Blackberry 2016 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

35

Company’s MD&A for the fiscal year ended February 29, 2016 for a discussion of credit risk related to the Company’s

investment portfolio.

The Company expects its quarterly revenue and operating results to fluctuate.

The Company’s profit margins vary across its products and distribution channels. Gross margins on the Company’s products

vary across product lines and can change over time as a result of product transitions, pricing and configuration changes, and

component, warranty, and other cost fluctuations. In addition, the Company’s gross margin and operating margin percentages,

as well as overall profitability, may be materially adversely impacted as a result of a shift in product, geographic or channel

mix, component cost increases, price competition, or the introduction of new products, including those that have higher cost

structures with flat or reduced pricing.

New product introductions can significantly impact net sales, product costs and operating expenses. The Company could also

be subject to unexpected developments late in a quarter, such as lower-than-anticipated demand for the Company’s products,

issues with new product introductions, an internal systems failure, or failure of one of the Company’s logistics, components

supply, or manufacturing partners.

Future issuances of common shares by the Company, including upon any conversion of the Debentures, will be

dilutive to existing shareholders.

The Company is authorized to issue an unlimited number of voting common shares, an unlimited number of non-voting Class A

common shares and an unlimited number of preferred shares issuable in series on terms and conditions established by the

Board, generally without the approval of shareholders. Existing shareholders have no pre-emptive rights in connection with

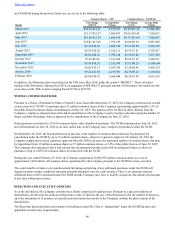

such further issues. During fiscal 2014, the Company issued $1.25 billion aggregate principal amount of Debentures, which

may be converted at the holders’ option for up to 125,000,000 common shares (subject to adjustment in certain circumstances).

If the Debentures were converted in full as at February 29, 2016, the common shares issued would represent approximately

19.3% of the Company’s then outstanding common shares. Subject to TSX and NASDAQ rules requiring shareholder

approval, the Company may make future acquisitions or enter into financings or other transactions involving the issuance of

common shares or securities convertible into common shares, which may be dilutive to existing shareholders. Sales or

issuances of substantial numbers of common shares, or the perception that such sales could occur, may adversely affect

prevailing market pricing for the Company’s common shares.

There could be adverse tax consequences for the Company’s shareholders in the United States if the Company is or

was a passive foreign investment company.

Under U.S. federal income tax laws, if a company is, or for any past period was, a passive foreign investment company

(“PFIC”), there could be adverse U.S. federal income tax consequences to U.S. shareholders even if the Company is no longer a

PFIC. The determination of whether the Company is a PFIC is a factual determination made annually based on various facts

and circumstances and thus is subject to change, and the principles and methodology used in determining whether a company is

a PFIC are subject to interpretation. While the Company does not believe that it is currently or has been a PFIC, there can be no

assurance that the Company was not a PFIC in the past and will not be a PFIC in the future. U.S. shareholders are urged to

consult their tax advisors concerning U.S. federal income tax consequences of holding the Company’s common shares if the

Company is or has been considered a PFIC.

DIVIDEND POLICY AND RECORD

The Company has not paid any cash dividends on its common shares during the last three fiscal years. The Company will

consider paying dividends on its common shares in the future when circumstances permit, having regard to, among other

things, the Company’s earnings, cash flows and financial requirements, as well as relevant legal and business considerations.

DESCRIPTION OF CAPITAL STRUCTURE

The Company’s authorized share capital consists of an unlimited number of voting common shares without par value, an

unlimited number of non-voting, redeemable, retractable class A common shares without par value, and an unlimited number of

non-voting, cumulative, redeemable, retractable preferred shares without par value, issuable in series. Only common shares are

issued and outstanding.

Common Shares

Each common share is entitled to one vote at meetings of the shareholders and to receive dividends if, as and when declared by

the Board. Dividends which the Board determines to declare and pay shall be declared and paid in equal amounts per share on

the common shares and class A common shares at the time outstanding without preference or distinction. Subject to the rights

of holders of shares of any class of share ranking prior to the common shares and class A common shares, holders of common

shares and class A common shares are entitled to receive the Company’s remaining assets ratably on a per share basis without

preference or distinction in the event that it is liquidated, dissolved or wound-up.