Cisco 2011 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

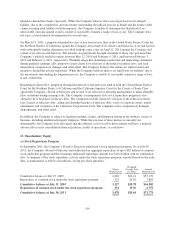

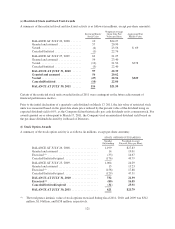

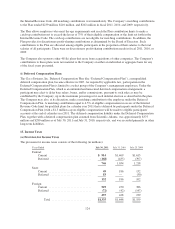

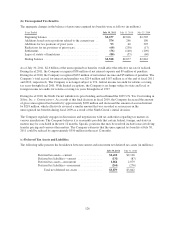

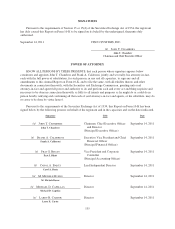

Income before provision for income taxes consists of the following (in millions):

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

United States .................................................. $1,214 $1,102 $1,650

International ................................................... 6,611 8,313 6,043

Total ..................................................... $7,825 $9,415 $7,693

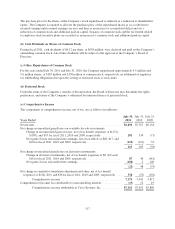

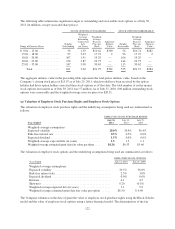

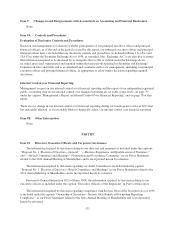

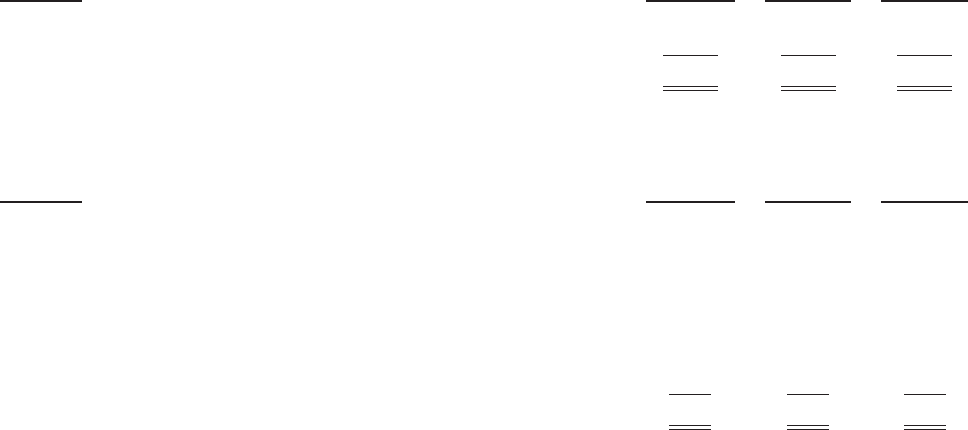

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for

income taxes consist of the following:

Years Ended July 30, 2011 July 31, 2010 July 25, 2009

Federal statutory rate ............................................ 35.0 % 35.0 % 35.0%

Effect of:

State taxes, net of federal tax benefit ............................ 1.5 1.4 1.3

Foreign income at other than U.S. rates .......................... (19.4) (19.3) (18.9)

Tax credits ................................................ (3.0) (0.5) (2.4)

Transfer pricing adjustment related to share-based compensation ..... —(1.7) 2.3

Nondeductible compensation .................................. 2.5 2.0 2.6

Other, net ................................................. 0.5 0.6 0.4

Total ................................................. 17.1% 17.5% 20.3%

In the second quarter of fiscal 2011, the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

reinstated the U.S. federal R&D tax credit, retroactive to January 1, 2010. As a result, the tax provision in fiscal 2011

includes a tax benefit of $65 million related to the R&D tax credit for fiscal 2010.

During fiscal 2010, the U.S. Court of Appeals for the Ninth Circuit (the “Ninth Circuit”) withdrew its prior holding and

reaffirmed the 2005 U.S. Tax Court ruling in Xilinx, Inc. v. Commissioner. This final decision impacted the tax treatment of

share-based compensation expenses for the purpose of determining intangible development costs under a company’s research

and development cost sharing arrangement. While the Company was not a named party to the case, this decision resulted in a

change in the Company’s tax benefits recognized in its financial statements. As a result of the decision, the Company

recognized in fiscal 2011 a combined tax benefit of $724 million, of which $158 million was recorded as a reduction to the

provision for income taxes and $566 million was recorded as an increase to additional paid-in capital. These tax benefits

effectively reversed the related charges that the Company incurred during fiscal 2009. The tax provision in fiscal 2009 also

included a net tax benefit of $106 million, related to the R&D tax credit for fiscal 2008, as a result of the Tax Extenders and

Alternative Minimum Tax Relief Act of 2008 which reinstated the U.S. federal R&D tax credit retroactive to January 1,

2008.

U.S. income taxes and foreign withholding taxes associated with the repatriation of earnings of foreign subsidiaries were not

provided for on a cumulative total of $36.7 billion of undistributed earnings for certain foreign subsidiaries as of the end of

fiscal 2011. The Company intends to reinvest these earnings indefinitely in its foreign subsidiaries. If these earnings were

distributed to the United States in the form of dividends or otherwise, or if the shares of the relevant foreign subsidiaries were

sold or otherwise transferred, the Company would be subject to additional U.S. income taxes (subject to an adjustment for

foreign tax credits) and foreign withholding taxes. Determination of the amount of unrecognized deferred income tax liability

related to these earnings is not practicable.

As a result of certain employment and capital investment actions, the Company’s income in certain foreign countries is

subject to reduced tax rates and in some cases is wholly exempt from taxes. A portion of these tax incentives will expire at

the end of fiscal 2015 and the majority of the remaining balance will expire at the end of fiscal 2025. As of the end of the

respective fiscal years, the gross income tax benefits attributable to these tax incentives were estimated to be $1.3 billion

($0.24 per diluted share) in fiscal 2011, $1.7 billion ($0.30 per diluted share) in fiscal 2010, and $1.3 billion ($0.22 per

diluted share) in fiscal 2009. These gross income tax benefits for the respective years were partially offset by accruals of U.S.

income taxes on undistributed earnings.

125