Blackberry 2016 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

10

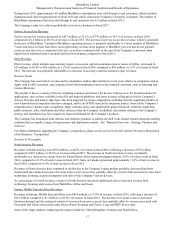

services revenue, excluding revenues from AtHoc and revenues from Good that were not considered organic from the

Company’s integration of Good products.

Accounting Policies and Critical Accounting Estimates

Accounting Policies

Please see Note 1 to the Consolidated Financial Statements for a description of the Company’s significant accounting policies,

which is included in the Annual Report.

Critical Accounting Estimates

The preparation of the Consolidated Financial Statements requires management to make estimates and assumptions with

respect to the reported amounts of assets, liabilities, revenues and expenses and the disclosure of contingent assets and

liabilities. These estimates and assumptions are based upon management’s historical experience and are believed by

management to be reasonable under the circumstances. Such estimates and assumptions are evaluated on an ongoing basis and

form the basis for making judgments about the carrying values of assets and liabilities that are not readily apparent from other

sources. Actual results could differ from these estimates.

The Company’s critical accounting estimates have been reviewed and discussed with the Company’s Audit & Risk

Management Committee and are set out below. Except as noted, there have not been any changes to the Company’s critical

accounting estimates during the past three fiscal years.

Valuation of Long-Lived Assets

The long-lived assets (“LLA”) impairment test prescribed by U.S. GAAP requires the Company to identify its asset groups and

test impairment of each asset group separately. To conduct the LLA impairment test, the asset group is tested for recoverability

using undiscounted cash flows over the remaining useful life of the primary asset. If forecasted net cash flows are less than the

carrying amount of the asset group, an impairment charge is measured by comparing the fair value of the asset group to its

carrying value. Determining the Company’s asset groups and related primary assets requires significant judgment by

management. Different judgments could yield different results.

The Company’s determination of its asset groups, its primary asset and its remaining useful life, and estimated cash flows are

significant factors in assessing the recoverability of the Company’s assets for the purposes of LLA impairment testing. The

Company’s share price can be affected by, among other things, changes in industry or market conditions, including the effect of

competition, changes in the Company’s results of operations, changes in the Company’s forecasts or market expectations

relating to future results, and the Company’s strategic initiatives and the market’s assessment of any such factors. See “Risk

Factors - The market price of the Company’s common shares is volatile” in the AIF. The current macroeconomic environment

and competitive dynamics continue to be challenging to the Company’s business and the Company cannot be certain of the

duration of these conditions and their potential impact on the Company’s future financial results and cash flows. A continued

decline in the Company’s performance, the Company’s market capitalization and future changes to the Company’s assumptions

and estimates used in the LLA impairment test, particularly the expected future cash flows, remaining useful life of the primary

asset and terminal value of the asset group, may result in further impairment charges in future periods of some or all of the

assets on the Company’s balance sheet. Although it does not affect the Company’s cash flow, an impairment charge to earnings

has the effect of decreasing the Company’s earnings or increasing the Company’s losses, as the case may be. The Company’s

share price could also be adversely affected by the Company’s recorded LLA impairment charges.

The Company used various valuation techniques to determine the fair values of its assets to measure and allocate impairment.

Techniques related to real estate, capital equipment and intangible assets included the direct capitalization method, market

comparable transactions, the replacement cost method, discounted cash flow analysis, as well as the relief from royalty and

excess earnings valuation methods. Determining valuations using these valuation techniques requires significant judgment and

assumptions by management. Different judgments could yield different results.

Inventory and Inventory Purchase Commitments

The Company’s policy for the valuation of inventory, including the determination of obsolete or excess inventory, requires

management to estimate the future demand for the Company’s products. Inventory purchases and purchase commitments are

based upon such forecasts of future demand and scheduled rollout and life cycles of new products. The business environment in

which the Company operates is subject to rapid changes in technology and customer demand. The Company performs an

assessment of inventory during each reporting period, which includes a review of, among other factors, demand requirements,

component part purchase commitments of the Company and certain key suppliers, product life cycle and development plans,

component cost trends, product pricing and quality issues. If customer demand subsequently differs from the Company’s

forecasts, requirements for inventory write-offs that differ from the Company’s estimates could become necessary. If

management believes that demand no longer allows the Company to sell inventories above cost or at all, such inventory is