Blackberry 2016 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

8

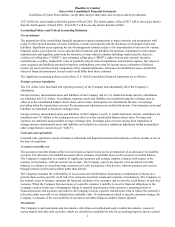

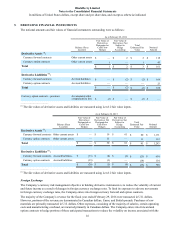

Income taxes

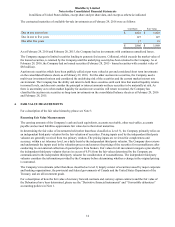

The Company uses the liability method of income tax allocation to account for income taxes. Deferred income tax assets

and liabilities are recognized based upon temporary differences between the financial reporting and income tax bases of

assets and liabilities, and measured using enacted income tax rates and tax laws that will be in effect when the differences

are expected to reverse. The Company records a valuation allowance to reduce deferred income tax assets to the amount

that is more likely than not to be realized. The Company considers both positive evidence and negative evidence, to

determine whether, based upon the weight of that evidence, a valuation allowance is required. Judgment is required in

considering the relative impact of negative and positive evidence.

Significant judgment is also required in evaluating the Company’s uncertain income tax positions and provisions for

income taxes. Liabilities for uncertain income tax positions are recognized based on a two-step approach. The first step is

to evaluate whether an income tax position has met the recognition threshold by determining if the weight of available

evidence indicates that it is more likely than not to be sustained upon examination. The second step is to measure the

income tax position that has met the recognition threshold as the largest amount that is more than 50% likely of being

realized upon settlement. The Company continually assesses the likelihood and amount of potential adjustments and

adjusts the income tax provisions, income taxes payable and deferred income taxes in the period in which the facts that

give rise to a revision become known. The Company recognizes interest and penalties related to uncertain income tax

positions as interest expense, which is then netted and reported within investment income.

The Company uses the flow-through method to account for investment tax credits (“ITCs”) earned on eligible scientific

research and experimental development expenditures. Under this method, the ITCs are recognized as a reduction to

income tax expense.

The Company has adopted ASC 740-10-65-4 Balance Sheet Classification of Deferred Income Taxes and this has been

prospectively applied starting in the fourth quarter of fiscal 2016.

Research and development

Research costs are expensed as incurred. Development costs for BlackBerry devices and licensed software to be sold,

leased or otherwise marketed are subject to capitalization beginning when a product’s technological feasibility has been

established and ending when a product is available for general release to customers. The Company’s products are

generally released soon after technological feasibility has been established and therefore costs incurred subsequent to

achievement of technological feasibility are not significant and have been expensed as incurred.

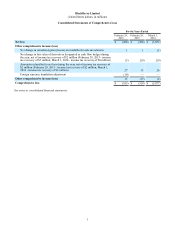

Comprehensive income (loss)

Comprehensive income (loss) is defined as the change in net assets of a business enterprise during a period from

transactions and other events and circumstances from non-owner sources and includes all changes in equity during a

period, except those resulting from investments by owners and distributions to owners. The Company’s reportable items

of comprehensive income (loss) are the cumulative translation adjustment resulting from non-U.S. dollar functional

currency subsidiaries as described under the foreign currency translation policy above, cash flow hedges as described in

Note 5, and changes in the fair value of available-for-sale investments as described in Notes 3 and 4. Realized gains or

losses on available-for-sale investments are reclassified into investment income using the specific identification basis.

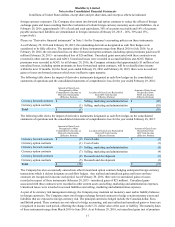

Earnings (loss) per share

Earnings (loss) per share is calculated based on the weighted average number of common shares outstanding during the

fiscal year. The treasury stock method is used for the calculation of the dilutive effect of stock options. The if-converted

method is used for the dilutive effect of the Debentures.

Stock-based compensation plans

The Company has stock-based compensation plans. Awards granted under the plans are detailed in Note 11(b).

The Equity Incentive Plan (the “Equity Plan”) was adopted during fiscal 2014 and replaced the Company’s previous

Equity Incentive Plan and Restricted Share Unit Plan (the “Prior Plans”). Awards previously granted under the Prior Plans

continue to be governed by the terms of the Prior Plans and by any amendments approved by the Company’s Board of

Directors (the “Board”). The Equity Plan provides for the grants of incentive stock options and restricted share units

(“RSUs”) to officers and employees of the Company or its subsidiaries. The number of common shares authorized under

the Equity Plan was originally 13,375,000 calculated at March 2, 2013, and increased by 8,000,000 common shares to

21,375,000 common shares, as approved by shareholders of the Company on June 23, 2015. Any shares that are subject

to options granted after fiscal 2013 are counted against this limit as 0.625 share for every one option granted, and any