Blackberry 2016 Annual Report Download - page 103

Download and view the complete annual report

Please find page 103 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

35

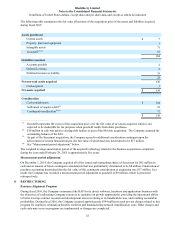

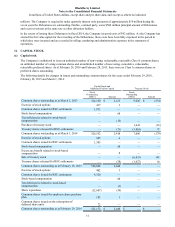

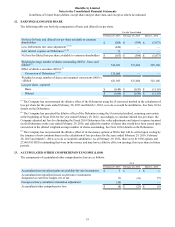

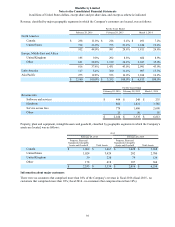

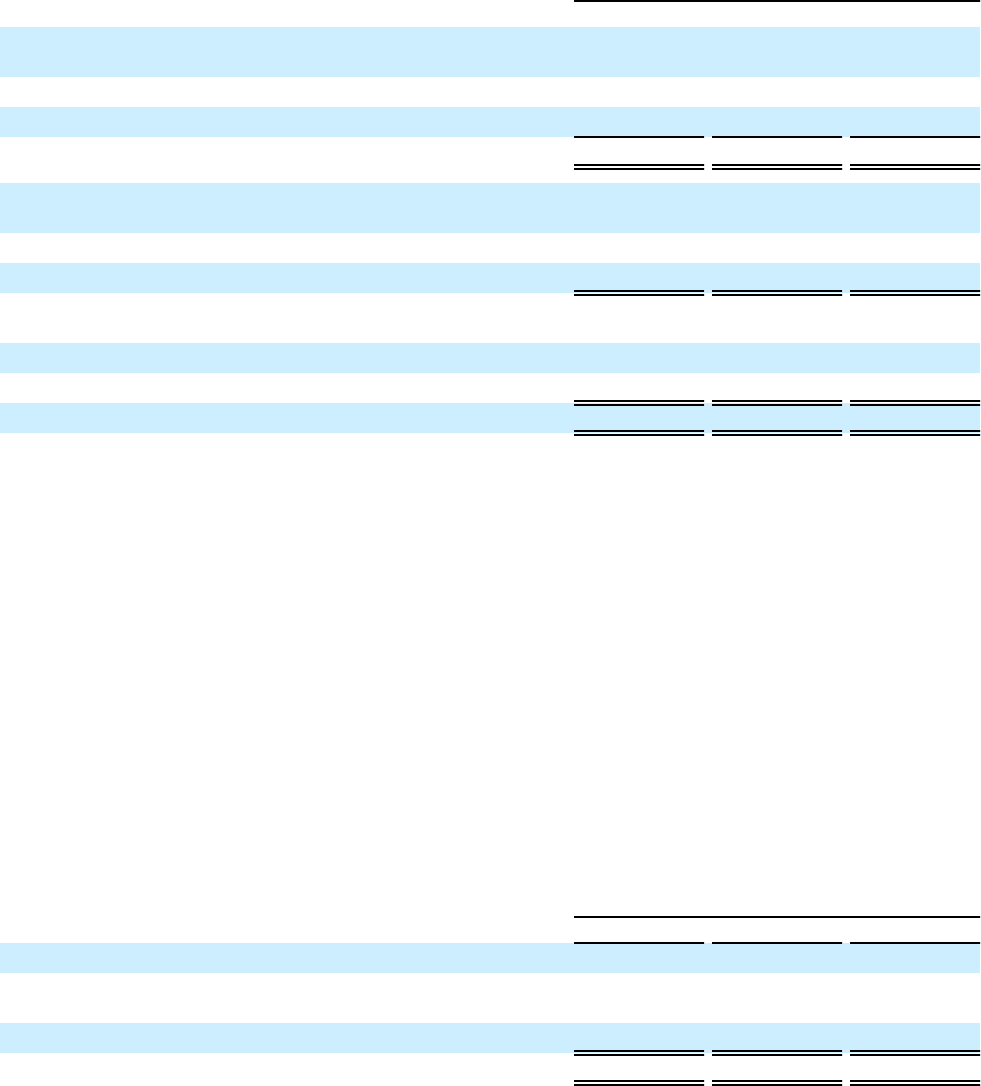

12. EARNINGS (LOSS) PER SHARE

The following table sets forth the computation of basic and diluted loss per share:

For the Years Ended

February 29, 2016 February 28, 2015 March 1, 2014

Net loss for basic and diluted loss per share available to common

shareholders $(208) $ (304) $ (5,873)

Less: Debentures fair value adjustment (1) (2) (430) — —

Add: interest expense on Debentures (1) (2) 75 — —

Net loss for diluted loss per share available to common shareholders $(563) $ (304) $ (5,873)

Weighted average number of shares outstanding (000’s) - basic and

diluted (2) 526,303 527,684 525,168

Effect of dilutive securities (000’s) (3)

Conversion of Debentures (1) (2) 125,000 — —

Weighted average number of shares and assumed conversions (000’s)

- diluted 651,303 527,684 525,168

Loss per share - reported

Basic $(0.40) $ (0.58) $ (11.18)

Diluted $(0.86) $ (0.58) $ (11.18)

______________________________

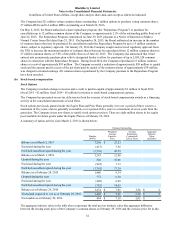

(1) The Company has not presented the dilutive effect of the Debentures using the if-converted method in the calculation of

loss per share for the years ended February 28, 2015 and March 1, 2014, as to do so would be antidilutive. See Note 10 for

details on the Debentures.

(2) The Company has presented the dilutive effect of the Debentures using the if-converted method, assuming conversion

at the beginning of fiscal 2016 for the year ended February 29, 2016. Accordingly, to calculate diluted loss per share, the

Company adjusted net loss by eliminating the Fiscal 2016 Debentures fair value adjustments and interest expense incurred

on the Debentures in the year ended February 29, 2016, and added the number of shares that would have been issued upon

conversion to the diluted weighted average number of shares outstanding. See Note 10 for details on the Debentures.

(3) The Company has not presented the dilutive effect of in-the-money options or RSUs that will be settled upon vesting by

the issuance of new common shares in the calculation of loss per share for the years ended February 29, 2016, February

28, 2015 and March 1, 2014, as to do so would be antidilutive. As at February 29, 2016, there were 811,996 options and

27,669,815 RSUs outstanding that were in-the-money and may have a dilutive effect on earnings (loss) per share in future

periods.

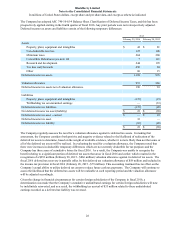

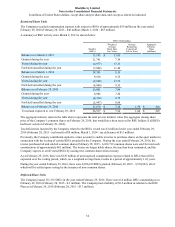

13. ACCUMULATED OTHER COMPREHENSIVE INCOME (LOSS)

The components of accumulated other comprehensive loss are as follows:

As at

February 29, 2016 February 28, 2015 March 1, 2014

Accumulated net unrealized gains on available-for-sale investments $ 3 $ 3 $ 1

Accumulated net unrealized losses on derivative instruments

designated as cash flow hedges, net of tax (1)(26) (9)

Foreign currency cumulative translation adjustment (10)——

Accumulated other comprehensive loss $(8) $ (23) $ (8)