Blackberry 2016 Annual Report Download - page 78

Download and view the complete annual report

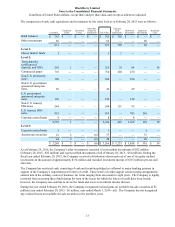

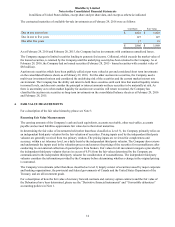

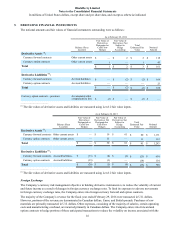

Please find page 78 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

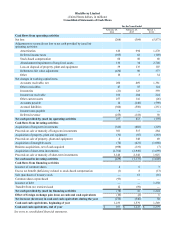

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

10

period. Early adoption is permitted for financial statements that have not been previously issued. The Company will adopt

this guidance in the first quarter of fiscal 2017 and is currently evaluating the impact that the adoption will have on its

financial position and disclosures.

In April 2015, the FASB issued a new accounting standards update on the topic of internal-use software. The amendments

in this update provide guidance to customers about whether a cloud computing arrangement includes a software license.

The amendments are effective for annual reporting periods beginning after December 15, 2015, including interim periods

within that reporting period. Early adoption is permitted. The Company will adopt this guidance in the first quarter of

fiscal 2017 and is currently evaluating the impact that the adoption will have on its results of operations, financial position

and disclosures.

In June 2015, the FASB issued a new accounting standards update for technical corrections and improvements that affect

a wide variety of topics in the codification. The amendments in this update correct unintended application of guidance,

make minor improvements, and provide clarification to the codification. The amendments that require transition guidance

are effective for annual reporting periods beginning after December 15, 2015, including interim periods within that

reporting period. Early adoption is permitted. The Company will adopt this guidance in the first quarter of fiscal 2017 and

is currently evaluating the impact that the adoption will have on its results of operations, financial position and

disclosures.

In July 2015, the FASB issued a new accounting standard update on the topic of inventory. The amendments in this update

provide guidance on the subsequent measurement of inventory from the lower of cost or market to the lower of cost and

net realizable value for entities using the first-in, first-out or the average cost method. The amendments in this update are

effective for fiscal years beginning after December 15, 2016, including interim periods within those fiscal years. It should

be applied prospectively with earlier application permitted as of the beginning of the interim or annual reporting period.

The Company will adopt this guidance in the first quarter of fiscal 2018 and is currently evaluating the impact that the

adoption will have on its results of operations, financial position and disclosures.

In September 2015, the FASB issued a new accounting standard on the topic of business combinations. The amendments

in this update require the acquirer who has reported provisional amounts for items in a business combination to recognize

adjustments to provisional amounts that are identified during the measurement period, in the reporting period in which the

adjustments are determined. The update requires that the acquirer record, in the same period’s financial statements, the

effect on earnings of changes in depreciation, amortization, or other income effects, if any, as a result of the change to the

provisional amounts, calculated as if the accounting had been completed at the acquisition date. The prior period impact

of the adjustment should be either presented separately on the face of the income statement or disclosed in the notes. The

guidance is effective for interim and annual periods beginning after December 15, 2015. Early application is permitted

and should be applied prospectively. The Company will adopt this guidance in the first quarter of fiscal 2017 and is

currently evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

In November 2015, the FASB issued a new accounting standard on the topic of income taxes. The amendments in this

update eliminate the current requirement for companies to separate deferred income tax liabilities and assets into current

and non-current amounts in a classified statement of financial position. Instead, companies will be required to classify all

deferred tax liabilities and assets as non-current. The guidance is effective for interim and annual periods beginning after

December 15, 2016. Early adoption is permitted. The Company has adopted this guidance early and applied it

prospectively in the fourth quarter of fiscal 2016.

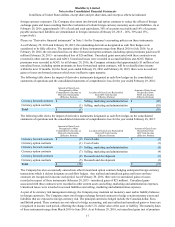

In January 2016, the FASB issued a new accounting standard on the topic of financial instruments. The amendments in

this update address certain aspects of recognition, measurement, presentation, and disclosure of financial instruments. The

standard primarily affects the accounting for equity investments, financial liabilities under the fair value option, and the

presentation and disclosure requirements for financial instruments. In addition, the guidance clarifies that an entity should

evaluate the need for a valuation allowance on a deferred tax asset related to available-for-sale securities. The guidance is

effective for interim and annual periods beginning after December 15, 2017, with early adoption permitted for certain

requirements. The Company will adopt this guidance in the first quarter of fiscal 2019 and is currently evaluating the

impact that the adoption will have on its results of operations, financial position and disclosures.

In February 2016, the FASB issued a new accounting standard on the topic of leases. The new standards would require

companies and other organizations to include lease obligations in their balance sheets, including a dual approach for

lessee accounting under which a lessee would account for leases as finance leases or operating leases. Both finance leases

and operating leases will result in the lessee recognizing a right-of-use (“ROU”) asset and a corresponding lease liability.

For finance leases the lessee would recognize interest expense and amortization of the ROU asset, and for operating

leases, the lessee would recognize a straight-line total lease expense. The guidance is effective for interim and annual