Blackberry 2016 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

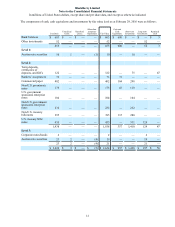

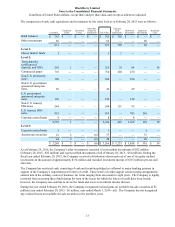

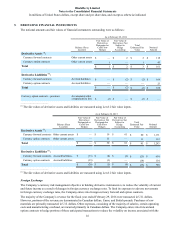

Notes to the Consolidated Financial Statements

In millions of United States dollars, except share and per share data, and except as otherwise indicated

9

shares that are subject to RSUs granted after fiscal 2013 are counted against this limit as one share for every RSU.

Awards previously granted under the Prior Plans and the Equity Plan that expire or are forfeited, or settled in cash, are

added to the shares available under the Equity Plan. Options forfeited will be counted as 0.625 shares to the shares

available under the Equity Plan. Shares issued as awards other than options (i.e., RSUs) that expire or are forfeited, settled

in cash or sold to cover withholding tax requirements are counted as one share added to the shares available under the

Equity Plan. In addition to awards under the Equity Plan, 10,521,418 RSUs were granted to Mr. Chen as an inducement

to enter into a contract of full-time employment.

The Company measures stock-based compensation expense for options at the grant date based on the award’s fair value as

calculated by the Black-Scholes-Merton (“BSM”) option pricing model for stock options and the expense is recognized

rateably over the vesting period. The BSM model requires various judgmental assumptions including volatility and

expected option life. In addition, judgment is also applied in estimating the number of stock-based awards that are

expected to be forfeited, and if actual results differ significantly from these estimates, stock-based compensation expense

and the Company’s results of operations would be impacted.

Any consideration paid by employees on exercise of stock options, plus any recorded stock-based compensation within

additional paid-in capital related to that stock option, is credited to capital stock.

RSUs are redeemed for common shares issued by the Company or the cash equivalent on the vesting dates established by

the Board or the Compensation, Nomination and Governance Committee of the Board. The RSUs generally vest over a

three-year period, either in equal annual installments or on the third anniversary date. The Company classifies RSUs as

equity instruments as the Company has the ability and intent to settle the awards in common shares. The compensation

expense for standard RSUs is calculated based on the fair value of each RSU as determined by the closing value of the

Company’s common shares on the business day of the grant date. The Company recognizes compensation expense over

the vesting period of the RSU.

Upon vesting of RSUs, new common shares will be issued by the Company from treasury.

The Company has a Deferred Share Unit Plan (the “DSU Plan”), originally approved by the Board on December 20, 2007,

under which each independent director is credited with Deferred Share Units (“DSUs”) in satisfaction of all or a portion

of the cash fees otherwise payable to them for serving as a director of the Company. At a minimum, 60% of each

independent director’s annual retainer will be satisfied in the form of DSUs. After his or her first year of service, a director

can elect to receive the remaining 40% in any combination of cash and DSUs. Within a specified period after such a

director ceases to be a director, DSUs will be redeemed for cash with the redemption value of each DSU equal to the

weighted average trading price of the Company’s shares over the five trading days preceding the redemption date.

Alternatively, the Company may elect to redeem DSUs by way of shares purchased on the open market or issued by the

Company.

DSUs are accounted for as liability-classified awards and are awarded on a quarterly basis. These awards are measured at

their fair value on the date of issuance and re-measured at each reporting period until settlement.

Advertising costs

The Company expenses all advertising costs as incurred. These costs are included in selling, marketing and

administration.

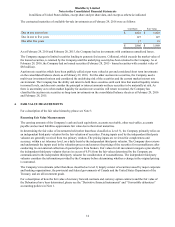

2. ADOPTION OF ACCOUNTING POLICIES

In May 2014, the Financial Accounting Standards Board (“FASB”) issued a new accounting standard on the topic of

revenue contracts, which replaces the existing revenue recognition standard. The new standard amends the number of

requirements that an entity must consider in recognizing revenue and requires improved disclosures to help readers of

financial statements better understand the nature, amount, timing and uncertainty of revenue recognized. For public

entities, the new standard is effective for annual reporting periods beginning after December 15, 2017, including interim

periods within that reporting period. Early adoption is permitted for annual reporting periods and interim periods therein

beginning after December 15, 2016. The Company will adopt this guidance in the first quarter of fiscal 2019 and is

currently evaluating the impact that the adoption will have on its results of operations, financial position and disclosures.

In April 2015, the FASB issued a new accounting standards update on the topic of debt issuance costs. The amendments in

this update require that debt issuance costs related to a recognized debt liability be presented in the balance sheet as a

direct deduction from the carrying amount of that debt liability, consistent with debt discounts. The amendments are

effective for annual reporting periods beginning after December 15, 2015, including interim periods within that reporting