Blackberry 2016 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

25

The weighted average number of shares outstanding was 525 million common shares for basic and diluted loss per share for the

fourth quarter of fiscal 2016. The weighted average number of shares outstanding was 529 million common shares for basic

and diluted earnings per share for the fourth quarter of fiscal 2015.

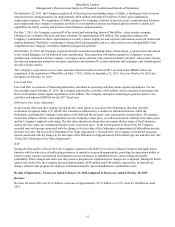

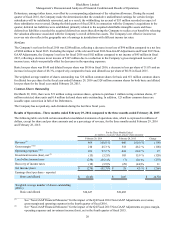

Selected Quarterly Financial Data

The following table sets forth the Company’s unaudited quarterly consolidated results of operations data for each of the eight

most recent quarters, including the quarter ended February 29, 2016. The information in the table below has been derived from

the Company’s unaudited interim consolidated financial statements that, in management’s opinion, have been prepared on a

basis consistent with the audited consolidated financial statements of the Company and include all adjustments necessary for a

fair presentation of information when read in conjunction with the audited consolidated financial statements of the Company.

The Company’s quarterly operating results have varied substantially in the past and may vary substantially in the future.

Accordingly, the information below is not necessarily indicative of results for any future quarter.

(in millions, except per share data)

Fiscal Year 2016 Fiscal Year 2015

Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth

Quarter Third

Quarter Second

Quarter First

Quarter

Revenue $ 464 $ 548 $ 490 $ 658 $ 660 $ 793 $ 916 $ 966

Gross margin 210 236 185 310 318 410 425 451

Operating expenses 451 340 152 221 424 549 623 431

Income (loss) before income

taxes (256) (120) 21 73 (1)(160)(218)(6)

Provision for (recovery of)

income taxes (18) (31) (30) 5 (29)(12)(11)(29)

Net income (loss) $ (238) $ (89) $ 51 $ 68 $ 28 $ (148) $ (207) $ 23

Earnings (loss) per share

Basic earnings (loss) per

share $ (0.45) $ (0.17) $ 0.10 $ 0.13 $ 0.05 $ (0.28) $ (0.39) $ 0.04

Diluted earnings (loss) per

share $ (0.45) $ (0.17) $ (0.24) $ (0.10) $ 0.05 $ (0.28) $ (0.39) $ (0.37)

Research and development $ 108 $ 100 $ 122 $ 139 $ 134 $ 154 $ 186 $ 237

Selling, marketing and

administration 179 175 186 173 138 171 195 400

Amortization 77 68 67 65 68 74 75 81

Abandonment/impairment of

long-lived assets 127 2 5 1 34 — — —

Debentures fair value

adjustment (40) (5) (228)(157) 50 150 167 (287)

Operating expenses $ 451 $ 340 $ 152 $ 221 $ 424 $ 549 $ 623 $ 431

Financial Condition

Liquidity and Capital Resources

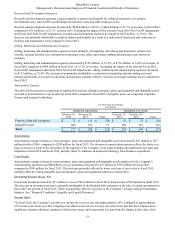

Cash, cash equivalents, and investments decreased by $642 million to $2.6 billion as at February 29, 2016 from $3.3 billion as

at February 28, 2015, primarily as a result of the Good, AtHoc, WatchDox and Encription acquisitions and cash used in the

Repurchase Program, partially offset by receipt of the Company’s fiscal 2015 Canadian income tax refund. The majority of the

Company’s cash, cash equivalents, and investments are denominated in U.S. dollars as at February 29, 2016.