability, due to the complexities and uncertainty surrounding the judicial process in Brazil and the nature of the

claims asserting joint liability with the importer, the Company is unable to determine the likelihood of an

unfavorable outcome against it and is unable to reasonably estimate a range of loss, if any. The Company does

not expect a final judicial determination for several years.

On March 31, 2011, a purported shareholder class action lawsuit was filed in the United States District Court for

the Northern District of California against the Company and certain of its officers and directors. A second lawsuit

with substantially similar allegations was filed with the same court on April 12, 2011 against the Company and

certain of its officers and directors. The lawsuits are purportedly brought on behalf of those who purchased the

Company’s publicly traded securities between May 12, 2010 and February 9, 2011, and between February 3,

2010 and February 9, 2011, respectively. Plaintiffs allege that defendants made false and misleading statements

during quarterly earnings calls, purport to assert claims for violations of the federal securities laws, and seek

unspecified compensatory damages and other relief. The Company believes the claims are without merit and

intends to defend the actions vigorously. While the Company believes there is no legal basis for liability, due to

the uncertainty surrounding the litigation process, the Company is unable to reasonably estimate a range of loss,

if any, at this time.

Beginning in April 2011, purported shareholder derivative lawsuits were filed in both the United States District

Court for the Northern District of California and the California Superior Court for the County of Santa Clara

against the Company’s Board of Directors and several of its officers for allowing management to make allegedly

false statements during earnings calls. The Company’s management of its stock repurchase program is also

alleged to have breached a fiduciary duty. The complaints include claims for violation of the federal securities

laws, breach of fiduciary duty, aiding and abetting breaches of fiduciary duty, waste of corporate assets, unjust

enrichment, and violations of the California Corporations Code. The complaint seeks compensatory damages,

disgorgement, and other relief.

In addition, the Company is subject to legal proceedings, claims, and litigation arising in the ordinary course of

business, including intellectual property litigation. While the outcome of these matters is currently not

determinable, the Company does not expect that the ultimate costs to resolve these matters will have a material

adverse effect on its consolidated financial position, results of operations, or cash flows.

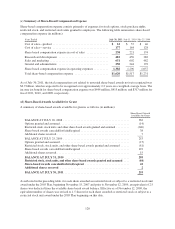

13. Shareholders’ Equity

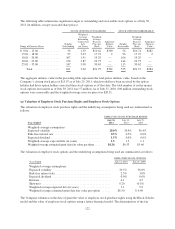

(a) Stock Repurchase Program

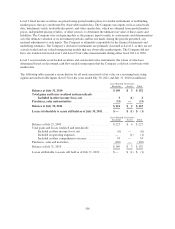

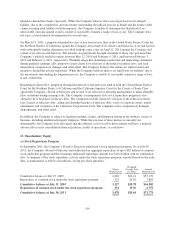

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 30,

2011, the Company’s Board of Directors had authorized an aggregate repurchase of up to $82 billion of common

stock under this program and the remaining authorized repurchase amount was $10.2 billion with no termination

date. A summary of the stock repurchase activity under the stock repurchase program, reported based on the trade

date, is summarized as follows (in millions, except per-share amounts):

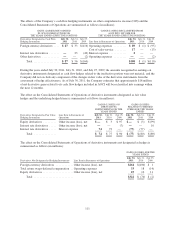

Shares

Repurchased

Weighted-

Average Price

per Share

Amount

Repurchased

Cumulative balance at July 25, 2009 ............................. 2,802 $20.41 $57,179

Repurchase of common stock under the stock repurchase program ..... 325 24.02 7,803

Cumulative balance at July 31, 2010 3,127 $20.78 $64,982

Repurchase of common stock under the stock repurchase program ..

351 19.36 6,791

Cumulative balance at July 30, 2011 3,478 $20.64 $71,773

116