Blackberry 2016 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

17

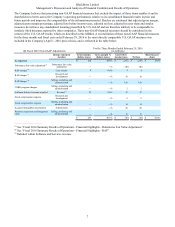

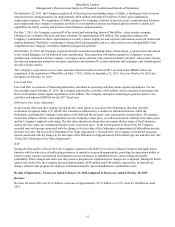

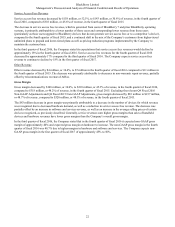

During fiscal 2016, approximately 4.0 million BlackBerry smartphones were sold through to end customers, which included

shipments made and recognized prior to fiscal 2016 and which reduced the Company’s inventory in channel. The number of

BlackBerry smartphones that were sold through to end customers was 8.5 million in fiscal 2015.

The Company’s plan is to achieve profitability in its device business in fiscal 2017.

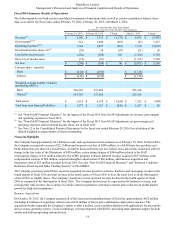

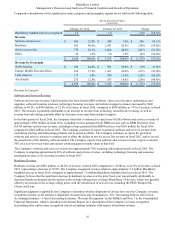

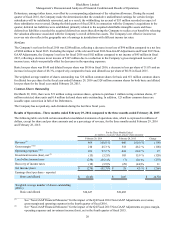

Service Access Fees Revenue

Service access fees revenue decreased by $827 million, or 51.5%, to $779 million, or 36.1% of revenue, in fiscal 2016,

compared to $1.6 billion, or 48.2% of revenue, in fiscal 2015. The decrease in service access fees revenue, which is generated

from users of BlackBerry 7 and prior BlackBerry operating systems, is primarily attributable to a lower number of BlackBerry

7 users and lower revenue from those users (particularly as those users upgrade to BlackBerry devices that do not generate

service access fees or to a competitor’s device), as well as a continued shift in the mix of the Company’s customers from

higher-tiered unlimited plans to prepaid and lower-tiered plans, compared to fiscal 2015.

Other Revenue

Other revenue, which includes non-warranty repairs, accessories, and telecommunications revenues of AtHoc, decreased by

$25 million, or 50.0% to $25 million, or 1.2% of revenue in fiscal 2016 compared to $50 million, or 1.5% of revenue in fiscal

2015. The decrease was primarily attributable to a decrease in accessory and non-warranty repair revenues.

Revenue Trends

The Company has seen both its revenue and its smartphone market share decline in recent years relative to companies such as

Apple with its iOS ecosystem, and companies that build smartphones based on the Android ecosystem, such as Samsung and

Lenovo/Motorola.

This decline is due to a variety of factors, including consumer preferences for devices with access to the broadest number of

applications, such as those available in the iOS and Android platforms, and lower average selling prices for the Company’s

devices. Revenue and market share have also been impacted by intense competition, including from the significant number of

new Android based competitors that have emerged, and by the BYOD trend in the enterprise market. Some of the Company’s

competitors have greater name recognition, larger customer bases, and significantly greater financial, technical, marketing,

public relations, sales, distribution and other resources than the Company. In addition, uncertainty relating to the Company’s

strategy and operations may have negatively impacted demand for the Company’s products.

The Company has introduced both software and hardware products to address the shift in the market toward enterprise mobility

solutions that can handle a range of requirements and deployment models. See “Business Overview - Strategy, Products and

Services”.

For further information regarding the Company’s competitors, please see the section in the AIF entitled “Narrative Description

of the Business - Competition”.

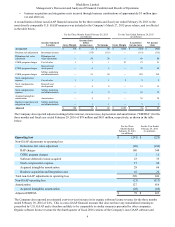

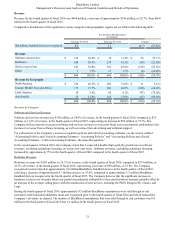

Revenue by Geography

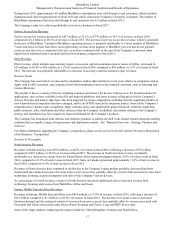

North America Revenues

Revenues in North America were $952 million, or 44.0% of revenue in fiscal 2016, reflecting a decrease of $39 million

compared to $991 million, or 29.6% of revenue in fiscal 2015. The decrease in North American revenue is primarily

attributable to a decrease in revenue from the United States, which represented approximately 33.0% of total revenue in fiscal

2016, compared to 23.2% of total revenue in fiscal 2015. Sales in Canada represented approximately 11.0% of total revenue in

fiscal 2016, compared to 6.4% of total revenue in fiscal 2015.

Revenues in North America have continued to decline due to the Company’s aging product portfolio, decreased hardware

demand and the continued erosion of revenue from service access fees, partially offset by a result of the increased revenue from

technology licensing, acquired companies and sales of the Company’s newest devices.

As a percentage of overall revenue, revenues in North America increased significantly due to increased revenue from

technology licensing and revenue from WatchDox, AtHoc and Good.

Europe, Middle East and Africa Revenues

Revenues in Europe, Middle East and Africa were $816 million, or 37.8% of revenue, in fiscal 2016, reflecting a decrease of

$615 million compared to $1.4 billion, or 43.0% of revenue, in fiscal 2015. The decrease in revenue is due to decreased

hardware demand and the continued erosion of revenues from service access fees, partially offset by revenue associated with

Secusmart and Good, increased revenue from software licensing and Classic, Leap and PRIV device sales.

Some of the larger markets comprising this region include the United Kingdom, Germany and South Africa.