Cisco 2011 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

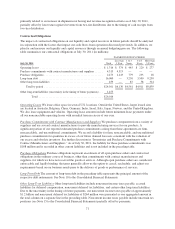

build-to-stock products. All inventories are accounted for at the lower of cost or market. Inventory is written down

based on excess and obsolete inventories determined primarily by future demand forecasts. Inventory write-downs

are measured as the difference between the cost of the inventory and market, based upon assumptions about future

demand, and are charged to the provision for inventory, which is a component of our cost of sales.

Our ending balance for purchase commitments with contract manufacturers and suppliers reflects improvement

and stabilization in lead times and the mitigation of many of the constraints at our component suppliers that we

experienced in fiscal 2010. Due to the earthquake in Japan and resulting industry-wide component supply

constraints, we made increased commitments to secure our near-term supply needs. Offsetting these increases in

purchase commitments were actions we have taken related to the restructuring of our consumer business. While

we may experience longer than normal lead times in the future, our lead times to customers improved on nearly

all of our products during fiscal 2011 and as of the end of fiscal 2011 were within a normal range for nearly all of

our products.

We purchase components from a variety of suppliers and use several contract manufacturers to provide

manufacturing services for our products. During the normal course of business, in order to manage

manufacturing lead times and help ensure adequate component supply, we enter into agreements with contract

manufacturers and suppliers that allow them to procure inventory based upon criteria as defined by us or that

establish the parameters defining our requirements and our commitment to securing manufacturing capacity. A

significant portion of our reported purchase commitments arising from these agreements are firm, noncancelable,

and unconditional commitments. In certain instances, these agreements allow us the option to cancel, reschedule,

and adjust our requirements based on our business needs prior to firm orders being placed. Our purchase

commitments are for short-term product manufacturing requirements as well as for commitments to suppliers to

secure manufacturing capacity.

We record a liability, included in other current liabilities, for firm, noncancelable, and unconditional purchase

commitments for quantities in excess of our future demand forecasts consistent with the valuation of our excess

and obsolete inventory. The purchase commitments for inventory are expected to be primarily fulfilled within

one year.

Inventory and supply chain management remain areas of focus as we balance the need to maintain supply chain

flexibility to help ensure competitive lead times with the risk of inventory obsolescence because of rapidly

changing technology and customer requirements. We believe the amount of our inventory and purchase

commitments is appropriate for our revenue levels.

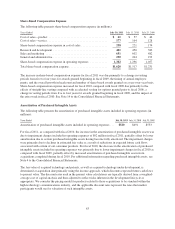

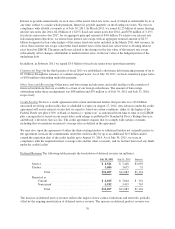

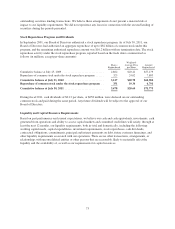

Financing Receivables and Guarantees We measure our net balance sheet exposure position related to our

financing receivables and financing guarantees by reducing the total of gross financing receivables and financing

guarantees by the associated allowances for credit loss and deferred revenue. As of July 30, 2011, our net balance

sheet exposure position related to financing receivables and financing guarantees was as follows (in millions):

FINANCING RECEIVABLES

FINANCING

GUARANTEES TOTAL

July 30, 2011

Lease

Receivables

Loan

Receivables

Financed

Service

Contracts

and Other Total

Channel

Partner

End-User

Customers Total

Gross amount less unearned income . . $2,861 $1,468 $ 2,637 $ 6,966 $ 336 $ 277 $ 613 $ 7,579

Allowance for credit loss .......... (237) (103) (27) (367) — — — (367)

Deferred revenue ................ (120) (262) (2,044) (2,426) (248) (248) (496) (2,922)

Net balance sheet exposure .... $2,504 $1,103 $ 566 $ 4,173 $ 88 $ 29 $ 117 $ 4,290

Financing Receivables Gross financing receivables less unearned income have increased by 33% compared with

the end of fiscal 2010, driven by a 49% increase in gross financed service contracts, a 30% increase in gross lease

receivables, and an 18% increase in gross loan receivables. We provide financing to certain end-user customers

68