Blackberry 2016 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

5

• Announced the availability of the Company’s multi-OS EMM platform in the Microsoft Azure Marketplace, allowing

customers full access to their BES12 licenses while benefiting from the Microsoft cloud architecture.

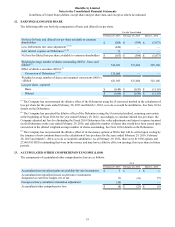

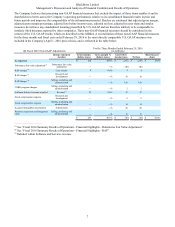

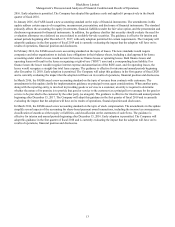

Financial Highlights

• Achieved positive free cash flow and positive adjusted EBITDA in each of the quarters in fiscal 2016;

• Achieved non-GAAP revenue of approximately $527 million from software and services for the year;

• Commenced a normal course issuer bid to purchase up to 27 million common shares of the Company; and

• Commenced the RAP with the objectives of reallocating Company resources to capitalize on growth opportunities,

providing the operational ability to better leverage contract research and development services relating to its handheld

devices, and reaching sustainable profitability.

Director and Executive Officer Appointments

• Appointed the Honourable Wayne G. Wouters, PC, an executive leader in government relations, strategic leadership,

international trade and economic policy, to the board of directors of the Company (the “Board”);

• Appointed Laurie Smaldone Alsup, M.D., an executive leader in drug development, regulatory strategy, and regulatory

approvals in the pharmaceutical and biotechnology industries, to the Board; and

• Appointed Carl Wiese as President of Global Sales of the Company.

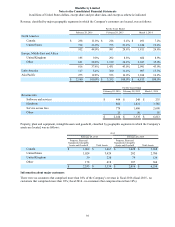

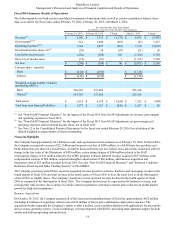

Change in Fiscal Year

Effective in the fourth quarter of fiscal 2016, the Company changed its fiscal year from a 52 or 53 week year ending the last

Saturday in February or the first Saturday in March to a calendar basis ending the last day of February. The purpose of this

change is to be consistent with common practice in the software industry. The Company believes this is appropriate due to its

increased emphasis on software and its completed acquisitions of software companies with recurring revenue streams.

Accordingly, the Company’s fiscal quarters will end on the last days of May, August, November, and February. The Company

does not believe that the impact of the change is material.

For further information about the impact of the change in fiscal year, please see Note 1 to the Consolidated Financial

Statements.

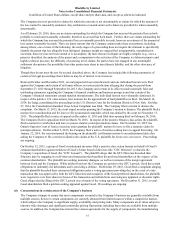

Common Share Repurchase Program

On May 6, 2015, the Board authorized the Repurchase Program to purchase for cancellation up to 12 million common shares of

the Company, or approximately 2.5% of the outstanding public float as of June 22, 2015. The purpose of the Repurchase

Program is to offset dilution from the Company’s employee share purchase plan and an amendment to the Company’s equity

incentive plan increasing the number of shares available thereunder, both as approved by the shareholders of the Company on

June 23, 2015.

Daily purchases are limited to 578,619 common shares, other than block purchases. Pursuant to a Notice of Intention to Make a

Normal Course Issuer Bid dated June 25, 2015, the Repurchase Program commenced on June 29, 2015 and will terminate on

June 28, 2016 or on such earlier date as BlackBerry may complete its purchases under such program.

On January 29, 2016 the Company sought and received regulatory approval from the Toronto Stock Exchange to increase the

maximum number of common shares that may be repurchased from 12 million common shares to 27 million common shares,

or 5.8% of the public float as of June 22, 2015. The Company also announced that it had entered into an automatic purchase

plan with its designated broker to allow for purchases of up to 2,685,524 common shares in connection with the Repurchase

Program..

During fiscal 2016, the Company repurchased 13 million common shares at a cost of approximately $93 million. The

Company recorded a reduction of approximately $59 million to capital stock and the amount paid in excess of the per share

paid-in capital of the common shares of approximately $34 million was charged to retained earnings. All common shares

repurchased by the Company pursuant to the Repurchase Program have been canceled.

The actual number of shares to be purchased and the timing and pricing of any additional purchases under the Repurchase

Program will depend on future market conditions and upon potential alternative uses for cash resources. There is no assurance

that any additional shares will be purchased under the Repurchase Program and the Company may elect to modify, suspend or

discontinue the program at any time without prior notice.

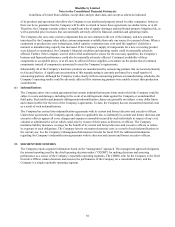

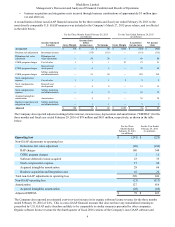

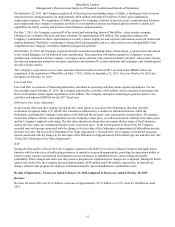

Operating Segments

As disclosed in Note 15 to the Consolidated Financial Statements, the Company reports segment information based on the

“management” approach. The management approach designates the internal reporting used by the chief operating decision

maker (“CODM”) for making decisions and assessing performance as a source of the Company’s reportable operating

segments. The CODM, who for the Company is the Chief Executive Officer, makes decisions and assesses the performance of

the Company on a consolidated basis, and the Company is a single reportable operating segment.