Blackberry 2016 Annual Report Download - page 89

Download and view the complete annual report

Please find page 89 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

21

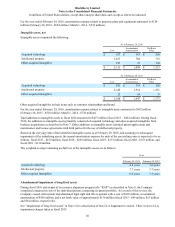

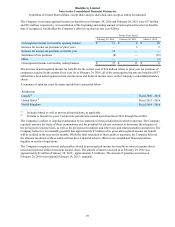

During fiscal 2014, the Company experienced a significant decline in its share price following its pre-release of its second

quarter fiscal 2014 results on September 20, 2013, as well as its announcement on November 4, 2013 that Fairfax

Financial Holdings Limited (“Fairfax”) and other institutional investors were investing in the Company through the $1.0

billion private placement of the Debentures in lieu of finalizing the purchase of the Company as contemplated in the

previously announced letter of intent. The Company further identified the continuing decline in revenue, the generation of

operating losses and the decrease in cash flows from operations as indicators of potential LLA impairment. Further, the

Company believed that its strategic review process may have increased market uncertainty as to the future viability of the

Company and may have negatively impacted demand for the Company’s products. Accordingly, a cash flow

recoverability test was performed as of November 4, 2013 (the “Measurement Date”). The estimated undiscounted net

cash flows were determined utilizing the Company’s internal forecast and incorporated a terminal value of the Company

utilizing its market capitalization, calculated as the number of the Company’s common shares outstanding as at the interim

testing date multiplied by the average market price of the shares over a 10 day period following the Measurement Date.

The Company used this duration in order to incorporate the inherent market fluctuations that may affect any individual

closing price of the Company’s shares. As a result, the Company concluded that the carrying value of its net assets

exceeded the undiscounted net cash flows as at the Measurement Date. Consequently, step two of the LLA impairment

test was performed whereby the fair values of the Company’s assets were compared to their carrying values. As a result,

the Company recorded a non-cash, pre-tax charge against its LLA of $2.7 billion in fiscal 2014, of which $852 million of

the charge was applicable to property, plant and equipment and $1.9 billion was applicable to intangible assets.

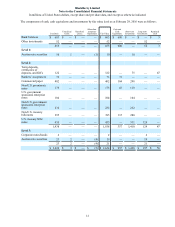

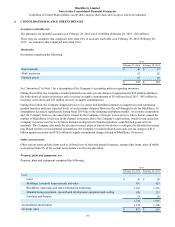

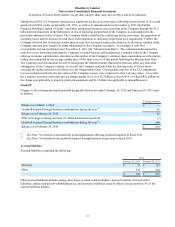

Goodwill

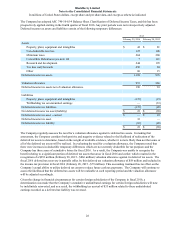

Changes to the carrying amount of goodwill during the fiscal years ended February 29, 2016 and February 28, 2015 were

as follows:

Carrying Amount

Balance as at March 1, 2014 $ —

Goodwill acquired through business combinations during the year (1) 85

Balance as at February 28, 2015 85

Effect of foreign exchange on non-U.S. dollar denominated goodwill (7)

Goodwill acquired through business combinations during the year (2) 540

Balance as at February 29, 2016 $ 618

______________________________

(1) See Note 7 for details on measurement period adjustments affecting goodwill acquired in fiscal 2015.

(2) See Note 7 for details on the goodwill acquired through business acquisitions in fiscal 2016.

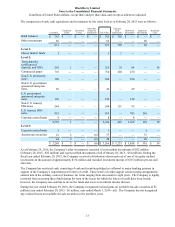

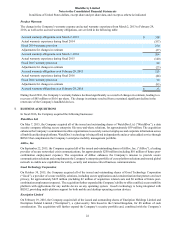

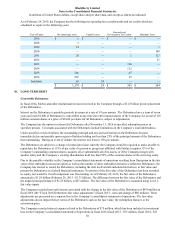

Accrued liabilities

Accrued liabilities comprised the following:

As at

February 29, 2016 February 28, 2015

Warranty $ 33 $ 123

Other 335 544

$ 368 $ 667

Other accrued liabilities include, among other items, accrued vendor liabilities, accrued royalties, accrued carrier

liabilities, salaries and payroll withholding taxes, and derivative liabilities, none of which were greater than 5% of the

current liabilities balance.