Blackberry 2016 Annual Report Download - page 99

Download and view the complete annual report

Please find page 99 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

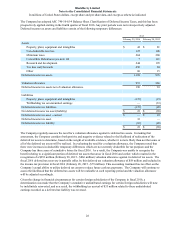

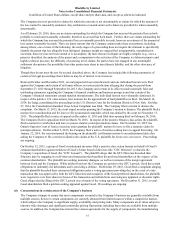

31

million). The Company is required to make quarterly interest only payments of approximately $19 million during the

seven years the Debentures are outstanding. Fairfax, a related party, owns $500 million principal amount of Debentures

and receives interest at the same rate as other debenture holders.

In the course of issuing these Debentures in fiscal 2014, the Company incurred costs of $42 million. As the Company has

elected the fair value option for the recording of the Debentures, these costs have been fully expensed in the period in

which they were incurred and are recorded in selling, marketing and administration expenses in the statement of

operations.

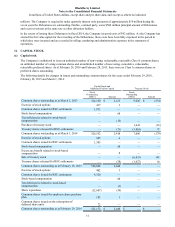

11. CAPITAL STOCK

(a) Capital stock

The Company is authorized to issue an unlimited number of non-voting, redeemable, retractable Class A common shares,

an unlimited number of voting common shares and an unlimited number of non-voting, cumulative, redeemable,

retractable preferred shares. As at February 29, 2016 and February 28, 2015, there were no Class A common shares or

preferred shares outstanding.

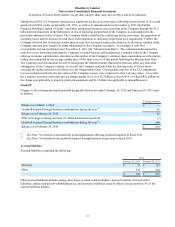

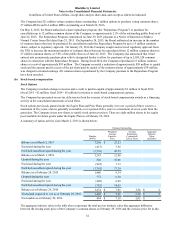

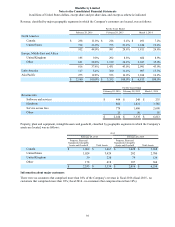

The following details the changes in issued and outstanding common shares for the years ended February 29, 2016,

February 28, 2015 and March 1, 2014:

Capital Stock and

Additional Paid-in Capital Treasury Stock

Stock

Outstanding

(000’s) Amount

Stock

Outstanding

(000’s) Amount

Common shares outstanding as at March 2, 2013 524,160 $ 2,431 9,020 $ (234)

Exercise of stock options 417 3 — —

Common shares issued for RSU settlements 1,975 — — —

Stock-based compensation —68——

Tax deficiencies related to stock-based

compensation —(13) — —

Purchase of treasury stock — — 1,641 (16)

Treasury shares released for RSU settlements —(71)(3,001) 71

Common shares outstanding as at March 1, 2014 526,552 2,418 7,660 (179)

Exercise of stock options 945 6 — —

Common shares issued for RSU settlements 1,305 — — —

Stock-based compensation —50——

Excess tax benefit related to stock-based

compensation — 8 — —

Sale of treasury stock — — (6,033) 141

Treasury shares released for RSU settlements —(38)(1,627) 38

Common shares outstanding as at February 28, 2015 528,802 2,444 — —

Exercise of stock options 402 3 — —

Common shares issued for RSU settlements 4,320 — — —

Stock-based compensation —60——

Tax deficiencies related to stock-based

compensation —(1) — —

Share repurchase (12,607)(59) — —

Common shares issued for employee share purchase

plan 183 1 — —

Common shares issued on the redemption of

deferred share units 72———

Common shares outstanding as at February 29, 2016 521,172 $ 2,448 $ — $ —