Blackberry 2016 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

31

Certain governments are also imposing requirements for the filtering of content available to end users. These requirements vary

across varying jurisdictions and compliance with these requirements may be costly. Conversely, a failure to comply could result

in adverse publicity, a ban on the Company’s products and services as well as other regulatory sanctions.

An expansion of the Company’s online commercial presence may also require significant additional investment in security

measures to protect the transmission of confidential data, including payment information, and to augment protection for the

Company’s servers and network. Any failure by the Company to implement adequate measures around security of payments, or

security of confidential or personal information of the end users of the Company’s products, could result in regulatory

enforcement or potential litigation and have a detrimental impact on the BlackBerry brand and the Company’s reputation.

The Company’s business is subject to risks inherent in foreign operations, including fluctuations in foreign

currencies.

Sales outside of North America account for a significant portion of the Company’s revenue. The Company maintains offices in

a number of foreign jurisdictions and intends to continue to pursue international market growth opportunities. The Company

has limited experience conducting business in some of these jurisdictions and it may not be aware of all the factors that may

affect its business in these jurisdictions. The Company is subject to a number of risks associated with its foreign operations that

may increase liability and costs, lengthen sales cycles and require significant management attention. These risks include:

• compliance with the laws of the United States, Canada and other countries that apply to the Company’s

international operations, including import and export legislation, lawful access, privacy laws and anti-corruption

laws;

• increased reliance on third parties to establish and maintain foreign operations;

• complications in compliance with, and unexpected changes in, foreign regulatory requirements, including

requirements relating to content filtering and requests from law enforcement authorities;

• trading and investment policies;

• consumer protection laws that impose additional obligations on the Company or restrict the Company’s ability

to provide limited warranty protection;

• instability in economic or political conditions, including inflation, recession and actual or anticipated military

conflicts, social upheaval or political uncertainty;

• foreign exchange controls and cash repatriation restrictions (such as those recently experienced by the Company

in Venezuela and Argentina);

• tariffs and other trade barriers;

• increased credit risk and difficulties in collecting accounts receivable;

• potential adverse tax consequences;

• uncertainties of laws and enforcement relating to the protection of intellectual property or secured technology;

• litigation in foreign court systems;

• cultural and language differences; and

• difficulty in managing a geographically dispersed workforce in compliance with local laws and customs that

vary from country to country.

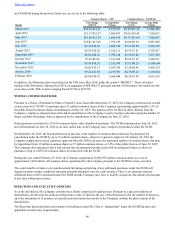

In addition, the Company is exposed to foreign exchange risk as a result of transactions in currencies other than its U.S. dollar

functional currency. The majority of the Company’s revenue and purchases of raw materials are denominated in U.S. dollars.

However, some revenue, a substantial portion of operating costs, including salaries and manufacturing overhead, as well as

capital expenditures, are incurred in other currencies, primarily Canadian dollars, Euros and British Pounds. If the Canadian

dollar appreciates relative to the U.S. dollar, the Company’s Canadian dollar denominated expenses will increase when

converted to U.S. dollars for financial reporting purposes. If the Euro depreciates relative to the U.S. dollar, the Company’s

Euro denominated revenues will decrease when translated to U.S. dollars for financial reporting purposes. Foreign exchange

rate fluctuations may materially affect the Company’s results of operations in future periods. For more details, please refer to

the discussion of foreign exchange and income taxes in the Company’s MD&A for the fiscal year ended February 29, 2016.

All of the above factors may have a material adverse effect on the Company’s business, results of operations and financial

condition and there can be no assurance that the policies and procedures implemented by the Company to address or mitigate

these risks will be successful, that Company personnel will comply with them, or that the Company will not experience these

factors in the future.

Defects in the Company’s products and services can be difficult to detect and remedy. If defects occur, they could

have a material adverse effect on the Company’s business.

The Company’s products and services are highly complex and sophisticated and may contain design defects, errors or security

vulnerabilities that are difficult to detect and correct. Errors may be found in new products or services or improvements to

existing products or services after delivery to the Company’s customers. If these defects are discovered, the Company may not

be able to successfully correct them in a timely manner or at all. The occurrence of defects, errors or vulnerabilities in the