Blackberry 2016 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

11

periods beginning after December 15, 2018. Early adoption is permitted. The Company will adopt this guidance in the

first quarter of fiscal 2020 and is currently evaluating the impact that the adoption will have on its results of operations,

financial position and disclosures.

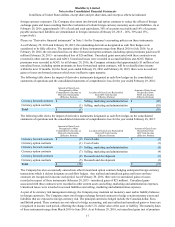

In March 2016, the FASB issued a new accounting standard on the topic of revenue from contracts with customers. The

amendments in this update clarify the implementation guidance on principal versus agent considerations. When another

party, along with the reporting entity, is involved in providing goods or services to a customer, an entity is required to

determine whether the nature of its promise is to provide that good or service to the customer (as a principal) or to arrange

for the good or service to be provided to the customer by the other party (as an agent). The guidance is effective for

interim and annual periods beginning after December 15, 2017. The Company will adopt this guidance in the first quarter

of fiscal 2019 and is currently evaluating the impact that the adoption will have on its results of operations, financial

position and disclosures.

In March 2016, the FASB issued a new accounting standard on the topic of stock compensation. The amendments in this

update simplify several aspects of the accounting for share-based payment award transactions, including the income tax

consequences, classification of awards as either equity or liabilities, and classification on the statements of cash flows.

The guidance is effective for interim and annual periods beginning after December 15, 2016. Early adoption is permitted.

The Company will adopt this guidance in the first quarter of fiscal 2018 and is currently evaluating the impact that the

adoption will have on its results of operations, financial position and disclosures.

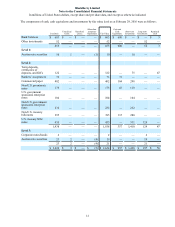

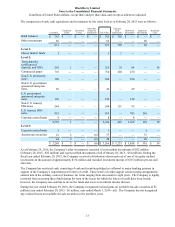

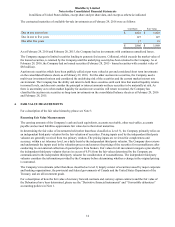

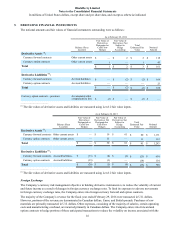

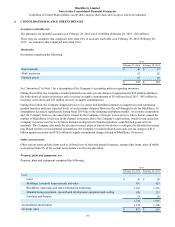

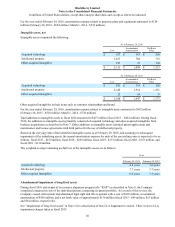

3. CASH, CASH EQUIVALENTS AND INVESTMENTS

The Company defines fair value as the price that would be received to sell an asset or paid to transfer a liability in an

orderly transaction between market participants at the measurement date. When determining the fair value measurements

for assets and liabilities required to be recorded at fair value, the Company considers the principal or most advantageous

market in which it would transact and considers assumptions that market participants would use in pricing the asset or

liability, such as inherent risk, non-performance risk and credit risk. The Company applies the following fair value

hierarchy, which prioritizes the inputs used in the valuation methodologies in measuring fair value into three levels:

• Level 1 - Unadjusted quoted prices at the measurement date for identical assets or liabilities in active markets.

• Level 2 - Observable inputs other than quoted prices included in Level 1, such as quoted prices for similar

assets and liabilities in active markets; quoted prices for identical or similar assets and liabilities in markets

that are not active; or other inputs that are observable or can be corroborated by observable market data.

• Level 3 - Significant unobservable inputs which are supported by little or no market activity.

The fair value hierarchy also requires the Company to maximize the use of observable inputs and minimize the use of

unobservable inputs when measuring fair value.