Blackberry 2016 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

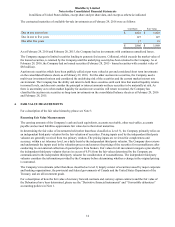

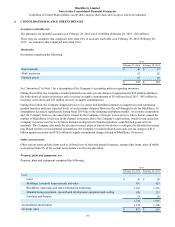

20

For the year ended February 29, 2016, amortization expense related to property, plant and equipment amounted to $124

million (February 28, 2015 - $184 million; March 1, 2014 - $532 million).

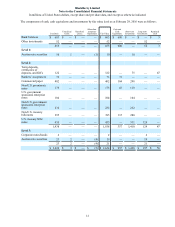

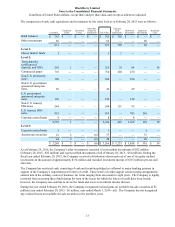

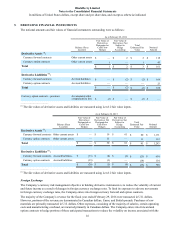

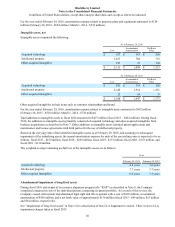

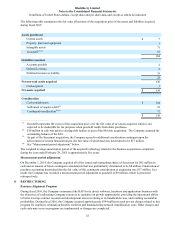

Intangible assets, net

Intangible assets comprised the following:

As at February 29, 2016

Cost Accumulated

Amortization Net Book

Value

Acquired technology $ 677 $ 367 $ 310

Intellectual property 1,437 704 733

Other acquired intangibles 197 27 170

$ 2,311 $ 1,098 $ 1,213

As at February 28, 2015

Cost Accumulated

Amortization Net Book

Value

Acquired technology $ 451 $ 315 $ 136

Intellectual property 2,545 1,314 1,231

Other acquired intangibles 22 14 8

$ 3,018 $ 1,643 $ 1,375

Other acquired intangibles include items such as customer relationships and brand.

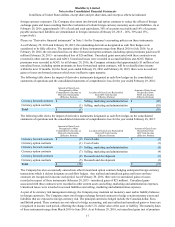

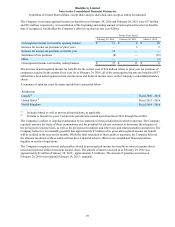

For the year ended February 29, 2016, amortization expense related to intangible assets amounted to $492 million

(February 28, 2015 - $510 million; March 1, 2014 - $738 million).

Total additions to intangible assets in fiscal 2016 amounted to $477 million (fiscal 2015 - $481 million). During fiscal

2016, the additions to intangible assets primarily consisted of acquired technology and other acquired intangibles from

business acquisitions as described in Note 7. Other additions to intangible assets included patent applications and

maintenance and license agreements with third parties for the use of intellectual property.

Based on the carrying value of the identified intangible assets as at February 29, 2016, and assuming no subsequent

impairment of the underlying assets, the annual amortization expense for each of the succeeding years is expected to be as

follows: fiscal 2017 - $270 million; fiscal 2018 - $229 million; fiscal 2019 - $171 million; fiscal 2020 - $153 million; and

fiscal 2021 - $130 million.

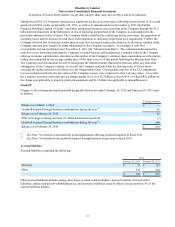

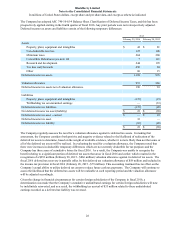

The weighted average remaining useful lives of the intangible assets are as follows:

As at

February 29, 2016 February 28, 2015

Acquired technology 4.4 years 3.6 years

Intellectual property 7.7 years 5.7 years

Other acquired intangibles 6.0 years 3.5 years

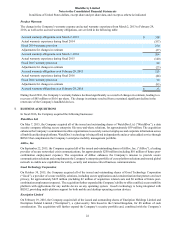

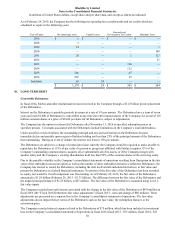

Abandonment/impairment of long-lived assets

During fiscal 2016 and as part of its resource alignment program (the “RAP”) as described in Note 8, the Company

completed a targeted review of the individual patents composing its patent portfolio. As a result of this review, the

Company ceased enforcement and abandoned legal right and title to patents with a cost of $592 million, accumulated

amortization of $456 million, and a net book value of approximately $136 million (fiscal 2015 - $49 million, $15 million

and $34 million, respectively).

See “Impairment of long-lived assets” in Note 1 for a description of how LLA impairment is tested. There were no LLA

impairment charges taken in fiscal 2015.