Blackberry 2016 Annual Report Download - page 126

Download and view the complete annual report

Please find page 126 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

18

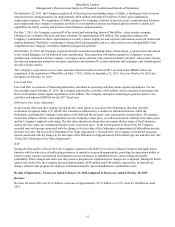

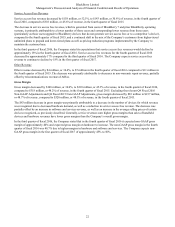

Latin America Revenues

Revenues in Latin America were $117 million, or 5.4% of revenue, in fiscal 2016, reflecting a decrease of $263 million

compared to $380 million, or 11.4% of revenue, in fiscal 2015. The decrease in revenues is due to decreased hardware demand

and the continued erosion of revenues from service access fees.

Some of the larger markets comprising this region include Argentina, Mexico and Brazil.

Asia Pacific Revenues

Revenues in Asia Pacific were $275 million, or 12.8% of revenue, in fiscal 2016, reflecting a decrease of $258 million

compared to $533 million, or 16.0% of revenue, in fiscal 2015. The decrease in revenues is due to decreased hardware demand

and the continued erosion of revenues from service access fees, partially offset by Classic and PRIV device sales and revenue

associated with Good.

Some of the larger markets comprising this region include Indonesia, Hong Kong and India.

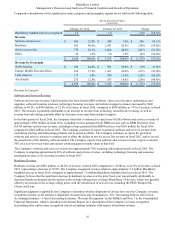

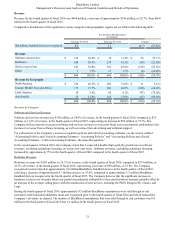

Gross Margin

Gross margin decreased by $663 million or 41.3%, to $941 million, or 43.6% of revenue, in fiscal 2016, compared to $1.6

billion, or 48.1% of revenue, in fiscal 2015. Excluding the relevant Fiscal 2016 Non-GAAP Adjustments and Fiscal 2015 Non-

GAAP Adjustments explained in “Non-GAAP Financial Measures” above, gross margin decreased by $610 million to $1.0

billion, or 46.5% of revenue, compared to 1.6 billion, or 48.8% of revenue, in fiscal 2015.

The $610 million decrease in gross margin was primarily attributable to a decrease in the number of devices for which revenue

was recognized due to decreased hardware demand, as well as a reduction in service access fees revenue, partially offset by the

increase in software and services revenue, as well as an increase in the average selling prices of certain devices recognized, as

previously described compared to fiscal 2015. Generally, service revenues earn higher gross margins than sales of handheld

devices and hardware revenues have lower gross margins than the Company’s overall gross margin.

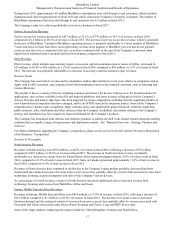

Operating Expenses

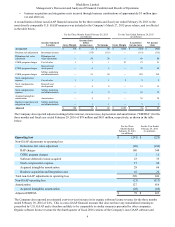

The table below presents a comparison of research and development, selling, marketing and administration, and amortization

expense for fiscal 2016 compared to fiscal 2015.

For the Fiscal Years Ended

(in millions)

February 29, 2016 February 28, 2015 Change

% of

Revenue % of

Revenue % of

Change

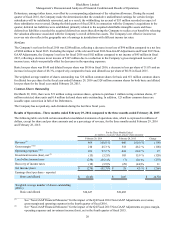

Revenue(1) $ 2,160 $ 3,335 $ (1,175) (35.2)%

Operating expenses

Research and development(1)(2) 469 21.7 % 711 21.3% $ (242) (34.0)%

Selling, marketing and administration(1)(2) 712 33.0 % 904 27.1% (192) (21.2)%

Amortization(1)(2) 277 12.8 % 298 8.9% (21) (7.0)%

Abandonment/impairment of long-lived

assets 136 6.3 % 34 1.0% 102 300.0 %

Debentures fair value adjustment(1)(2) (430) (19.9)% 80 2.4% (510) (637.5)%

Total $ 1,164 53.9 % $ 2,027 60.7% $ (863) (42.6)%

(1) See “Non-GAAP Financial Measures” for the impact of the Fiscal 2016 Non-GAAP Adjustments on revenue and

operating expenses in fiscal 2016.

(2) See “Non-GAAP Financial Measures” for the impact of the Fiscal 2015 Non-GAAP Adjustments on operating

expenses in fiscal 2015.

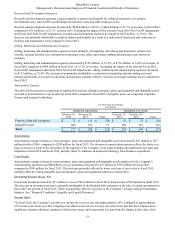

Operating expenses decreased by $863 million, or 42.6%, to $1.2 billion, or 53.9% of revenue in fiscal 2016, compared to $2

billion, or 60.7% of revenue, in fiscal 2015. Excluding the impact of the relevant Fiscal 2016 Non-GAAP Adjustments and

Fiscal 2015 Non-GAAP Adjustments, operating expenses decreased by $424 million, or 27.2%. This decrease was primarily

attributable to a decrease in salaries and benefits costs due to a reduction in headcount and decline in marketing and advertising

expenses, partially offset by increases in foreign exchange losses.