Blackberry 2016 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

44

various senior management positions in the Royal Bank of Canada and served as a member of the Group Executive responsible

for the overall strategic direction of the company. Prior to this, Ms. Stymiest held positions as Chief Executive Officer at TMX

Group Inc., Executive Vice-President & CFO at BMO Capital Markets and Partner of Ernst & Young LLP. Ms. Stymiest is

currently a Director of George Weston Limited, Sun Life Financial Inc., University Health Network and the Canadian Institute

for Advanced Research.

Timothy Dattels – Mr. Dattels has an MBA from Harvard Business School and is a Senior Partner of TPG Capital. Prior to

joining TPG, Mr. Dattels served as a partner and Managing Director of Goldman Sachs and was head of Investment Banking

for all Asian countries other than Japan. Through these roles, Mr. Dattels has gained extensive experience with financial

analysis, financial advisory, analytics for mergers and acquisitions, public valuations, and financial valuation.

Dr. Laurie Smaldone Alsup – Dr. Smaldone Alsup has an MD from Yale University, where she completed her residency in

Internal Medicine and fellowship in Medical Oncology. She is Chief Operating Officer and Chief Scientific Officer of NDA

Group AB (which recently merged with PharmApprove where Dr. Smaldone Alsup was President and Chief Scientific Officer),

a leading drug development consulting company. She previously served in clinical and regulatory roles of increasing

responsibility and scope while at Bristol Myers Squibb, including Senior Vice President of Global Regulatory Science. In

addition, she served as CEO of Phytomedics, an early stage biopharmaceutical company focused on arthritis and inflammation.

Dr. Smaldone Alsup has extensive risk management and executive leadership experience.

The Hon. Wayne Wouters – Mr. Wouters has a BComm (Honours) from the University of Saskatchewan and an MA in

economics from Queen’s University. From 2009 to 2014, Mr. Wouters was the Clerk of the Privy Council of Canada and held

the roles of Deputy Minister to the Prime Minister, Secretary to the Cabinet and Head of the Public Service. Prior to his tenure

as Clerk, Mr. Wouters was Secretary of the Treasury Board of Canada and served in deputy ministerial and other senior

positions in the Canadian public service. He is currently Strategic and Policy Advisor to McCarthy Tétrault LLP and serves as

a member of the Board of Trustees of United Way Worldwide. Mr. Wouters has extensive experience with economic policy and

international trade matters, which included oversight of multi-billion dollar budgets on behalf of the Government of Canada.

The Board has also determined that Ms. Stymiest is an audit committee financial expert within the meaning of General

Instruction B(8)(a) of Form 40-F under the U.S. Securities Exchange Act of 1934, as amended. The SEC has indicated that the

designation of a person as an audit committee financial expert does not make such person an “expert” for any purpose, impose

any duties, obligations or liability on such person that are greater than those imposed on members of the Audit Committee and

the Board who do not carry this designation or affect the duties, obligations or liability of any other member of the audit

committee or the Board.

As set out in the Audit and Risk Management Committee’s charter, the committee is responsible for pre-approving all non-audit

services to be provided to the Company by its independent external auditor. The Company’s practice requires senior

management to report to the Audit and Risk Management Committee any provision of services by the auditors and requires

consideration as to whether the provision of the services other than audit services is compatible with maintaining the auditor’s

independence. All audit and audit-related services are pre-approved by the Audit and Risk Management Committee.

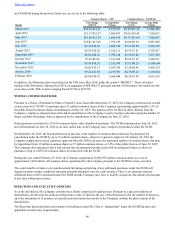

Audit Fees

The aggregate fees billed by Ernst & Young LLP (“EY”) chartered accountants, the Company’s independent external auditor,

for the fiscal years ended February 29, 2016 and February 28, 2015, respectively, for professional services rendered by EY for

the audit of the Company’s annual financial statements or services that are normally provided by EY in connection with

statutory and regulatory filings or engagements for such fiscal years were $2,567,933 and $3,458,051, respectively.

Audit-Related Fees

The aggregate fees billed by EY for the fiscal years ended February 29, 2016 and February 28, 2015, respectively, for assurance

and related services rendered by EY that are reasonably related to the performance of the audit or review of the Company’s

financial statements and are not reported above as “Audit Fees” were $13,042 and $33,785, respectively. The fees paid in this

category relate to provision of assurance services related to certain contractual compliance clauses, as well as the Company’s

corporate social responsibility disclosures.

Tax Fees

The aggregate fees billed by EY for the fiscal years ended February 29, 2016 and February 28, 2015, respectively, for

professional services rendered by EY for tax compliance, tax advice, tax planning and other services were $36,180 and $9,432,

respectively. Tax services provided included international tax compliance engagements.