Cisco 2011 Annual Report Download - page 134

Download and view the complete annual report

Please find page 134 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

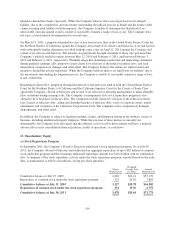

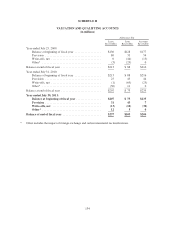

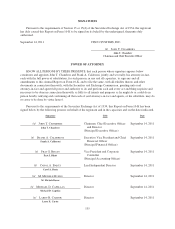

(b) Unrecognized Tax Benefits

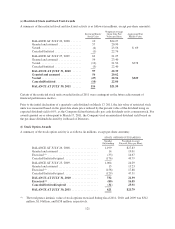

The aggregate changes in the balance of gross unrecognized tax benefits were as follows (in millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Beginning balance .................................. $2,677 $2,816 $2,505

Additions based on tax positions related to the current year . . 374 246 190

Additions for tax positions of prior years ................. 93 60 307

Reductions for tax positions of prior years ................ (60) (250) (17)

Settlements ........................................ (56) (140) (109)

Lapse of statute of limitations .......................... (80) (55) (60)

Ending balance ..................................... $2,948 $2,677 $2,816

As of July 30, 2011, $2.6 billion of the unrecognized tax benefits would affect the effective tax rate if realized.

During fiscal 2011, the Company recognized $38 million of net interest expense and $9 million of penalties.

During fiscal 2010, the Company recognized $167 million of net interest income and $5 million of penalties. The

Company’s total accrual for interest and penalties was $214 million and $167 million as of the end of fiscal 2011

and 2010, respectively. The Company is no longer subject to U.S. federal income tax audit for returns covering

tax years through fiscal 2001. With limited exceptions, the Company is no longer subject to state and local or

foreign income tax audits for returns covering tax years through fiscal 1997.

During fiscal 2010, the Ninth Circuit withdrew its prior holding and reaffirmed the 2005 U.S. Tax Court ruling in

Xilinx, Inc. v. Commissioner. As a result of this final decision in fiscal 2010, the Company decreased the amount

of gross unrecognized tax benefits by approximately $220 million and decreased the amount of accrued interest

by $218 million, which effectively reversed a similar amount that was recorded as an increase in the

unrecognized tax benefits during fiscal 2009 as a result of the Ninth Circuit’s initial decision.

The Company regularly engages in discussions and negotiations with tax authorities regarding tax matters in

various jurisdictions. The Company believes it is reasonably possible that certain federal, foreign, and state tax

matters may be concluded in the next 12 months. Specific positions that may be resolved include issues involving

transfer pricing and various other matters. The Company estimates that the unrecognized tax benefits at July 30,

2011 could be reduced by approximately $350 million in the next 12 months.

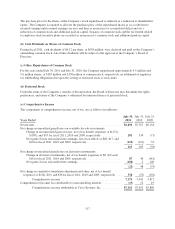

(c) Deferred Tax Assets and Liabilities

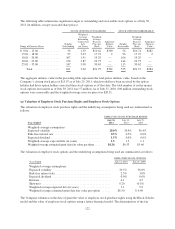

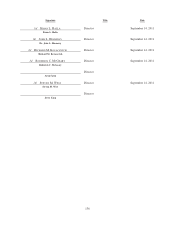

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 30, 2011 July 31, 2010

Deferred tax assets—current .................... $2,410 $2,126

Deferred tax liabilities—current ................. (131) (87)

Deferred tax assets—noncurrent ................. 1,864 2,079

Deferred tax liabilities—noncurrent .............. (264) (276)

Total net deferred tax assets ................. $3,879 $3,842

126