Blackberry 2016 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

20

Debentures, amongst other items, was offset by a corresponding adjustment of the valuation allowance. During the second

quarter of fiscal 2016, the Company made the determination that the cumulative undistributed earnings for certain foreign

subsidiaries will be indefinitely reinvested, and as a result, the withholding tax accrual of $33 million recorded in respect of

these subsidiaries was reversed. During the third quarter of fiscal 2016, in connection with the Company’s acquisitions in the

quarter, deferred tax liabilities were established, primarily related to the acquired identifiable intangible assets and these

deferred tax liabilities exceeded the acquired deferred tax assets thus allowing the Company to realize a tax benefit by releasing

the valuation allowance associated with the Company’s overall deferred tax assets. The Company’s net effective income tax

recovery rate also reflects the geographic mix of earnings in jurisdictions with different income tax rates.

Net Loss

The Company’s net loss for fiscal 2016 was $208 million, reflecting a decrease in net loss of $96 million compared to a net loss

of $304 million in fiscal 2015. Excluding the impact of the relevant Fiscal 2016 Non-GAAP Adjustments and Fiscal 2015 Non-

GAAP Adjustments, the Company’s net loss for fiscal 2016 was $102 million compared to net income of $45 million in fiscal

2015, reflecting a decrease in net income of $147 million due to a reduction in the Company’s gross margin and recovery of

income taxes, which was partially offset by decreases in the operating expenses.

Basic loss per share was $0.40 and diluted loss per share was $0.86 in fiscal 2016, a decrease in loss per share of 31.0% and an

increase in loss per share of 48.3%, respectively, compared to basic and diluted loss per share of $0.58 in fiscal 2015.

The weighted average number of shares outstanding was 526 million common shares for basic and 651 million common shares

for diluted loss per share for the fiscal year ended February 29, 2016 and 528 million common shares for both basic and diluted

loss per share for the fiscal year ended February 28, 2015.

Common Shares Outstanding

On March 29, 2016, there were 521 million voting common shares, options to purchase 1 million voting common shares, 27

million restricted share units and 0.4 million deferred share units outstanding. In addition, 125 million common shares are

issuable upon conversion in full of the Debentures.

The Company has not paid any cash dividends during the last three fiscal years.

Results of Operations - Three months ended February 29, 2016 compared to the three months ended February 28, 2015

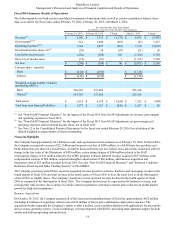

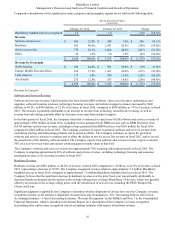

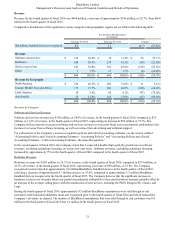

The following table sets forth certain unaudited consolidated statements of operations data, which is expressed in millions of

dollars, except for share and per share amounts and as a percentage of revenue, for the three months ended February 29, 2016

and February 28, 2015:

For the Three Months Ended

(in millions, except for share and per share amounts)

February 29, 2016 February 28, 2015 Change

Revenue(1) 464 100.0 % 660 100.0 % (196)

Gross margin (1)(2) 210 45.3 % 318 48.2 % (108)

Operating expenses (1)(2) 451 97.2 % 424 64.2 % 27

Investment income (loss), net (2) (15) (3.2)% 105 15.9 % (120)

Loss before income taxes (256) (55.1)% (1) (0.1)% (255)

Recovery of income taxes (18) (3.9)% (29) (4.4)% 11

Net income (loss) $(238) (51.3)% $ 28 4.3 % $ (266)

Earnings (loss) per share - reported

Basic and diluted $(0.45) $ 0.05 $ (0.50)

Weighted-average number of shares outstanding

(000’s)

Basic and diluted 524,627 528,685

_________________________

(1) See “Non-GAAP Financial Measures” for the impact of the Q4 Fiscal 2016 Non-GAAP Adjustments on revenue,

gross margin and operating expenses in the fourth quarter of fiscal 2016.

(2) See “Non-GAAP Financial Measures” for the impact of the Q4 Fiscal 2015 Non-GAAP Adjustments on gross margin,

operating expenses and investment income (loss), net in the fourth quarter of fiscal 2015.