Blackberry 2016 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2016 Blackberry annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BlackBerry Limited

Management’s Discussion and Analysis of Financial Condition and Results of Operations

6

As the Company’s recent acquisitions are integrated into its overall business structure and strategy, the Company is expecting

to change the internal reporting utilized by the CODM for decision making and performance assessment. As a result, the

Company expects that during fiscal 2017 adjustments in its management approach will result in a change in the Company’s

disclosure to present multiple operating segments.

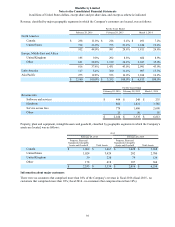

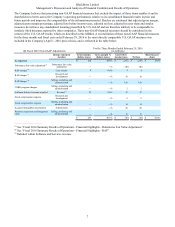

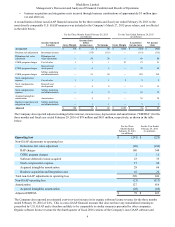

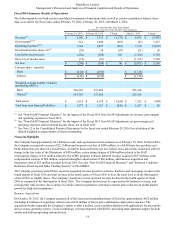

Non-GAAP Financial Measures

The Consolidated Financial Statements have been prepared in accordance with U.S. GAAP, and information contained in this

MD&A is presented on that basis. On April 1, 2016, the Company announced financial results for the three months and fiscal

year ended February 29, 2016, which included certain non-GAAP financial measures, including non-GAAP revenue, gross

margin, gross margin percentage, loss before income taxes, net loss and loss per share.

The Company has included additional non-GAAP adjustments (software deferred revenue acquired, stock compensation

expense, amortization of intangible assets acquired through business combinations and business acquisition and integration

costs incurred through business combinations) that are consistent with common practice in the software industry, and has

applied those adjustments to comparative periods. The Company believes this is appropriate due to its increased emphasis on

software and its acquisitions of software firms with recurring revenue streams.

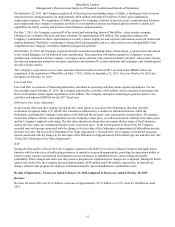

For the three months ended February 29, 2016, these measures were adjusted for the following (collectively, the “Q4 Fiscal

2016 Non-GAAP Adjustments”):

• the Q4 Fiscal 2016 Debentures Fair Value Adjustment (as defined below under “Fiscal 2016 Summary Results of

Operations – Financial Highlights – Debentures Fair Value Adjustment”) of approximately $40 million (pre-tax and

after tax);

• RAP charges, consisting of amounts associated with employee termination benefits, facilities, manufacturing network

simplification costs, and certain other costs of approximately $180 million (pre-tax and after tax);

• cost optimization and resource efficiency (“CORE”) program charges of approximately $2 million (pre-tax and after

tax);

• software deferred revenue acquired but not recognized due to business combination accounting rules of approximately

$23 million (pre-tax and after tax);

• stock compensation expense of approximately $17 million (pre-tax and after tax);

• amortization of intangible assets acquired through business combinations of approximately $28 million (pre-tax and

after tax); and

• business acquisition and integration costs incurred through business combinations of approximately $10 million (pre-

tax and after tax).

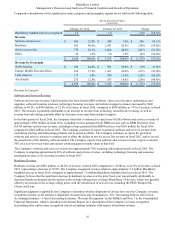

For the fiscal year ended February 29, 2016, these measures (collectively, the “Fiscal 2016 Non-GAAP Adjustments”)

consisted of:

• the Fiscal 2016 Debentures Fair Value Adjustment (as defined below under “Fiscal 2016 Summary Results of

Operations – Financial Highlights – Debentures Fair Value Adjustment”) of approximately $430 million (pre-tax and

after tax);

• RAP charges, consisting of employee termination benefits, facilities, manufacturing network simplification costs, and

certain other costs of approximately $344 million (pre-tax and after tax);

• CORE program charges of approximately $11 million (pre-tax and after tax);

• software deferred revenue acquired but not recognized due to business combination accounting rules of approximately

$33 million (pre-tax and after tax);

• stock compensation expense of approximately $60 million (pre-tax and after tax);

• amortization of intangible assets acquired through business combinations of approximately $66 million (pre-tax and

after tax); and

• business acquisition and integration costs incurred through business combinations of approximately $22 million (pre-

tax and after tax).