Blackberry 2016 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

19

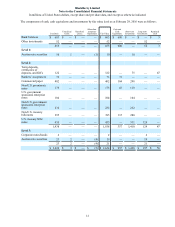

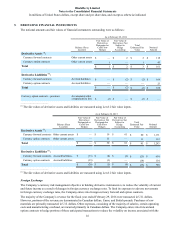

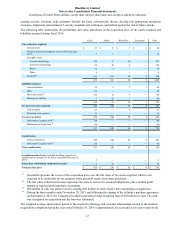

6. CONSOLIDATED BALANCE SHEETS DETAILS

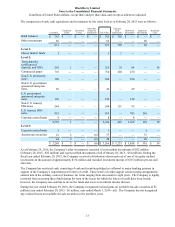

Accounts receivable, net

The allowance for doubtful accounts as at February 29, 2016 was $10 million (February 28, 2015 - $10 million).

There were no customers that comprised more than 10% of accounts receivable as at February 29, 2016 (February 28,

2015 – no customers that comprised more than 10%).

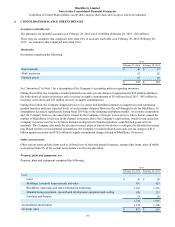

Inventories

Inventories comprised the following:

As at

February 29, 2016 February 28, 2015

Raw materials $ 46 $ 11

Work in process 32 62

Finished goods 65 49

$ 143 $ 122

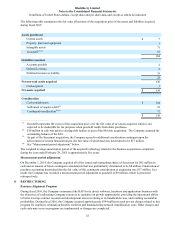

See “Inventories” in Note 1 for a description of the Company’s accounting policies regarding inventory.

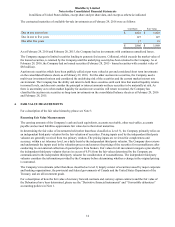

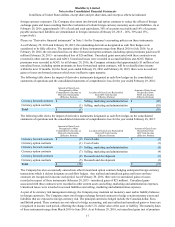

During fiscal 2016, the Company recorded primarily non-cash, pre-tax charges of approximately $36 million relating to

the write-down of certain inventories and a recovery in supply commitments of $3 million (fiscal 2015 - $95 million in

inventory write-down and $33 million recovery in supply commitments).

During fiscal 2014, the Company shipped devices to its carrier and distributor partners to support new and continuing

product launches and meet expected levels of end customer demand. However, the sell-through levels for BlackBerry 10

smartphones decreased significantly during fiscal 2014 due to the maturing smartphone market, very intense competition

and, the Company believes, the uncertainty created by the Company’s strategic review process. These factors caused the

number of BlackBerry 10 devices in the channel to increase above the Company’s expectations, which in turn caused the

Company to reassess and revise its future demand assumptions for finished products, semi-finished goods and raw

materials. The Company also made the decision to cancel plans to launch two devices to mitigate the identified inventory

risk. Based on these revised demand assumptions, the Company recorded primarily non-cash, pre-tax charges of $1.6

billion against inventory and $782 million in supply commitment charges related to BlackBerry 10 devices.

Other current assets

Other current assets include items such as deferred cost of sales and prepaid expenses, among other items, none of which

were greater than 5% of the current assets balance in all years presented.

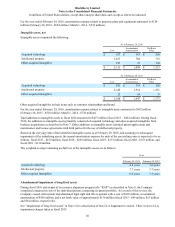

Property, plant and equipment, net

Property, plant and equipment comprised the following:

As at

February 29, 2016 February 28, 2015

Cost

Land $ 26 $ 26

Buildings, leasehold improvements and other 397 423

BlackBerry operations and other information technology 1,183 1,236

Manufacturing equipment, research and development equipment and tooling 120 211

Furniture and fixtures 18 20

1,744 1,916

Accumulated amortization 1,332 1,360

Net book value $ 412 $ 556