Blackberry 2016 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

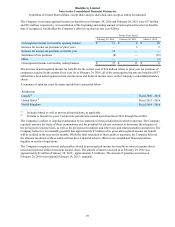

32

The Company had 521 million voting common shares outstanding, 1 million options to purchase voting common shares,

27 million RSUs and 0.4 million DSUs outstanding as at March 29, 2016.

On May 6, 2015, the Board authorized a share repurchase program (the “Repurchase Program”) to purchase for

cancellation up to 12 million common shares of the Company, or approximately 2.5% of the outstanding public float as of

June 22, 2015. The Repurchase Program commenced on June 29, 2015 pursuant to a Notice of Intention to Make a

Normal Course Issuer Bid dated June 25, 2015. On September 24, 2015, the Board authorized an increase in the number

of common shares that may be purchased for cancellation under the Repurchase Program by up to 15 million common

shares, subject to regulatory approval. On January 29, 2016 the Company sought and received regulatory approval from

the TSX to increase the maximum number of common shares that may be repurchased from 12 million common shares to

27 million common shares, or 5.8% of the public float as of June 22, 2015. The Company also announced that it had

entered into an automatic purchase plan with its designated broker to allow for purchases of up to 2,685,524 common

shares in connection with the Repurchase Program. During fiscal 2016, the Company repurchased 13 million common

shares at a cost of approximately $93 million. The Company recorded a reduction of approximately $59 million to capital

stock and the amount paid in excess of the per share paid-in capital of the common shares of approximately $34 million

was charged to retained earnings. All common shares repurchased by the Company pursuant to the Repurchase Program

have been canceled.

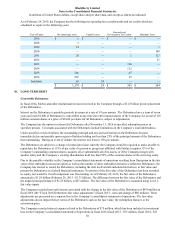

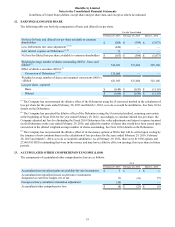

(b) Stock-based compensation

Stock Options

The Company recorded a charge to income and a credit to paid-in-capital of approximately $1 million in fiscal 2016

(fiscal 2015 - $2 million; fiscal 2014 - $5 million) in relation to stock-based compensation expense.

The Company has presented excess tax deficiencies from the exercise of stock-based compensation awards as a financing

activity in the consolidated statements of cash flows.

Stock options previously granted under the Equity Plan and Prior Plans generally vest over a period of three years to a

maximum of five years, and are generally exercisable over a period of five years to a maximum of seven years from the

grant date. The Company issues new shares to satisfy stock option exercises. There are eight million shares in the equity

pool available for future grants under the Equity Plan as at February 29, 2016.

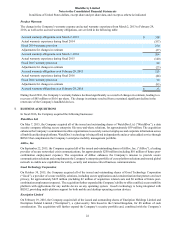

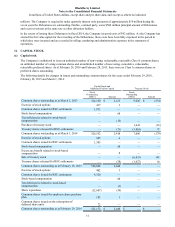

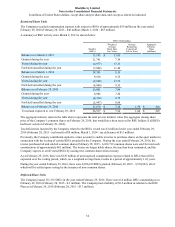

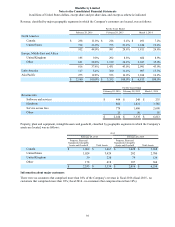

A summary of option activity since March 2, 2013 is shown below:

Options Outstanding

Number

(000’s)

Weighted

Average

Exercise

Price

Average

Remaining

Contractual

Life in Years

Aggregate

Intrinsic

Value

(millions)

Balance as at March 2, 2013 7,260 $ 27.53

Exercised during the year (417) 7.36

Forfeited/cancelled/expired during the year (3,576) 42.55

Balance as at March 1, 2014 3,267 12.08

Granted during the year 526 10.06

Exercised during the year (945) 7.13

Forfeited/cancelled/expired during the year (1,362) 17.10

Balance as at February 28, 2015 1,486 9.34

Granted during the year 772 6.30

Exercised during the year (402) 6.09

Forfeited/cancelled/expired during the year (382) 14.45

Balance as at February 29, 2016 1,474 $ 7.01 3.56 $ 2

Vested and expected to vest as at February 29, 2016 1,405 $ 7.01 3.52 $ 2

Exercisable as at February 29, 2016 494 $ 7.18 2.05 $ —

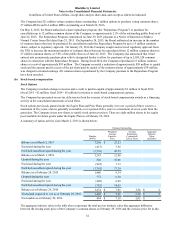

The aggregate intrinsic value in the table above represents the total pre-tax intrinsic value (the aggregate difference

between the closing stock price of the Company’s common shares on February 29, 2016 and the exercise price for in-the-