Blackberry 2016 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

45

All Other Fees

The aggregate fees billed by EY for the fiscal years ended February 29, 2016 and February 28, 2015, respectively, for

professional services rendered by EY for acquisition-related due diligence were $422,200 and nil, respectively.

INTEREST OF MANAGEMENT AND OTHERS IN MATERIAL TRANSACTIONS

During the three-year period ending February 29, 2016 and during the current fiscal year up to the date hereof, none of the

Company’s directors, executive officers, 10 percent shareholders or any of their associates or affiliates had a material interest,

directly or indirectly, in any transaction that has materially affected or is reasonably expected to materially affect the Company,

other than Mr. Watsa, the Chairman and Chief Executive Officer, and a significant shareholder, of Fairfax, which participated in

the Debenture Financing and continues to hold a significant proportion of the outstanding Debentures. See “General

Development of the Business - Fiscal 2014” and “Description of Capital Structure - Convertible Debentures” in this AIF.

TRANSFER AGENTS AND REGISTRARS

The Company’s transfer agent and registrar in Canada is Computershare Investor Services Inc. of Canada at its offices in

Toronto, Ontario. The co-transfer agent and registrar for the common shares in the United States is Computershare Trust

Company, Inc. at its offices in Denver, Colorado.

MATERIAL CONTRACTS

Other than as noted below, the Company has not entered into any material contracts, on or after January 1, 2002, that are

required to be filed pursuant to NI 51-102 of the Canadian Securities Administrators:

• the Trust Indenture providing for the issuance and conversion of the Debentures, dated as of November 13, 2013, as

supplemented by the First Supplemental Indenture dated as of December 12, 2013 and the Second Supplemental

Indenture dated as of April 30, 2014, which have been filed on SEDAR, and the terms of which are summarized under

“Description of Capital Structure - Convertible Debentures”; and

• the Agreement and Plan of Merger among BlackBerry Corporation, Good, Greenbrier Merger Corp. and Shareholder

Representative Services LLC dated September 4, 2015, providing for the acquisition of Good by the Company for a

purchase price of $425 million. The Agreement and Plan of Merger is summarized in the Company’s material change

report filed on SEDAR on September 14, 2015, which is incorporated by reference in this AIF.

INTERESTS OF EXPERTS

Ernst & Young LLP, Chartered Professional Accountants, Licensed Public Accountants, is the external auditor who prepared

the Independent Auditors’ Report to Shareholders in respect of the audited annual consolidated financial statements of the

Company for the year ended February 29, 2016 and the Report to Shareholders of an Independent Registered Public

Accounting Firm on the Company’s internal controls over financial reporting. Ernst & Young LLP is independent with respect

to the Company within the meaning of the Rules of Professional Conduct of the Chartered Professional Accountants of Ontario

and applicable securities laws.

ADDITIONAL INFORMATION

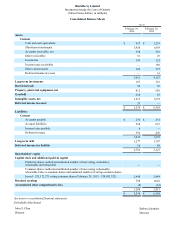

Additional information related to the Company can be found on SEDAR at www.sedar.com or on the SEC’s website at

www.sec.gov. Additional financial information is provided in the Company’s audited consolidated financial statements and the

Company’s MD&A for the year ended February 29, 2016, which can be found at www.sedar.com.

Additional information, including directors’ and officers’ remuneration and indebtedness to the Company, principal holders of

the securities of the Company and securities authorized for issuance under equity compensation plans, is contained in the

Company’s most recent management information circular.