Cisco 2011 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2011 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

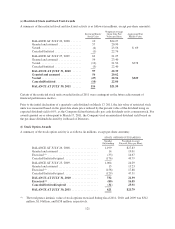

The purchase price for the shares of the Company’s stock repurchased is reflected as a reduction to shareholders’

equity. The Company is required to allocate the purchase price of the repurchased shares as (i) a reduction to

retained earnings until retained earnings are zero and then as an increase to accumulated deficit and (ii) a

reduction of common stock and additional paid-in capital. Issuance of common stock and the tax benefit related

to employee stock incentive plans are recorded as an increase to common stock and additional paid-in capital.

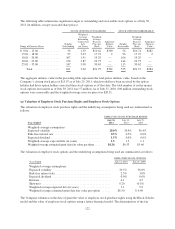

(b) Cash Dividends on Shares of Common Stock

During fiscal 2011, cash dividends of $0.12 per share, or $658 million, were declared and paid on the Company’s

outstanding common stock. Any future dividends will be subject to the approval of the Company’s Board of

Directors.

(c) Other Repurchases of Common Stock

For the years ended July 30, 2011 and July 31, 2010, the Company repurchased approximately 9.5 million and

5.6 million shares, or $183 million and $130 million of common stock, respectively, in settlement of employee

tax withholding obligations due upon the vesting of restricted stock or stock units.

(d) Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights,

preferences, and terms of the Company’s authorized but unissued shares of preferred stock.

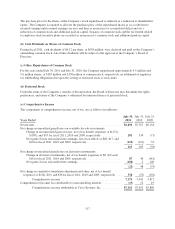

(e) Comprehensive Income

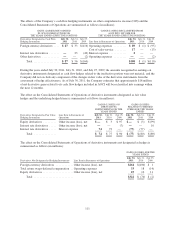

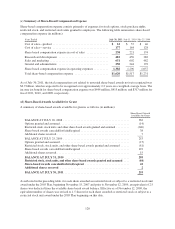

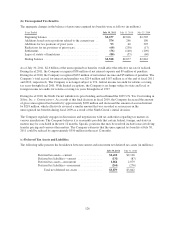

The components of comprehensive income, net of tax, are as follows (in millions):

Years Ended

July 30,

2011

July 31,

2010

July 25,

2009

Net income ........................................................... $6,490 $7,767 $6,134

Net change in unrealized gains/losses on available-for-sale investments:

Change in net unrealized gains (losses), net of tax benefit (expense) of $(151),

$(199), and $33 for fiscal 2011, 2010 and 2009, respectively .............. 281 334 (71)

Net (gains) losses reclassified into earnings, net of tax effects of $68, $17, and

$10 for fiscal 2011, 2010 and 2009, respectively ........................ (112) (151) 33

169 183 (38)

Net change in unrealized gains/losses on derivative instruments:

Change in derivative instruments, net of tax benefit (expense) of $0, $(9) and

$16 for fiscal 2011, 2010 and 2009, respectively ........................ 87 46 (141)

Net (gains) losses reclassified into earnings .............................. (108) 2 108

(21) 48 (33)

Net change in cumulative translation adjustment and other, net of tax benefit

(expense) of $(34), $(9), and $38 for fiscal 2011, 2010 and 2009, respectively .... 538 (55) (192)

Comprehensive income ......................................... 7,176 7,943 5,871

Comprehensive (income) loss attributable to noncontrolling interests ............. (15) 12 19

Comprehensive income attributable to Cisco Systems, Inc. ............. $7,161 $7,955 $5,890

117