Blackberry 2016 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138

|

|

6

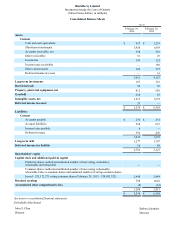

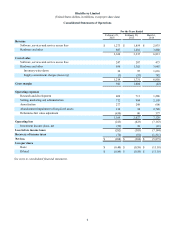

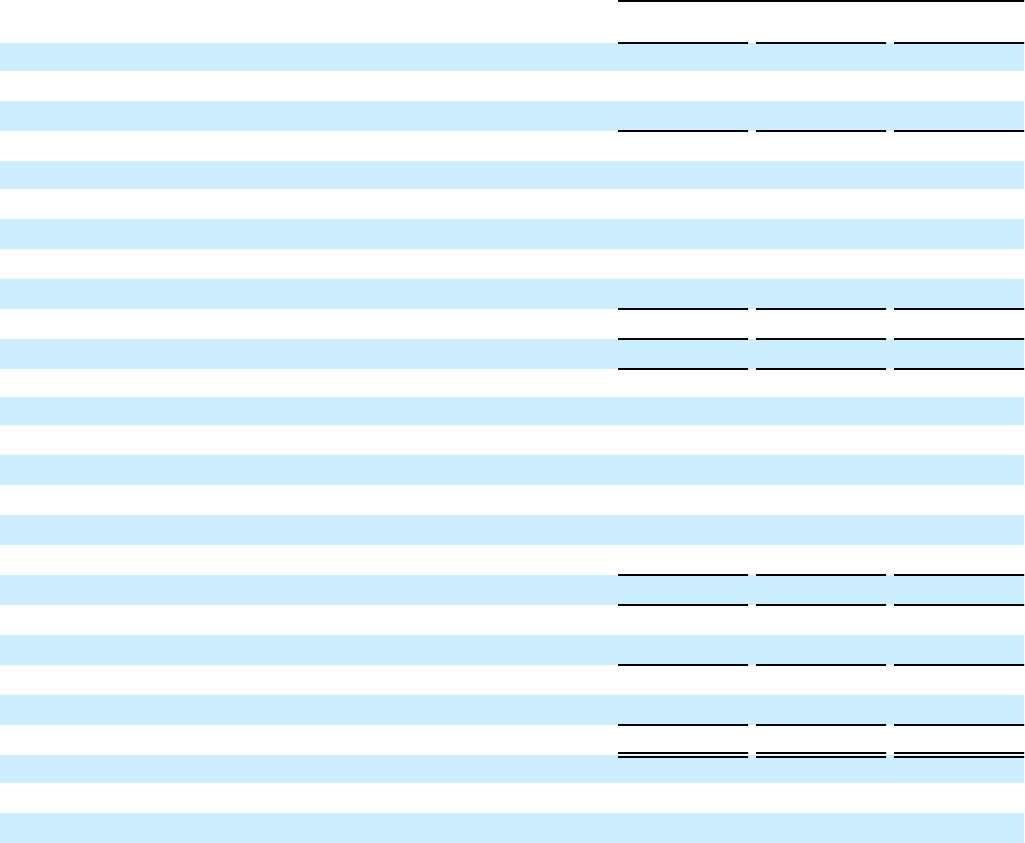

BlackBerry Limited

(United States dollars, in millions, except per share data)

Consolidated Statements of Operations

For the Years Ended

February 29,

2016 February 28,

2015 March 1,

2014

Revenue

Software, services and service access fees $ 1,273 $ 1,854 $ 2,933

Hardware and other 887 1,481 3,880

2,160 3,335 6,813

Cost of sales

Software, services and service access fees 247 287 473

Hardware and other 939 1,382 3,985

Inventory write-down 36 95 1,616

Supply commitment charges (recovery) (3)(33) 782

1,219 1,731 6,856

Gross margin 941 1,604 (43)

Operating expenses

Research and development 469 711 1,286

Selling, marketing and administration 712 904 2,103

Amortization 277 298 606

Abandonment/impairment of long-lived assets 136 34 2,748

Debentures fair value adjustment (430) 80 377

1,164 2,027 7,120

Operating loss (223)(423)(7,163)

Investment income (loss), net (59) 38 (21)

Loss before income taxes (282)(385)(7,184)

Recovery of income taxes (74)(81)(1,311)

Net loss $(208) $ (304) $ (5,873)

Loss per share

Basic $(0.40) $ (0.58) $ (11.18)

Diluted $(0.86) $ (0.58) $ (11.18)

See notes to consolidated financial statements.